August 2023 - Monthly Market Update

/Monthly Update || August 2023

“There’s a big difference between probability and outcome. Probable things fail to happen – and improbable things happen – all the time.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our fifty-ninth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, the crypto market is in a weird spot right now. The market is confused. There are crosscurrents right now that make it hard to tell which direction crypto wants to go. That’s accurate with regards to price movement but also more broadly, qualitatively accurate. Crypto doesn’t know whether it’s coming or going.

The biggest news in July was the favorable ruling for XRP vs SEC, but at this point it’s hard to know exactly how positive that event really was. XRP is a shitcoin and it’s unlikely (although not impossible!) to ever have a strong fundamental narrative around it that would warrant taking it seriously. And the immediate readthroughs to other Alts are not that clear. The judge’s ruling on XRP was nuanced and leaves plenty of unanswered questions, both as it relates to XRP and Alts broadly. Certainly, the SEC’s credibility took a real hit, but what exactly does that mean for crypto? The SEC can appeal the ruling and have already hinted at doing so. The XRP ruling does make it more likely the SEC will lose its case against Coinbase, but that could still take quarters (or years?) to play out.

More than anything, the XRP ruling highlights the need for sensible crypto legislation, but it’s a long putt to get that done before 2025 (although not impossible). So, while positive, crypto still finds itself in regulatory purgatory. You can see the market digesting all this confusion in the price action- XRP retraced about half of its initial pump off the SEC news, and volumes have collapsed. The other Alts that pumped in sympathy to XRP have given back most or all of those gains. Like I said, confusion.

The Bitcoin spot ETF situation, which we discussed at length last month, saw progress in July. And we do a have a distinct timeline on that situation –

I don’t have any unique firsthand insights into the ETF situation. I just take cues from the folks closer to it than me. The Bloomberg ETF analyst says the 8/13 date will almost certainly be a delay, so I just take that to be true. Assuming 8/13 is delay for ARK, we then have all the others in the first week of September. If those get delayed, then the Grayscale vs SEC case may likely move into the driver’s seat of this overall situation. As I laid out last month, Grayscale could get a favorable ruling against the SEC and that could STILL not mean automatic conversion of GBTC to an ETF and approval of all the other ETFs. That COULD be the outcome but not necessarily. You could imagine price spiking down on a delay announcement on 8/13. And you could imagine price spiking up on a favorable Grayscale ruling vs SEC, but then potentially giving those gains back as the market realizes there’s still uncertainty to the situation. If at some point you actually get a real green light on the spot ETFs, either through the Grayscale vs SEC case or through approval of one or more of the ETFs in the table above, then you’ll almost certainly get a big, sustained lift in price…but that’s far from a sure thing. Like I said, confusion.

So the market in July was digesting these potentially positive events (albeit with vectors of uncertainty) while also evaluating what may be lurking beneath the surface with Binance. The Binance situation continues to degrade, with multiple key executives jumping ship and the exchange essentially getting kicked out of Germany in July. Everyone seems to be waiting for the DOJ shoe to drop with Binance, but no one knows exactly when or exactly what will happen. If 1) the SEC is about to lose its fight in deeming Alts securities; and 2) we’re about to get an ETF; and 3) Binance doesn’t blow up FTX-style, then prices are going much higher from here. If 1) the SEC continues its battle against Alts; and 2) denies a spot ETF; and 3) Binance gets slammed by the DOJ and a hole in their balance sheet is exposed, we’re going much lower. If it’s some combination of the former and the latter, we probably chop around here for a while. Like I said, confusion.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

July Highlights

Judge Rules That Ripple’s Sales of XRP Do Not Constitute an Offer of Investment Contracts; Institutional Sales of XRP Were Securities; Sales to Public May Not Be Securities; Lawsuit Over Whether XRP Is a Security Will Go to Trial

SEC Hints at Potential Appeal of XRP Ruling

Coinbase Reinstates Trading of XRP

BlackRock and Five Other Spot Bitcoin ETFs Enter “Surveillance Sharing Agreements” with Coinbase

Transcript of Pre-motion Conference Filed in SEC vs Coinbase, Judge Appears to Align with Coinbase

Binance General Counsel, Chief Strategy Officer and SVP of Compliance All Quit in Response to Changpeng Zhao’s Interactions with US Regulators

Binance Withdraws License Application in Germany After It Was Set to Be Rejected Due to Changpeng Zhao

Binance Lays Off >1,000 Employees

Binance Cuts Employee Benefits, Citing a Decline in Profits

Former Celsius CEO Alex Mashinsky Arrested

SEC, DOJ, CFTC and FTC File Lawsuits Against Celsius and Mashinsky

Gemini Sues DCG and Barry Silbert, Claiming Fraud

Polychain Raises New $200mm Fund

CoinFund Raises New $158mm Fund

FTX Estate Files Summary Plan of Reorganization, Creditors Immediately Push Back

Sam Bankman-Fried Leaks Diary of Caroline Ellison to New York Times, DOJ Pleads with Court to Imprison Him for It

DOJ Drops Campaign Finance Criminal Charges Against Sam Bankman-Fried

FTX and Genesis Set to Resolve Bankruptcy Dispute

Powerhouse Lawyers Boies and Moskowitz Awarded Co-lead Counsel on Consolidated FTX Class Action Lawsuits

FTX Estate Sues Bankman-Fried and Other Executives for >$1bn

FTX Bankruptcy Estate Postpones Sale of FTX Japan

Richard Heart Sued by SEC For Securities Fraud

Crypto Bridge Multichain Hacked for $130mm, Loses Access to Remaining $220mm After CEO and His Sister Are Arrested in China

DeFi Protocol Curve Exploited for >$70mm, Threatens to Destabilize Entire DeFi Ecosystem

US Secret Service Seizes $58mm From Deltec Bank Tied to Crypto Frauds

Sequoia Cuts Crypto Fund from $585mm to $200mm, Cuts Ecosystem Fund in Half

US Stablecoin Bill Negotiations Stall, As White House Signals Disapproval

Nasdaq Halts Plan for Crypto Custody Due to U.S. Regulatory Conditions

KuCoin Lays Off 30% of Employees

Singapore Monetary Authority to Require Crypto Platforms to Hold Client Funds in Trusts, to Ban Lending and Staking by Retail Investors

DOJ Announces First-ever Criminal Case Involving an Attack on a Smart Contract Operated by a DEX

DeFi Protocol BarnBridge Says DAO Is Under SEC Investigation

| Asset Class | July | June | May | Apr | Q2-23 | Q1-23 | YTD | 2022 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -4% | 12% | -7% | 3% | 7% | 72% | 77% | -64% | 60% | 303% | BTC |

| NASDAQ | 4% | 6% | 8% | 1% | 15% | 21% | 44% | -33% | 27% | 48% | QQQ |

| S&P 500 | 3% | 6% | 0% | 1% | 8% | 7% | 20% | -19% | 27% | 16% | SPX |

| Total World Equities | 4% | 5% | -1% | 1% | 5% | 7% | 17% | -20% | 16% | 14% | VT |

| Emerging Market Equity | 6% | 4% | -2% | -1% | 0% | 4% | 11% | -22% | -5% | 15% | EEM |

| Gold | 2% | -2% | -1% | 1% | -3% | 8% | 7% | -1% | -4% | 25% | GLD |

| High Yield | 1% | 1% | -2% | 0% | -1% | 3% | 3% | -15% | 0% | -1% | HYG |

| Emerging Market Debt | 1% | 2% | -2% | 0% | 0% | 2% | 4% | -22% | -6% | 1% | EMB |

| Bank Debt | 0% | 2% | -1% | 0% | 1% | 1% | 2% | -7% | -1% | -2% | BKLN |

| Industrial Materials | 7% | 2% | -8% | -5% | -11% | 4% | -1% | -13% | 29% | 16% | DBB |

| USD | -1% | -1% | 2% | -1% | 0% | 0% | -1% | 8% | 6% | -7% | DXY |

| Volatility Index | 0% | -24% | 14% | -16% | -27% | -14% | -37% | 26% | -24% | 66% | VIX |

| Oil | 15% | 5% | -10% | 2% | -4% | -5% | 4% | 29% | 65% | -68% | USO |

Source: TradingView. As of 7/31/23.

Bad Actors Are attracted To Crypto Like Moths To A Flame

Since the November collapse of FTX, you’ve likely noticed a pretty palpable shift in tone and topic for these Monthly Updates. If you follow me on Twitter, you’ve likely noticed a palpable shift there as well.

In December, immediately after the FTX collapse, I wrote about “What Happened, What Needs To Happen”. I laid out the following changes I thought needed to occur in crypto -

Crypto has a large attack vector from intelligent sociopaths.

You can forgive someone and still refuse to allow them to return to positions of power and influence.

Crypto has a large attack vector from the daisy chain of secondhand due diligence.

Trust in general within crypto needs rearchitecting. We have normalized an unacceptable level of opacity.

The good guys aren’t being loud enough.

We must more effectively ride the line between optimism and skepticism.

The insane influx of venture capital across all stages perpetuated an attitude of “growth at any cost”.

This is a sensitive topic, but we need to be careful about blindingly worshipping entrepreneurs with autism/mental illness.

In January, I wrote about the difficulty in answering the question “what exactly is left of crypto?”-

The biggest reason it’s so tough to answer is because you really don’t know what actually happened the last couple years. Like what was “organic” vs what was “rampant reckless lending, intertwined with fraud, used to heavily lever long to speculate on vaporware”. Crypto is supposed to iterate from cycle to cycle, at least that’s always been pitched as the gameplan. But how much did we actually learn about how to best iterate over the last few years, with how distorted risk-taking was? It’s like we’ve been flying a plane in a heavy fog the last two years - you really have no idea what the ground looks like below you. The “Lending/Fraud/Risk-taking Trifecta” had such an undoubtedly strong influence over reflexivity, that you don’t know how reflexive this market would be without that Trifecta’s presence. That Trifecta affected how others in the market started taking risk, and it snowballed from there. What we’re experiencing now is the hangover. At some point we’ll get through the hangover, and new, more positive narratives will emerge. Again, I struggle at the moment to identify what those specifically will be and over what time frame. More time needs to pass to better understand what’s actually left.

In January I also wrote about my involvement in crypto going forward -

The path will become clearer in the coming months. I’m pretty sure God wants me to stay in crypto. Good and evil are so clearly wrapped up in all this. And I do still strongly believe in this technology’s potential to make the world a better place. That’s the “fight worth fighting” that I talk about so often here. I believe I have God-given gifts that I can contribute to this fight. I had been doing that already for years. But I wasn’t doing enough. I wasn’t fighting hard enough. Loud enough. I feel convicted that if I stay in crypto, I must fight harder to help deliver on this technology’s potential to make the world a better place. We all must. Too much damage has been done by bad actors. Bad actors are running the same playbook they’ve had for years and it’s STILL working. The FTX collapse wasn’t exactly the same as Mt Gox but it had many of the same factors and that was a DECADE ago. If we keep getting bit by snakes with the same scams we got bit by a DECADE ago, the good guys will lose this battle. Crypto will deliver on little or none of its potential to make the world a better place. What an absolute shame that would be.

…it’s important to remember that 99% of these projects will fail to achieve their vision and gain significant adoption. This fact must be embraced and a market participant must act accordingly. It’s also important to remember that speculation will remain a large driver of price action. It’s not a good strategy to just wish that people wouldn’t speculate on vaporware. You must be honest with yourself – speculation will be rampant in crypto for the foreseeable future. Act accordingly. You can accept this fact and still fight scams, scammers and vaporware. We must more effectively ride the line between optimism and skepticism than we have in the past.

In February I wrote about whether crypto is fight worth fighting -

Whether crypto delivers on all of, some of, or none of its potential to make the world a better place will be entirely dependent on the individuals working towards these various outcomes. It goes without saying, there are many bad actors in crypto. If this wasn’t abundantly clear before, surely 2022 really drove home that point. People that care only about stacking as many dollars as possible in their bank account, regardless of who gets hurt in the process. People that are willing to lie, cheat and steal in the pursuit of that goal. Even people that aren’t necessarily evil. Just people that love to gamble and view crypto like horse racing or the casino. Leaving aside the argument of whether gambling is inherently evil, I think it’s safe to say that it’s not doing any good in this world. It’s an activity that exploits the brain chemicals of humans that developed over millions of years of evolution. It brings no good to society. At best, it’s a transfer mechanism of money from bad risk takers to good. Crypto is filled with 1) bad actors; 2) actors that are indifferent towards good in the world; and 3) good actors, that want to do their part in pushing this technology towards making the world a better place. In that way, cohort #3 is in a fight against cohorts #1 and #2.

In March I wrote about the governmental and self-regulation of crypto –

Crypto honestly needs regulatory help. Look at the mess we’ve got ourselves in. But much of what regulators have been doing recently is not helpful. The CFTC seems to have a good handle on things, but Gensler’s SEC has been damaging. The OCC and Treasury are so closely intertwined with traditional finance, they’re always going to be on their side. And so you can’t help but be nervous about how beneficial these regulatory actions will actually end up being.

In the meantime, crypto can change on its own. Self-regulation in this context is just a social structure. It exists on Twitter and in Telegram and on podcasts and at conferences. What does this ecosystem collectively think about the last few years - the bull and the bear? Are we happy with the progress? Disappointed? What, if anything, do we want to collectively do differently going forward? I welcome more discussion on these topics.

In April I wrote about speaking out publicly against the most powerful person in crypto –

If you’ve been following me on Twitter and/or reading these Monthly Updates the last several months, you know I’ve been vocal in my opposition against Binance and Changpeng. In the wake of the CFTC allegations, it’s even more clear that opposition was well-warranted. After the FTX collapse, I looked at the setup for Binance, with their: 1) BNB token (with no real price discovery); 2) BUSD stablecoin (without full collateral backing); 3) large amount of wash trading (see here); 4) mostly fake BSC ecosystem (read this); 5) and general lack of transparency/truth from Changpeng (he participates in “transparency theater” but constantly lies), and it looked to me like a situation with a lot of systemic risk. A level of risk that could endanger the entire crypto ecosystem, just as FTX had done, but on an even larger scale.

Your hope for the outcome of the Binance regulatory actions likely boils down to what you think about Changpeng. As you think about where the crypto ecosystem is heading in the coming years, how do you feel about Changpeng driving that bus? As it currently sits, he’s the most powerful individual in crypto. How do you feel about that as it relates to this technology fulfilling its potential to make the world a better place? Different people feel different ways about that. I know how I feel.

In May I wrote about leadership in crypto –

One reason I’m worried about crypto is because I’m worried about the leadership of this ecosystem, or lack thereof. Rewind back a year ago, and many of the most prominent names in crypto at that time are currently facing criminal charges or at least bankruptcy. The visions pitched at the time of Bitcoin as an uncorrelated inflation hedge and Web3 eating the world have fallen flat. There is a leadership vacuum as so many prominent crypto voices have fallen from grace and a narrative vacuum as so many previous investment theses have disintegrated. In the meantime, the US has become a lot more adversarial towards crypto. Like a LOT. Tough backdrop.

Leadership is hard in crypto for numerous reasons. One reason is because decentralization is at the ethos of crypto, and decentralization means the absence of centralization. Leadership is by definition centralizing. I believe this has caused a higher degree of miscoordination about the overall “gameplan” for crypto than would otherwise be present. It’s a challenge inherent in the nature of crypto’s potential. I think we need to do a better job managing through that challenge.

Leadership in crypto is also a challenge because it is a global ecosystem that spans languages, time zones and cultures. The crypto ecosystem also spans all nature of motivations and interests. Put differently, people come to crypto for all SORTS of reasons. Some come to crypto for hard money. Some for privacy. Some for the tech. Some for Web3. Some for NFTs. Some to speculate. Some to gamble. Some to scam.

We can argue about the legitimacy of each of those reasons (and others), but they’re here and they’re not going anywhere. So how do you lead in an environment like that? How do you push the ecosystem in a direction where those factors come together in a way that maximizes the likelihood of positive outcomes for humanity?

It can start with discussion, perhaps partly in private but mostly in public. Discussion can lead to the identification of an agreed-upon set of goals and then a gameplan can be created to achieve those goals. No one said it would be easy, and it absolutely will not happen by accident and without a lot of intentionality. How can I contribute more in this endeavor? How can you?

In June I wrote about not deserving another bull market right now –

Frankly, we don’t deserve another bull market right now. We haven’t progressed nearly far enough from the mistakes of the last cycle. We don’t deserve another bull market when Changpeng Zhao continues to be the most powerful person in crypto. We don’t deserve another bull market with this much fraud. We don’t deserve another bull market without better regulations and better self-regulation practices. We don’t deserve another bull market with such flimsy token models. We don’t deserve another bull market without all that venture capital that went into crypto gaming producing a single game that has decent traction. We don’t deserve another bull market without smart contract platforms that are fast, cheap and reliable.

So those are some of the changes I think we need to see as foundations for a sustainable, additive bull market. We might get a bull market before some or any of those materialize, and that would have me again worried about the sustainability of said bull market. I think all of us have our own ways we can contribute to see these changes materialize. I think if we’re going to be a part of this ecosystem, we’re obligated to be shepherds. I’ve been writing that in the opening paragraph of these letters for 4 ½ years.

And in July I wrote about some of my recent experiences in calling out bad actors –

Most of what I’ve been doing over the last six months on Twitter has been speaking truth to the most powerful person in crypto, Changpeng Zhao. I’ve never done anything like that before. But I am compelled to speak up in light of the damage done to this ecosystem over the last 18 months and the pain I’ve endured personally with getting my investors’ money stuck in the FTX collapse. If you’ve been reading these monthlies, you know how I feel about the bad guys kicking the shit out of the good guys in crypto. And you know the strength of my conviction in needing to do more personally to fight the good fight. So it’s been in that spirit that I’ve been waging this public campaign against a very powerful bad actor. It’s a new journey for me but one in which I feel like I’m making a difference in a tangibly positive way.

Good actors need to be louder in this space. Full stop. I’m just trying to do my little part. And by doing so, I feel more in alignment with my purpose now than ever. My mental health is the best it’s been in years. Physically, I’m in some of the best shape of my life. My spiritual life is truly the strongest it’s ever been. I feel sturdy and excited about what the future holds, even if there is plenty of uncertainty in that future. I’m not expecting it to be an easy ride. I’m 5+ years into this and it would be silly to expect it to be an easy ride. Being in this space is challenging in a multitude of ways.

One challenge is that if you are going to participate in this ecosystem in a way that is as straightforward and truthful as you can possibly be, you should expect to be gaslighted. You should be prepared to be gaslighted, because there are many bad actors here and those bad actors will gaslight you and they will convince others to do the same. This toxic trait is more present in crypto than other industries. I’ve worked in other industries. I have friends and family that work in all sorts of industries. They don’t deal with the type of problems we deal with, because either there’s less bad actors in their industry or those bad actors just aren’t able to cause as much damage as in crypto…or both. It seems like the entertainment industry would probably give crypto a run for its money, but very few other industries. So that’s just something you need to grow accustomed to if you’re going to publicly call out bad actors. It’s all good though. I’ve been sleeping great at night lately.

So with that as a rather long (but necessary) introduction, I restate the thesis “Bad Actors Are Attracted To Crypto Like Moths To A Flame”, and pose the questions- Why is this the case? What can be done about it?

That statement has been true since the very beginning of crypto. We mustn’t forget that the origins of crypto are pretty shady. Silk Road was the first major use case for the first crypto asset, and that whole story is just chock-full of bad actors, from Dread Pirate Roberts to the Secret Service agent investigating Silk Road that stole 1,600 BTC during the investigation. Mt Gox followed soon thereafter. And the following decade is littered with more of the same, on increasingly larger scales.

Bad actors come to this space because they’ve had enormous success here. As a friend often says, “some of the best people I’ve ever met are in crypto but all of the worst people I’ve ever met are in crypto”. There’s likely no other industry where the worst people can make the most money. Nowhere else on planet Earth do bad actors have better opportunities. Why?

The assets are hackable in a way no other asset is. The blockchain can’t be rolled back. You can’t hack someone’s stock portfolio.

Token prices are easily manipulated.

There aren’t good sets of regulations, either domestically or abroad.

There is no such thing as insider information.

For nearly all of crypto, there’s been no such thing as insider trading, although that may be changing now.

The technology is technically complex, which increases obfuscation of all sorts.

There are essentially no valuation methodologies to anchor to.

Tokens become liquid orders of magnitude faster than most other types of investments.

The tokens trade with a lot of liquidity, especially the large ones.

Crypto is global and remote.

Pseudonymity is at the bedrock of Bitcoin and thus we allow for and even celebrate anonymity, which opens up enormous attack vectors that wouldn’t otherwise exist.

Crypto embraces being an extremely risky asset class and thus excuses behavior and market structure that would never fly elsewhere.

So for all those reasons and many more, we get a lopsided proportion of bad actors here. And Lord knows we get all types of bad actors. The crypto landscape looks like the cantina scene from Star Wars -

Real world bad guys that use crypto for laundering money and averting sanctions.

Market manipulators.

Crypto project ruggers.

NFT ruggers.

Exchange founders that fraudulently use customer funds.

Borrowers that fraudulently lie to lenders.

Lenders that make such egregiously bad loans that they could be fraudulent.

Investors willing to buy anything if they can dump on retail later for a profit.

Project founders willing to build anything if they can dump on retail later for a profit.

Project founders willing to raise money and never really try to build anything.

Ponzi operators that would make Chuck Ponzi blush.

Hackers.

Exploiters.

Investors that will publicly lie over and over again to big audiences to keep the price of a token up.

Project founders that will publicly lie over and over again to big audiences to keep the price of a token up.

For basically every single one of those I could give you a name or a few names of violators and they’d be some of the very biggest names in the crypto space. Sam Bankman-Fried. Three Arrows Capital. Alex Machinsky. Avi Eisenberg. Changpeng Zhao. Do Kwon. Lazarus Group. Arthur Hayes. PlusToken. Richard Heart. The list goes on and on. I mean you could put together 100 names of that stature from over the years that belong in one of those categories. What are we going to do about that?

Good regulations domestically and abroad help with essentially every single one of those. That’s just a fact. We need help from regulators, full stop. It needs to be well-constructed in order to help the optimal amount. The drafting of the regulations could be co-opted by anti-crypto special interest groups and there’s a risk they could be written so deleteriously so as to significantly diminish the entire value proposition of crypto. So we need to try and fight back against bad regulations while simultaneously trying to get helpful regulation enacted. The risks from either side of that equation going poorly are significant. It’s tremendously unhelpful that the guy we sent to Washington to represent us in the making of those regulations ended up being Millennial Madoff. So now we’re dealing with the aftermath of that and the whole space is quite exposed to regulatory risk right now. My personal influence doesn’t reach that far because Washington is a pretty tough nut to crack. And I don’t have the amount of millions sitting around it takes to buy your way into those discussions. So we’re at the mercy of those that do. If you’re either one of those types of people, Godspeed.

While we wait for external government regulations, we must change self-regulation. I’ve written about this a lot over the last eight months. Self-regulation in crypto is a social construct. It exists on Twitter and in Telegram and at conferences and on podcasts and Zoom calls. Those are the avenues of self-regulation in crypto. Go back up and read those two bulleted lists. In what ways can we decide to change our collective behavior so as to lessen the impact from those couple dozen bullet points?

In many ways it boils down to which individuals and which projects we collectively decide to anoint -

If LUNA hadn’t gained massive parabolic adoption, Do Kwon’s damage wouldn’t have been systemic.

If we collectively decided to demand more transparency from Celsius, BlockFi and Genesis, the CeFi lending daisy chain wouldn’t have been so systemic.

If venture investors decided FTX needed an independent board of directors, Sam’s fraud couldn’t have reached the scale it did.

If we demand more public transparency from exchanges, they won’t be able to steal from customers as easily.

The collective non-“big wigs” can demand that the “big wigs” lock their token investments up for longer. We’ve seen bad token structures in major projects that the market just plain rejects – ICP, HBAR and FIL all come to mind. We can collectively decide to do a lot more of that.

We can collectively ask tough questions on big stages and then amplify the answers whether they’re good or bad.

We can just demand a higher burden of proof before trust or even benefit of the doubt is given.

We can be unwilling to let exchanges trade against customers. Imagine that!

We can demand Stablecoins deliver trustworthy audits.

You can read the above list and really understand what I mean when I say self-regulation is a social structure. We just collectively decide and then vote with our feet/wallets. It’s not some impossible task. This space has expelled bad actors before, but we’re woefully incompetent at doing it effectively and in a timely fashion. And I get it. It’s not super easy. There’s a daisy chain of shitty actors strewn across subsectors that push back on these sorts of demands and that pushback makes it hard to take stand. But we can just collectively decide to do it. It’s like deciding to lose 15 lbs and then convincing your friend group to lose 15 lbs with you. It’s a social structure that pushes for specific actions that lead to specific outcomes.

We have to be broadly more skeptical from the outset, especially of any individual or project that begins to gain significant power and influence. I’ve written about this concept a bunch of different ways over the last eight Monthly Updates. I’ll try another way - those of us paying close attention to the space that have reasonably sized public audiences need to be sounding loud alarm bells when things start rising in prominence. If you want to be important in crypto, you should undergo a metaphorical proctology exam. The ecosystem should get a really good look at who you are and what you have to show for yourself. It’s an enormous honor and obligation to be a leader in this ecosystem. Why don’t we treat it as such? We’ve been doing a really bad job at that for over a decade. There’s enormous room for collective improvement here. No one is going to do it for us.

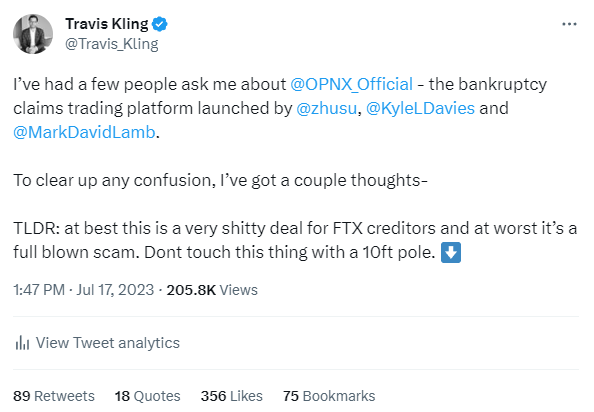

“Opnx” is a good example. This is the bankruptcy claims trading platform started by Su Zhu and Kyle Davies. NOT EXACTLY A LONG PUTT FOR EXPELLING BAD ACTORS. You write a tweet thread –

.

The tweet thread gets good traction. Other good actors rally around it and amplify it. Repeat as necessary until threat is extinguished. Mission accomplished.

Not rocket science, but it does take ACTIVE good actors to execute the gameplan. To expand on a previously discussed concept, crypto has 1) active good actors; 2) passive good actors; 3) indifferent actors; and 4) bad actors. We can close off a lot of the attack vectors from #4 with government regulation and more effective self-regulation. But more effective self-regulation requires the conversion of #2’s to #1’s and existing #1’s to be even louder. #4’s will still exist, but they’ll be neutered in their influence by the words and actions of #1’s. #3’s will still exist too, but they’re mostly followers - If less deleterious paths are readily available, less will be taken.

I’ve put more effort into this ecosystem than anything I’ve ever done. That’s a fact. Many thousands of hours. Sacrificed all sorts of stuff for crypto. Many of us have. Be honest with yourself about what you have to show for it, beyond maybe dollars in bank account. I am worried about this ecosystem that I’ve poured my blood, sweat and tears into over the last six years. You should be too, if you’re so inclined. The good guys are getting the shit kicked out of us by the bad guys. We have immediately actionable changes we can start making. Today.

Market Update – Liquid Crypto Asset Investing

| Symbol | July | June | May | Apr | Q2-23 | Q1-23 | YTD | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -4% | 12% | -7% | 3% | 7% | 72% | 77% | -64% | 60% | 303% |

| ETH | -4% | 3% | 0% | 3% | 6% | 52% | 55% | -67% | 399% | 469% |

| XRP | 47% | -8% | 10% | -12% | -12% | 58% | 106% | -59% | 278% | 14% |

| BCH* | -17% | 138% | -4% | -5% | 117% | 16% | 108% | -75% | 6% | 71% |

| EOS | -1% | -16% | -13% | -14% | -37% | 38% | -13% | -72% | 17% | 1% |

| BNB | 0% | -22% | -9% | 7% | -24% | 29% | -2% | -52% | 1269% | 172% |

| XTZ | 2% | -11% | -10% | -11% | -28% | 56% | 15% | -84% | 116% | 49% |

| XLM | 36% | 20% | -2% | -14% | 1% | 55% | 111% | -73% | 108% | 184% |

| LTC | -15% | 19% | 2% | -1% | 21% | 28% | 32% | -52% | 17% | 202% |

| TRX | 2% | 5% | 8% | 12% | 27% | 10% | 43% | -28% | 181% | 101% |

| Aggregate Mkt Cap | -3% | 5% | -5% | 1% | 1% | 49% | 46% | -64% | 186% | 301% |

| Aggregate DeFi* | 0% | 1% | -4% | -3% | -5% | 50% | 42% | -77% | 581% | 1177% |

| Aggr Alts Mkt Cap | 0% | -2% | -3% | 0% | -5% | 33% | 26% | -64% | 479% | 274% |

Source: CoinMarketCap. As of 7/31/23. BCH includes SV. Aggregate DeFi from Coingecko.

July was one of the lowest months of price volatility in Bitcoin history. The chart below shows daily Bollinger Band Width (a measure of realized volatility) in orange. Historical periods of comparably low volatility are market in yellow.

Source: TradingView. As of 8/1/23.

As you can see, we’ve had seven prior instances of comparably very low volatility, and five of those seven saw prices increase thereafter. Which is to say, usually when price squeezes this much, it’s preparing to move higher.

It’s easy to imagine why price would move higher in the near-term. A spot BTC ETF would get that done for sure. On the flipside, a heavy-handed DOJ action against Binance would spike volatility in the other direction. Perhaps you get both in quick succession – remember volatility works both ways.

To match that very low volatility, Coinbase had its lowest monthly BTC trading volumes in 3 ½ years.

Source: TradingView. As of 8/1/23.

It’s pretty strange to see so little volume follow through on the spot Bitcoin ETF announcements. I think it speaks to the uncertainty around the likelihood and timing of approvals on those ETFs. I think it also speaks to troubles lurking at Binance. The market is confused right now.

Below is an updated version of a chart I’ve shown here the last few months. I think this still paints an accurate picture.

Source: TradingView. As of 8/1/23.

ETHBTC remains in its 2+ year range and continues its slow, yearlong grind from the top of that range back towards the bottom.

Source: TradingView. As of 8/1/23.

ETHBTC has underperformed by ~25% over the last year, which isn’t really that much. There’s good fundamental reasons for that underperformance. Alts have been under heavy regulatory scrutiny and the regulatory fate of Alts is currently still uncertain. This hits ETH directly, even if ETH is unlikely to itself be deemed a security.

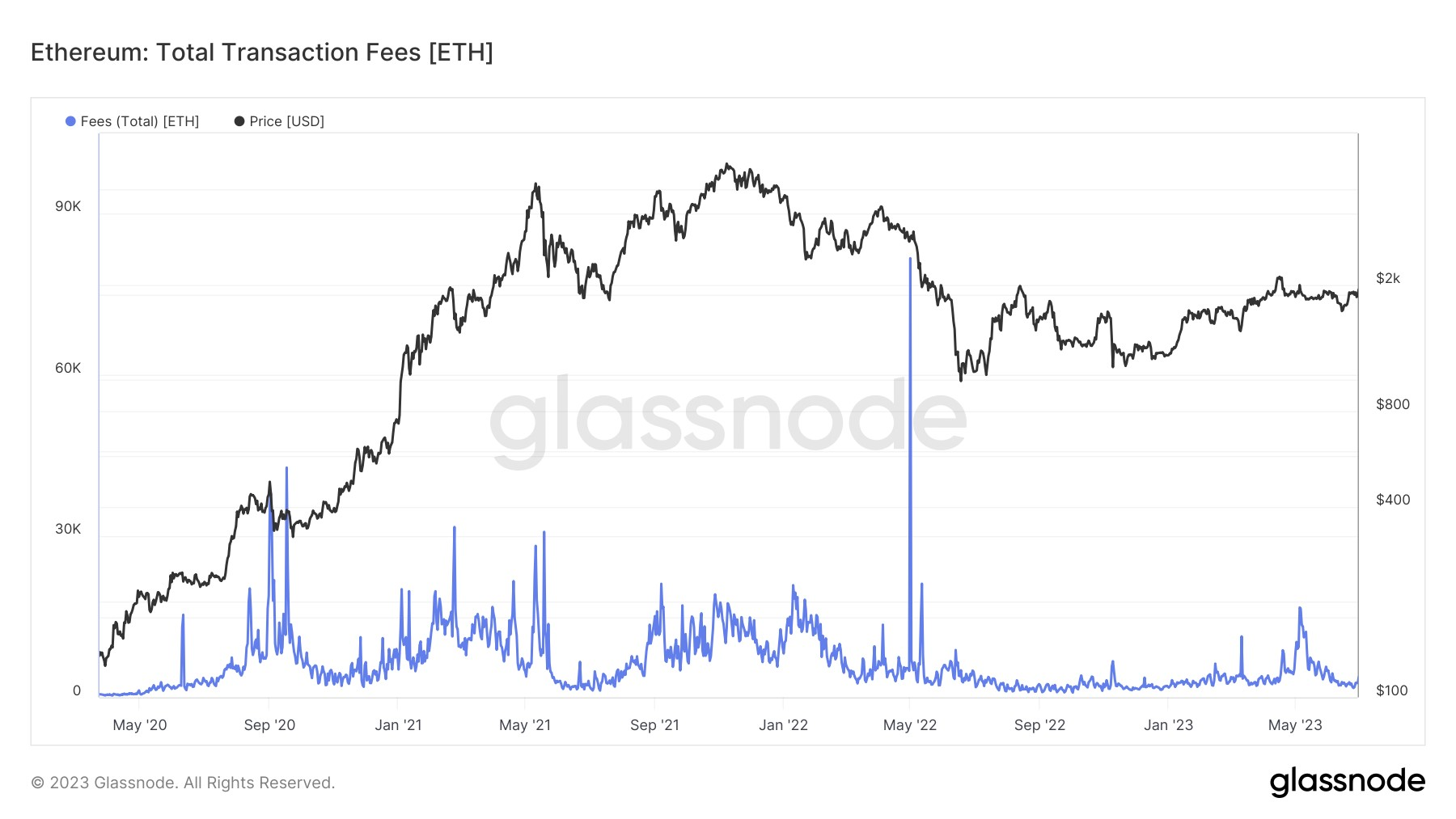

ETH’s value is a function of the activity on the ETH blockchain and that activity has been quite dead over the last year.

As of 8/1/23.

NFTs are dead. Gaming is dead. DeFi is dead. Not saying it will stay that way forever, but that’s the state of ETH blockchain activity at the moment.

As previously mentioned, XRP pumped hard on the favorable ruling against the SEC and was +47% in July. That said, it has given back half of the initial pump and you can see below there has been no follow through in trading volume. This speaks to the confusion in how to interpret the judge’s ruling the SEC case and also speaks to the general malaise in the crypto markets right now.

Source: TradingView. As of 8/1/23.

SOL pumped nearly 50% in sympathy with XRP. It’s given back the large majority of that pump and trading volumes have collapsed back down. No follow through.

Source: TradingView. As of 8/1/23.

Same story with ADA (and bunch of other Alts). Pumped 32% with XRP ruling. Gave almost all of it back. No volume.

Source: TradingView. As of 8/1/23.

Just one chart from Macro today. NASDAQ has gone up 45% YTD in a straight line with very little pullback and is now just 6% away from ATHs. It’s been one of the best starts ever for the NASDAQ. Very few investors expected this kind of performance at the beginning of the year and there are still trillions of dollars on the sideline in money market funds that could find its way back into tech stocks. In prior years, this QQQ performance would have pulled Bitcoin and the rest of crypto up strongly along with it. But Bitcoin is essentially flat since mid-March. Too many idiosyncratic issues going on in crypto right now. But if the ETFs get approved and Binance risk turns out to be ok, we’re likely due for a catch-up trade.

Source: TradingView. As of 8/1/23.

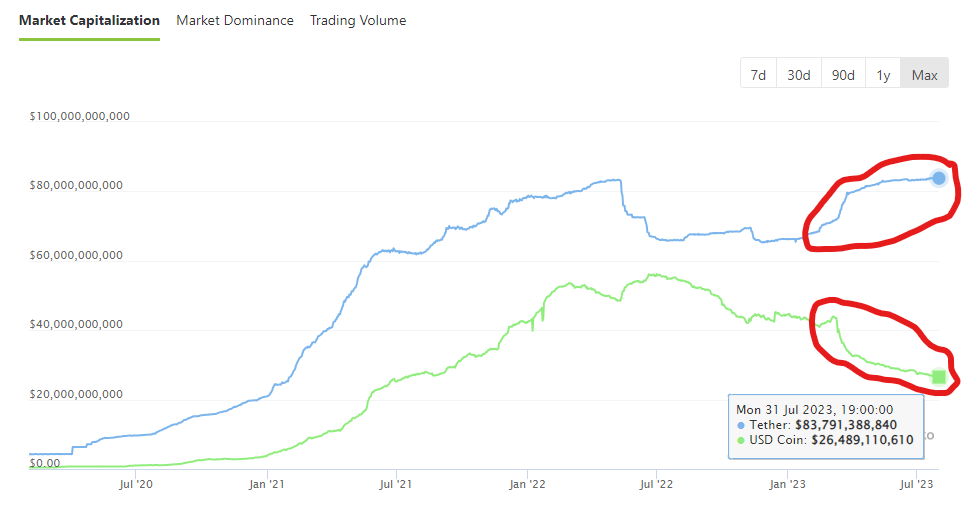

Finally, I want to bring up Tether. They recently released their Q2-23 attestation and that business is a total behemoth. I wrote a tweet containing some of details here. I specifically want to point out this chart –

Source: Coingecko. As of 7/31/23.

YTD, Tether’s market cap has increased $17.6bn while USDC’s market cap has declined by $18bn. There was a particular acceleration in both these trends beginning in March, on the heels of the banking crisis in the US. You can see the two market caps are essentially mirror images of each other. Why is that? My guess is Operation Chokepoint 2.0 and the collapse of Silvergate and Signature pushed funds out of the US banking system into Deltec. Apparently, whoever had access to USDC redeems also had access to Tether mints. The key takeaway here is Tether is incredibly powerful and growing more powerful by the day. It’s Tether’s world and we’re just living in it.

Closing Remarks

It felt good to write that main section of this month’s update. It’s good to see a gameplan all in one place like that. It’s not an impossible task to set out on a path to improve how this ecosystem regulates itself. How we identify and expel bad actors. How we demand greater transparency. I’m one guy with a newsletter and a fund and a Twitter account. You may have lesser or greater influence than I do, and we all have our little part we can do.

I suspect there aren’t that many truly bad actors reading this. I would guess there’s a fair amount of passively good actors and indifferent actors reading this. I invite you to take this Monthly Update as an opportunity for self-reflection. Why am I reading this Monthly Update? Why am I involved in crypto at all? To stack as much money in your bank account as possible? OK…to what end, though? And how much longer do you think that’s going to work? Yeah we’ll probably get another bull cycle in the next two years. If you trade it well, you can make a lot of money. But if that bull cycle isn’t built on firmer, more sustainable foundations, it will implode just like 2013 and 2017 and 2021. More people will get hurt. More users will be turned off from the space forever. If crypto implodes even more spectacularly this next cycle than the previous cycle, what are the chances we won’t get another shot at delivering on this technology’s potential to make the world a better place? Crypto has burned successively more people in each cycle. How much longer can we keep that up before we run out of new ecosystem participants to burn?

It's the ratio of 1) actively good actors to 2) passively good actors + 3) indifferent actors + 4) bad actors that has me most worried. If I were going to guess, maybe 20% are actively good actors. Another 25% are passively good actors, maybe 40% are indifferent and 15% are bad actors. We gotta juice that ratio or the space is at risk of failing. I’ve laid out some reasons why bad actors are drawn to this space like moths to a flame, and I’ve laid out some things we can do about it.

I welcome feedback of all sorts on any of the ideas I presented here today. This should be a discussion. I’m not trying to preach at anyone and I’m talking to myself as much as anything. The only thing necessary for the triumph of evil is for good men to do nothing.

“Better than a thousand days of diligent study is one day with a great teacher.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS