August 2020 - Monthly Market Update

/Monthly Update || August 2020

“We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important to ensure survival under negative outcomes than it is to guarantee maximum returns under favorable ones.”

Opening Remarks

Greetings from inside Ikigai Asset Management¹ headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-third Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, Bitcoin’s breakout of a 2 ½ year downtrend perfectly coincided with a new all-time high in gold prices in late July. Every day that this relationship between gold and BTC shows strong positive correlation is a day where Bitcoin’s narrative as a digital store of value is strengthened. The strengthening of that narrative is undoubtedly a positive tailwind for Bitcoin’s investment case, as its market cap is currently ~2% of gold’s. The backdrop for that move higher, which we will dive into in detail below, was one characterized by dollar weakness. So, it’s not so much that Gold and Bitcoin were going up, but the USD was going down.

The move in gold, along with strongly positive crypto-specific news flow, is enough to put BTC’s current price in rare company. In its 10+ year history, Bitcoin price has only closed higher 82 days. While current price is still ~80% away from ATH, the major technical hurdle with just leapt over was an important one that clears the way for a potential swift path upward.

As we move into the sixth month of a global pandemic and the monetary, fiscal and political responses that accompany it, the future which will provide the backdrop for Bitcoin to make new ATHs is getting ever so incrementally more clear as one month turns to the next. That’s not to say the global macro path forward is crystal clear at all. Far from it. Uncertainty abounds. But some pieces of the puzzle are starting to form more clearly.

One piece that is a large but crucially important unknown is the degree to which society will continue to recoil from unchecked power failing at various levels. This is more on display today than it has been in many decades. The political process of the United States has rotted from the inside out and that rot has metastasized into banking and industry. Does this come as a shock to you? It shouldn’t. The Founding Fathers warned many times of this exact thing:

“There is nothing which I dread so much as a division of the republic into two great parties, each arranged under its leader, and concerting measures in opposition to each other. This, in my humble apprehension, is to be dreaded as the greatest political evil under our Constitution.”

“The eyes of our citizens are not yet sufficiently open to the true cause of our distresses. They ascribe them to every thing but their true cause, the banking system; a system, which, if it could do good in any form, is yet so certain of leading to abuse, as to be utterly incompatible with the public safety and prosperity.”

“However [political parties] may now and then answer popular ends, they are likely in the course of time and things, to become potent engines, by which cunning, ambitious, and unprincipled men will be enabled to subvert the power of the people and to usurp for themselves the reins of government, destroying afterwards the very engines which have lifted them to unjust dominion.”

And so we find ourselves, some 200+ years later, reaping what we’ve sewn from decades of unchecked power and fundamentally misaligned incentives. From the beginning, politicians were meant to represent the people, but that relationship has been distorted and corrupted to the point where politicians are incentivized to pull growth forward into the present at the expense of the future. They do this in many ways, at the behest of special interest groups wielding immense influence. It’s precisely what the Founding Fathers were warning about.

What are we, the people, to do about it? What will we do about it? That is unclear. Maybe we, the people, don’t do much about it at all right now. Maybe the unrest our country faces this very moment can be placated with democratic socialism and the can will be kicked another 5, 10, 20 years down the road. But eventually, inevitably, those chickens come home to roost. And then what?

I believe a non-sovereign money can be part of the solution. If the Founding Fathers were around today, I’m certain they would’ve felt the same way.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors. Contact us to see if you qualify.

July Highlights

Office of the Comptroller of the Currency Allowing Banks to Custody Crypto

Bitcoin Deemed Money in Federal Court Under Money Transmitters Act

Mastercard Expands Program to Allow More Crypto Firms to Issue Cards

VISA Unveils Roadmap to Further Integration with Bitcoin and Other Crypto

Paypal Chooses Paxos Exchange For Crypto Trading Business

Chinese Police Arrest 27 Alleged Masterminds Behind Plus Token Scam

Massive Twitter Back-end Hack Utilizes Simplistic Bitcoin Scam

| Asset Class | July | June | May | April | March | Q2-20 | YTD | Instrument |

|---|---|---|---|---|---|---|---|---|

| Bitcoin | 24% | -3% | 9% | 34% | -25% | 42% | 57% | BTC |

| NASDAQ | 7% | 6% | 7% | 15% | -7% | 30% | 25% | QQQ |

| S&P 500 | 6% | 2% | 5% | 13% | -13% | 20% | 1% | SPX |

| Total World Equities | 5% | 3% | 5% | 10% | -15% | 19% | -3% | VT |

| Emerging Market Equity | 8% | 6% | 3% | 7% | -16% | 17% | -4% | EEM |

| Gold | 11% | 3% | 3% | 7% | 0% | 13% | 30% | GLD |

| High Yield | 5% | -1% | 2% | 4% | -10% | 6% | -3% | HYG |

| Emerging Market Debt | 4% | 3% | 6% | 4% | -15% | 13% | -1% | EMB |

| Bank Debt | 1% | 0% | 2% | 3% | -7% | 4% | -5% | BKLN |

| Industrial Materials | 8% | 5% | 4% | 1% | -10% | 10% | -2% | DBB |

| USD | -4% | -1% | -1% | 0% | 1% | -2% | -3% | DXY |

| Volatility Index | -20% | 11% | -19% | -36% | 33% | -43% | 78% | VIX |

| Oil | 4% | 8% | 35% | -43% | -55% | -17% | -72% | USO |

Source: TradingView. As of 7/31/20.

“We’re not Even Thinking About, Thinking About, Thinking About Raising Rates”

In last month’s Monthly Update, we unpacked a number of critical large macro factors that are currently advancing in various directions. If you haven’t read that Monthly Update, you can read it here. Those specific factors were:

Inflation/deflation

US/China relations

Fed balance sheet expansion

Fiscal stimulus

Gold

Stock market weirdness

Pace of economic recovery

Coronavirus

The 2020 Presidential election

Facebook ad boycott

Social unrest

We’re going to give brief updates on each of these, keeping in mind the overarching theme of dollar weakness. How weak is the dollar? Yeah it’s been pretty weak. But it’s still >25% above 2011 levels.

Source: TradingView. As of 7/31/20

At time of writing, the United States still has a best monetary policy house on a really crappy monetary policy block. So while this dollar weakness is a crucial part of the overall macro picture at the moment, we believe it’s much more of a trade than a terminal illness.

For several months now I’ve posed the aphorism, “it’s all one trade”. I think that’s still the case. I’ve posted the below chart for several months now. This time I added inverted DXY (green). It’s still all one trade.

Source: TradingView. As of 7/31/20.

Inflation/Deflation

Inflation expectations crept up in July but still remain below pre-Covid levels and firmly in a 7+ year downtrend. The dollar was fighting strong deflationary forces before anyone ever said corona. Those deflationary forces remain in place now and the Fed/Treasury/Congress are shooting against them, determined to generate inflation by any means necessary.

Source: TradingView. As of 7/30/20.

The recent dollar weakness has been less about headline core CPI inflation than it has been about monetary debasement. Same with precious metals strength, which we’ll get to.

US/China Relations

This situation continues to devolve on a month-over-month basis. In July, the US suddenly announced closure of the China consulate in Houston. That night, Chinese officials were witnessed burning documents in trash bins in the courtyard of the consulate. In immediate retaliation, China ordered closure of the US consulate in Chengdou.

This escalation is multifaceted: Uighur sanctions; cutting diplomatic ties with Hong Kong; South China Sea tensions; Visa restrictions; India involvement. In a speech on July 25th, Secretary of State Mike Pompeo said “We must admit our truth that should guide us in the years and decades to come, that if we want to have a free 21st century, and not the Chinese century of which Xi Jinping dreams, the old paradigm of blind engagement with China simply won't get it done. We must not continue it and we must not return to it." He called President Xi “a true believer in a bankrupt totalitarian ideology.”

To the extent the US government is waging these various escalations and defending their inevitable retaliations, that likely puts pressure on the dollar, at least temporarily. This situation, which will be greatly impacted by the election in November, continues to be one of the largest macro factors in existence today.

Fed Balance Sheet Expansion

While QE continues at $120bn/month, the balance sheet has leveled off as the Fed is lending less in the overnight repo market and less through more exotic direct lending facilities.

Source: Federal Reserve. As of 6/30/20.

As a result, projections for near-term Fed balance sheet expansion have fallen.

Source: Financial Times. As of 7/15/20.

Why have they fallen? Because QE worked.

I mean let’s be honest, look at Treasury yields and the MOVE index (a measure of Treasury yield volatility). It worked. For the moment. The Fed has subdued markets with its actions for the time being. You sure this train runs out of track at 0?

Source: TradingView. As of 7/30/20.

If you’ve been paying attention to Fed messaging this month, you know they’ve been priming the market through their mouthpiece. They’re “not even thinking about, thinking about, thinking about raising rates”. That’s likely explicit yield curve control coming, likely at the September meeting with some sort of preview at Jackson Hole in August. But look at the MOVE index and shape of the curve – we’re there already. And the Fed is telling you they’re going to let inflation run hot for a while, likely by any means necessary. That’s guaranteed negative real yields for an extended period. That’s dollar weakness..

Fiscal Stimulus

The United States just put up its worst-ever quarterly GDP decline by a wide margin.

Source: CNBC. As of 7/30/20.

Many parts of the economy are in really bad shape and are not likely to see a rapid recovery.

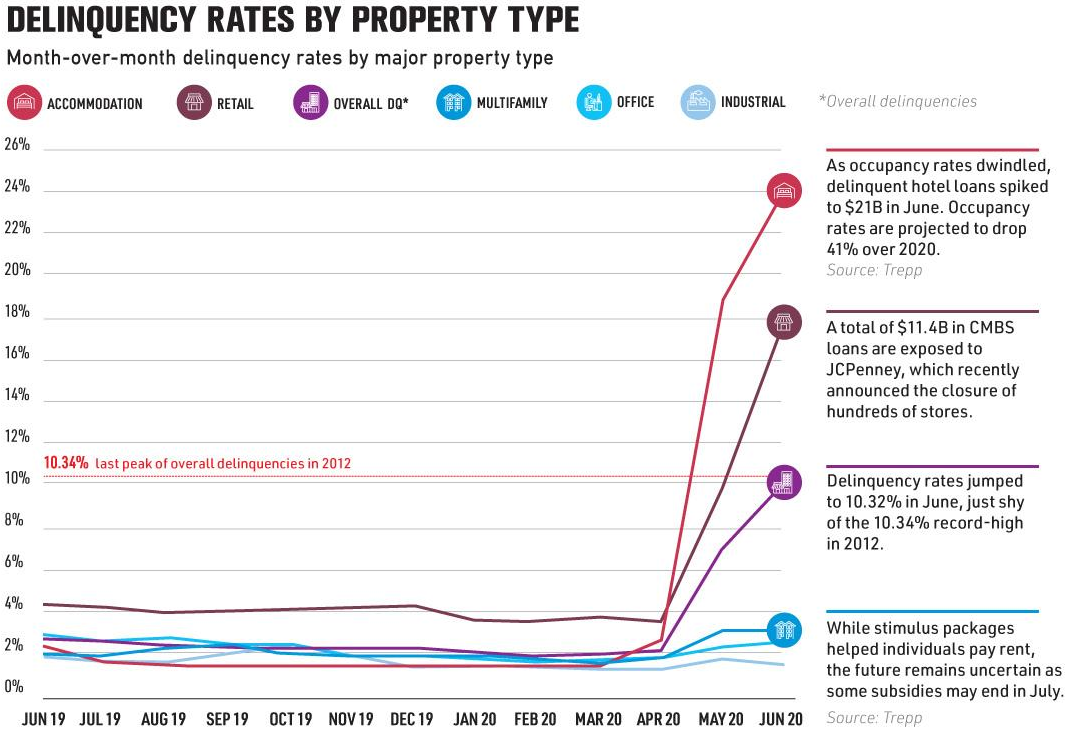

Source: Trepp. As of June 2020.

The US government knows they need to provide fiscal support to the people and businesses devastated by the coronavirus. Right now, politicians are trying to figure out specifically what types of fiscal stimulus to deliver and how much. But it’s going to be a lot and if it’s not enough they’ll come back and do more. They know they have to. Look at the NASDAQ. You can’t have a price chart look like that with an unemployment chart that looks like THAT and not give people support. The pitchforks will come out. The market believes that to be true too. So the dollar is weakening.

Gold

Last month I posted the gold chart and said, “this looks like a chart that wants new ATHs.” I was expecting it to take a bit longer than three weeks, but here we are. I mentioned earlier that recent dollar weakness and precious metals strength have both been less about headline core CPI inflation than they have been about monetary debasement. You can also see that in the oil price recovery, which has struggled. The difference between inflation risk and debasement is nuanced but I believe is centered around negative real yields and hedging tail risk. Friendly reminder of where gold (and Bitcoin) sit on the “cost to hold” list:

Source: @charliebilello. As of 7/28/20.

There are secular deflationary trends everywhere you look. But there are unsustainable monetary and fiscal policies everywhere you look too. That’s the tail risk. Buying gold most acutely addresses this tail risk of unsustainability. When you don’t know, you want to be antifragile.

The world is looking for a new world reserve currency. It’s a pain having to deal with the dollar all the time. TBD on what the alternative is. Non-sovereign perhaps?

Source: ECB. As of June 2018.

The US likes having the world reserve currency for a number of reasons but it’s a pain for them to deal with as well and the whole thing is getting increasingly unsustainable. Don’t take my word for it though. On July 28th Goldman Sachs chief commodity strategist Jeffrey Currie, wrote that "real concerns around the longevity of the US dollar as a reserve currency have started to emerge." That setup is weakening the dollar.

Stock Market Weirdness

For several months now I’ve been publicly talking about the collective WallStreetBets, RobinHood, Davey Day Trade Global movement and its influence on the market. I had some folks on Twitter disagree with me on that point. Then Davey Day Trade interviewed the President.

Exuberance as measured by put/call ratios, sits as nosebleed levels.

Everyone is in the same trades.

Source: Ollari Consulting. As of 7/29/20.

Single stock options are trading more volume than shares for the first time ever.

SPACs have gone gong show in the last couple months,

Source: Yahoo Finance. As of 7/21/20. Light green denotes YTD comparison

Like I said last month, lots of stock market weirdness. That weirdness continued in July. This weirdness is indicative of a high degree of risk that belies the rapidly declining volatility.

Source: TradingView. As of 7/31/20.

Why hold dollars when you can punt “stonks”? This weakens the dollar.

Pace of Economic Recovery

Coronavirus cases in the United States have slowed the pace of economic recovery relative to expectations 30 and 60 days ago. In May of this year, there were hopes the US economy would be doing much better by year-end. Those hopes have faded.

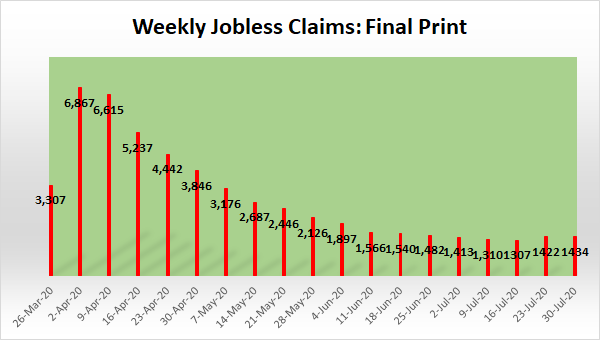

Weekly jobless claims have flatlined at a high level, with more than 30mm currently collecting unemployment.

Source: Ollari Consulting. As of 7/30/20.

There is a chance that unemployment number may be beginning to grow at an increasing rate again.

Source: Ollari Consulting. As of 7/30/20.

The US is not alone. The whole world is experiencing a dramatic decrease in economic output, and the projections are moving incrementally lower.

But it is undoubtedly true that the United States has disappointed its people and rest of Earth’s population in how poorly it has dealt with this pandemic. At a time when the US could be showing its strength in the face of adversity, it has faltered. If you think it looks bad as an American, imagine how bad it looks from the outside. This is weakening the dollar.

Coronavirus

Last month I said the good news was the death counts have significantly decoupled from the case counts. It appears I spoke too soon. July saw a doubling month-over-month in daily deaths and a stubbornly high flatlined case count.

Source: CDC. As of 7/31/20.

Source: CDC. As of 7/31/20.

Hard to have a “second wave” when you never finished the first one. In terms of potential outcomes for controlling the virus, the US finds itself on the bad end of the spectrum at the moment. This is sad. And it is weakening the dollar.

The 2020 Presidential Election

I posted this chart last month. Trump was able to stop the bleeding in July but he has a lot of wood to chop in the next 90 days.

Source: Real Clear Politics. As of 7/30/20.

While it’s not set in stone, it appears increasingly likely that Kamala Harris will be Joe Biden’s running mate. I believe Biden is suffering from significant cognitive decline due to his advanced age. It remains difficult for me to imagine Biden winning the election in November if he has to debate Trump. I have no doubt that both sides will pull out all the stops over the next three months to try and discredit the other side and swing the vote in their favor. This will be a source of volatility in financial markets in the coming months and may be contributing to dollar weakness.

Facebook Ad Boycott

The #StopHateForProfit campaign continued through July and remains in place today. The underlying issue is the complicated intertwinement of free speech and hate speech on social media. This issue, amongst others, was on display on July 29th when Congress heard testimony via video conference from Mark Zuckerberg, Jeff Bezos, Tim Cook and Sundar Pichai. At that moment, 16% of the market cap of the S&P 500 was on Zoom testifying in front of congress. While the broad focus of the hearing was antitrust and competitive tactics, it also took a political turn as Republican politicians drove points about anti-conservative biases of tech platforms. Overall it was a relative non-event but I expect big tech to remain in the political and societal spotlight between now and the election.

Social Unrest

While the country-wide Black Lives Matter protests subsided in their strength and numbers over July, it is apparent that BLM and systemic racism will be a key factor in the election in November.

Source: Google. As of 7/31/20.

While calls to defund the police have abated and the Seattle CHAZ has mostly disbanded, July saw federal law enforcement brought to Portland to control daily aggressive protests and rioting. The aggressiveness of riots in Portland stands out relative to ongoing protests in other cities across America and has resulted in dishearteningly dystopian scenes. The people of America remain angry.

“It’s All One Trade”

It’s all one trade and the trade is crowded. Dollar weakness is now wrapped up in this trade. With Bitcoin breaking out alongside a new ATH in gold, BTC is even more closely tied to this trade than it was a month ago. My sense is that the dollar weakness is more of a trade than a long-term trend, and that trade may be getting pretty oversold here.

Source: TradingView. As of 7/31/20.

This is the Dollar Optimism Index. Also due for a bounce.

Source: @SentimentTrader. As of 7/23/20.

Dollar weakness. Inflation/deflation. US/China relations. Fed balance sheet expansion. Fiscal stimulus. Gold. Stock market weirdness. Pace of economic recovery. Coronavirus. The 2020 Presidential election. Facebook ad boycott. Social unrest. All of these macro factors will see significant advancement in the coming months and will play out through price action in asset classes globally. Bitcoin will be no exception.

MARKET UPDATE – LIQUID CRYPTO ASSET INVESTING

| Symbol | July | June | Q2-20 | Q1-20 | YTD | Q4-19 | Q3-19 | Q2-19 | Q1-19 | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 24% | -3% | 42% | -11% | 57% | -13% | -23% | 164% | 10% | 92% | -43% |

| ETH | 53% | -2% | 69% | 3% | 167% | -28% | -38% | 105% | 6% | -3% | -76% |

| XRP | 47% | -13% | 1% | -10% | 34% | -25% | -35% | 28% | -12% | -45% | -93% |

| BCH* | 40% | -12% | -1% | 26% | 73% | -3% | -47% | 154% | -1% | 30% | -87% |

| EOS | 31% | -12% | 6% | -14% | 20% | -13% | -49% | 38% | 63% | 0% | -86% |

| BNB | 34% | -10% | 22% | -8% | 51% | -13% | -51% | 86% | 182% | 123% | -16% |

| XTZ | 20% | -16% | 46% | 20% | 110% | 49% | -3% | -12% | 129% | 192% | -27% |

| XLM | 45% | -5% | 64% | -10% | 114% | -26% | -41% | -3% | -5% | -60% | -90% |

| LTC | 40% | -9% | 6% | -5% | 40% | -26% | -54% | 101% | 99% | 36% | -84% |

| TRX | 20% | 3% | 41% | -13% | 48% | -8% | -55% | 36% | 25% | -29% | -93% |

| Aggregate Mkt Cap | 29% | -2% | 44% | -5% | 76% | -14% | -29% | 117% | 14% | 51% | -60% |

| Aggr Alts Mkt Cap | 38% | 0% | 45% | 4% | 109% | -16% | -40% | 68% | 18% | -1% | -77% |

Source: CoinMarketCap. As of 7/31/20. BCH includes SV.

BTC, once again, finds itself as the best performing asset class YTD by a wide margin, up about 2x relative to gold YTD. In his Bitcoin investment thesis, Paul Tudor Jones referred to BTC as “the fastest horse”. So far he’s been right, although he wasn’t talking about a three-month race.

An opaque but important advancement in a major factor affecting BTC is the PlusToken arrests. In the July 1st Monthly Update I said:

“At their current pace of distribution, we think PlusToken has ~2 months of selling left. We would be surprised

to see BTC punch through $10.5k before that supply overhang is removed. We would be surprised if

BTC didn’t punch through $10.5k in the two months following that supply overhang removal. It’s just that simple.”

Beginning late June and continuing into early July, the wallet forensics work from analyst ErgoBTC showed significant changes to PlusToken’s distribution style. On July 6th, BTC distributions out of mixers onto exchanges appeared to cease. Three weeks later, Chinese police announced the arrest of 27 primary suspects and another 82 “core members” to Plus Token. Even though Chinese police said they arrested six Plus Token scammers a year ago. My kneejerk reaction is it would be a classic CCP move to be dumping BTC on the market for a year, finish the selling and then announce the arrests of the PlusToken scammers, but that’s mostly conjecture. Truth is, there’s a good chance we’ll never know exactly what happened with PlusToken and the Chinese government’s involvement with it. But there’s also a good chance this entire situation may be drawing to a conclusion. If I never have to say PlusToken again, that will be welcomed.

BTC began rising towards the top of its multi-month range on July 21st amid a backdrop of DeFi and Yield Farming mania that then carried over into strong ETH outperformance. We’ve seen this movie before. In early 2019, Binance Launchpad IEO mania lead to drastic BNB outperformance which primed BTC for a large advance higher. This time around it was DeFi->Yield Farming->ETH->BTC. Why does the ETH leg of that trade make so much sense? Simple.

Source: Defipulse.com. As of 7/31/20.

I posted the chart below last month, now updated for July. As mentioned last month, while the % increases are eyepopping, the $ increases in market cap are relatively small.

| Market Cap | % Change | Market Cap Growth | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 12/31/2019 | 3/31/2020 | 6/30/2020 | 7/31/2020 | Q1-20 | Q2-20 | July | YTD | Q1-20 | Q2-20 | July | YTD | |

| LEND | $19 | $26 | $171 | $406 | 38% | 563% | 137% | 2077% | $7 | $145 | $235 | $387 |

| KNC | 32 | 77 | 222 | 291 | 145% | 187% | 31% | 823% | 46 | 144 | 69 | 259 |

| REN | 26 | 40 | 128 | 139 | 55% | 223% | 9% | 444% | 14 | 88 | 11 | 113 |

| BNT | 18 | 12 | 77 | 115 | -33% | 550% | 48% | 546% | -6 | 66 | 38 | 97 |

| LRC | 21 | 27 | 79 | 115 | 31% | 194% | 46% | 461% | 6 | 52 | 36 | 95 |

| ZRX | 109 | 99 | 234 | 273 | -10% | 137% | 17% | 150% | -10 | 135 | 39 | 164 |

| REP | 97 | 110 | 181 | 221 | 13% | 65% | 22% | 128% | 13 | 71 | 40 | 124 |

| MKR | 424 | 328 | 461 | 562 | -23% | 41% | 22% | 33% | -96 | 133 | 101 | 138 |

| Total | $744 | $718 | $1,553 | $2,122 | -$26 | $835 | $569 | $1,378 | ||||

Source: CoinMarketCap. As of 7/31/20.

Some new developments in “DeFi” in July mirror some of the wackiness we’ve seen in equity markets recently, like companies seeing their stock prices surge after bankruptcy is declared. If you haven’t heard of AMPL or YFI, it might be worth taking a peek at. They’re ponzis. And market participants seem to basically be ok with that.

Currently, ETH’s market cap is ~18% of BTC’s. ETH’s relative liquidity is larger than its relative market cap, but ETH is still much less liquid than BTC. There are no regulated futures or options on ETH. BTC is broadly owned by many as a digital gold investment and a hedge against monetary and fiscal policy irresponsibility, while ETH is more narrowly owned for the potential of its underlying technology. All of that to say, it requires a meaningfully smaller amount of capital to move ETH’s price significantly than BTC’s.

So where does that put us on ETH vs BTC at the moment? ETHBTC is currently ~80% off the lows of Sept 2019 but still 70% off the highs of Feb 2018. While ETHBTC appears to be forming a channel of higher lows and higher highs, it also currently sits at its most overbought level ever on the weekly RSI, which is to say, caution is warranted and near-term underperformance of ETH vs BTC may be in store.

Source: TradingView. As of 7/31/20.

Over the more medium-term, the fate of ETH likely rests in ETH 2.0, the long-awaited migration to PoS from PoW to facilitate scaling. ETH in its current form is wholly inadequate to support the throughput necessary to fulfill its promise as a

“decentralized world computer.” The deadlines to get ETH 2.0 moving continue to suffer from pushback after pushback but at some point early next year the show should finally get on the road. At that point, ETH will be viewed less through the lens of a dream and more through the lens of what it can actually do.

I’ve said this many times before, but it bears repeating. There are many use cases for distributed ledger technology. We believe money, and specifically store of value, is the killer app right now. When evaluating the various use cases for DLT, we ask ourselves four questions:

1. How ready is the tech for the world?

2. How ready is the world for the tech?

3. What do you need decentralization for?

4. How decentralized is decentralized enough?

We also apply the following framework: there is the value created by the technology and the value accrued by the token. Those are two different things. The bridge between those two things is token structure. Token structures for cryptoassets that do not enjoy a monetary premium struggle to present compelling value accrual propositions, even under the assumption that value is created.

We believe Bitcoin much more fully answers the above four questions than any other cryptoasset in existence today. We believe Bitcoin’s value accrual proposition is much more compelling given its token structure. We are not Bitcoin maximalists. We have much hope for the future of the broader cryptoasset ecosystem. But hope isn’t a strategy. That’s pumpamentals. And investing in pumpamentals is an entirely different thing altogether. Bitcoin works as a store of value right now. The world needs it right now. That’s the thesis.

Last month we posted the chart below to highlight potential downside price risk and overhead resistance. BTC punched through that resistance and shook off an overbought StochRSI. No wonder everyone in crypto is so excited right now. It’s for good reason. BTC is knocking on the door.

Source: TradingView. As of 7/31/20.

That doesn’t mean that now is time to throw caution to the wind. Last month we said:

“What we can say with confidence is that this is not a highly levered Bitcoin market. Nothing like February 2020.

Neither longs nor shorts have found themselves more than mildly offsides over the last 2+ months and neither

are offsides currently. That means price action is more heavily driven by spot. This is healthy.”

Unfortunately, that is no longer the case. Bitcoin leverage increased meaningfully on the pump through the 10k’s and longs currently sit meaningfully offsides based on our read of the market. This is a significant source of risk and potential downside price action. Simply put, when longs or shorts get meaningfully offsides, they are VERY rarely rewarded for that positioning. In almost every case, that offsidedness eventually has to pay the piper and price moves against them. Sometimes this can happen without a lot of fireworks. Often it happens with fireworks. We are watching this setup closely.

One source of optimism is Bakkt volumes, which hit two consecutive days of record levels at the end of July. The jump is stark. Something changed about the market participants on Bakkt. Regardless it’s bullish.

Source: @patrickrooney. As of 7/31/20.

This increase in activity on Bakkt was matched by CME, which skyrocketed to a new ATH in open interest into month end. It’s hard to be bearish in the face of developments like these.

Source: Arcane Research. As of 7/28/20.

Cross-coin correlation appears to have made a cyclical top in mid-May and has been declining for more than two months. This is healthy.

Source: Coinmetrics. As of 7/31/20.

Lastly, a simply chart we’ve shown many times before. Beautiful isn’t it?

Source: @Pladizow. As of 7/31/20.

Closing Remarks

Bitcoin is the most reflexive asset in the world, which makes good sense because there is no other asset that derives so much of its value from network effect. The only difference between Bitcoin being undervalued and overvalued today is what the future adoption rate of Bitcoin is. Bitcoin’s price is also manipulated. You can either hate it or love it, but that’s a fact. Because of that, Bitcoin experiences what I call “manufactured reflexivity”. These big moves that BTC so often has and just had in July are often manufactured, especially at the point of ignition. Risky Whales see an opportunity to generate profits and they seize on that. Free market capitalism at its finest.

That said, these manufactured moves are a big source of idiosyncratic risk and be definition it’s difficult to put a sound risk management process around handling idiosyncratic risk. There are entities out there with a LOT of BTC that will act aggressively to generate profits. These entities often collude so then they act like even MORE BTC. When upside reflexivity is manufactured, the intention of those actors would initiate it is to find others to buy their BTC off of them at higher prices at which point price pulls back and perhaps some downside reflexivity is manufactured.

I say that as a warning to keep your wits about you. Don’t let a price run get to your head or a price pullback get to your heart. Always keep it in the back of your head that Bitcoin’s price is usually doing what it’s doing because Risky Whales that hold a lot of it WANT it to do that. And as a final reminder, Bitcoin’s price is likely to reach a new ATH precisely when the Risky Whales want it to. Not before. Not after.

So put yourself in the shoes of a Risky Whale. Is now the time you’d take Bitcoin to new ATHs? It’s hard to say. But punching it out of a 2 ½ year downtrend the same day gold makes a new ATH is certainly a game plan that makes plenty of sense.

“A merry companion on the road is as good as a nag”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS