DeFi Kingdoms - April Update

/Last month we talked about DeFi Kingdoms, and the vast amount of content they delivered in March. This month I’d like to recap what happened in April, and talk a bit about how we see the path forward.

In case you do not follow DFK, it’s a GameFi project based on the Harmony chain that recently expanded to AVAX. But despite the innovation the price of the Jewel token was down 90% over the course of the month. So what happened?

For context, most people are aware that the broader markets have been under pressure. Bonds, the NASDAQ, and especially crypto. In this environment, the market is prone to strong negative reflexive reactions to negative news. This is especially true for smaller cap crypto names which reside further out on the risk curve.

Leading up to the launch of Crystalvale around the end of March, there was a lot of excitement and the price of Jewel rallied from the $3 range into the $10 range. But over the month of April the price leaked lower and returned to the $3 range as the last week of the month closed in. It was around this time that an exploit which was known but not considered top priority started to be a larger problem than first assumed.

Locked Jewel balances were intended to remain locked until the beginning of the unlock period, after which time they would unlock in a linear fashion for about one year. However, a game feature called appropriately “mining” allowed some NFT characters to chip away at this balance before the unlock date. Someone discovered that by moving the entire locked balance from one account to another this process could be sped up. As more people started to catch up, there was a point where somewhere in the neighborhood of 12k Jewel per hour were being unlocked before their time.

A patch was pushed out and this situation was remedied approximately 48-hours after this came to light. But there were more dark clouds on the horizon as it was also revealed that DFK’s founder, FriskyFox had in fact sourced the initial $15k of liquidity for the Jewel/One liquidity pool from an acquaintance. This acquaintance had subsequently been given control over this wallet and had been playing the game under the moniker “LiquidLuck.”

This controversy began to create a stir in Discord and on Twitter, and took a strange turn when a huge number of unknown accounts seemingly sprung up out of nowhere in Discord that nobody had seen before. They started calling for FF’s head on a silver platter and it seemed at the time that the community had turned against the game’s founder.

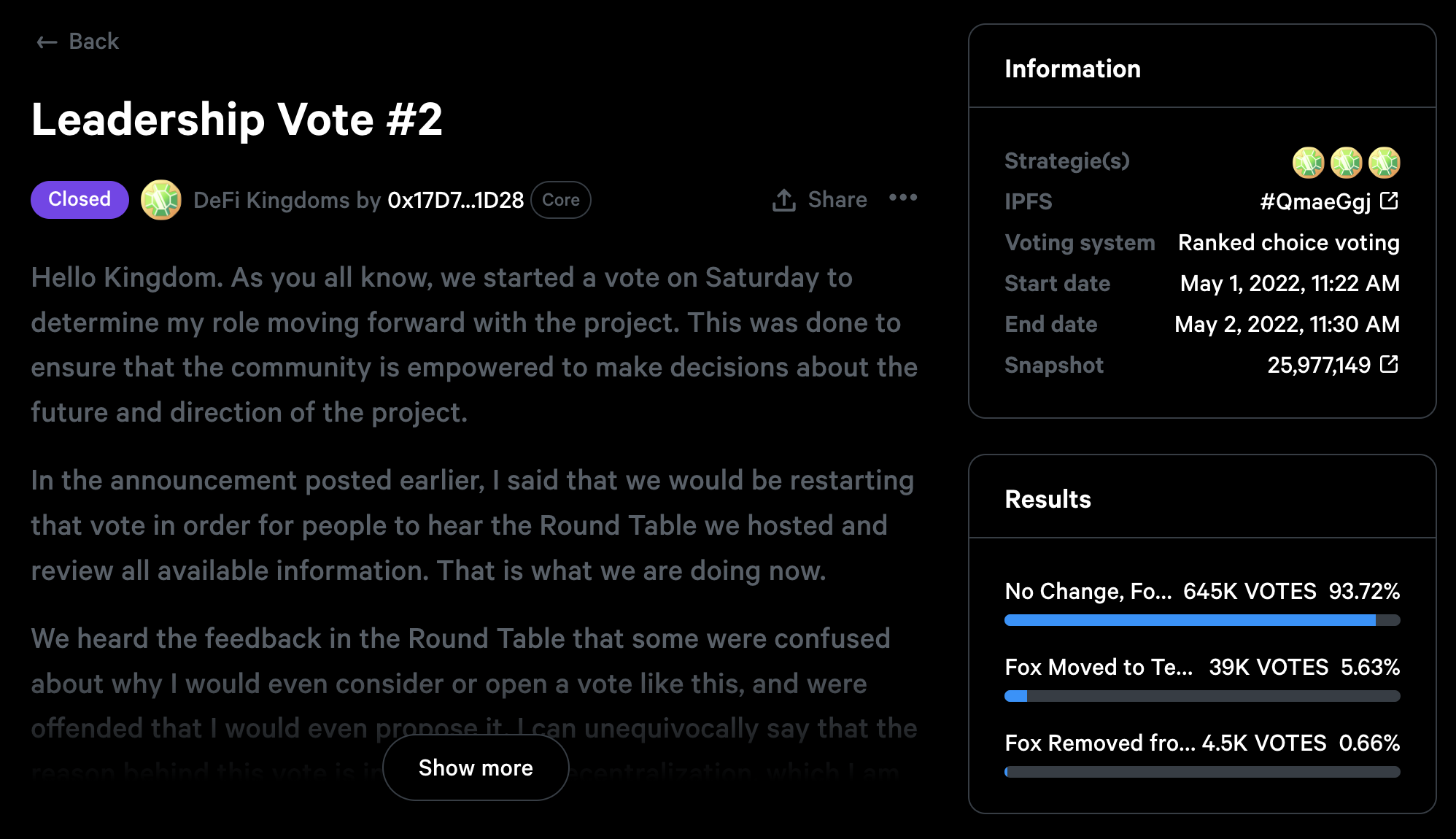

At this time FF put up a poll admitting that he had not disclosed the source of the initial LP funds and offered to resign if the community deemed it necessary. The price of Jewel fell 40% or more overnight. However, after the votes were tallied it became clear that the community was overwhelmingly in support of FriskyFox and voted to keep the founder at a rate of 9:1.

But it was at this time that another piece of negative news came out. Someone had found a transaction in FF’s wallet history that linked him to a previous project. This project had essentially rugged the community and left a bad taste in many people’s mouths. FF admitted that he was in fact affiliated with this team, but had only a minor role as a front-end developer working on the website.

And again, another poll was posted where FriskyFox explained that he had left that project because of the founder’s behavior. He had kept this information to himself because while the other project was still active he didn’t want to come out and attack them. Also, he didn’t want people to think that DFK had anything to do with the other project.

A second vote was posted and FF offered again to step aside if the community believed that he was in fact an obstacle to the success of DFK. However, for a second time the community responded with over 93% saying that FF’s position should not be changed.

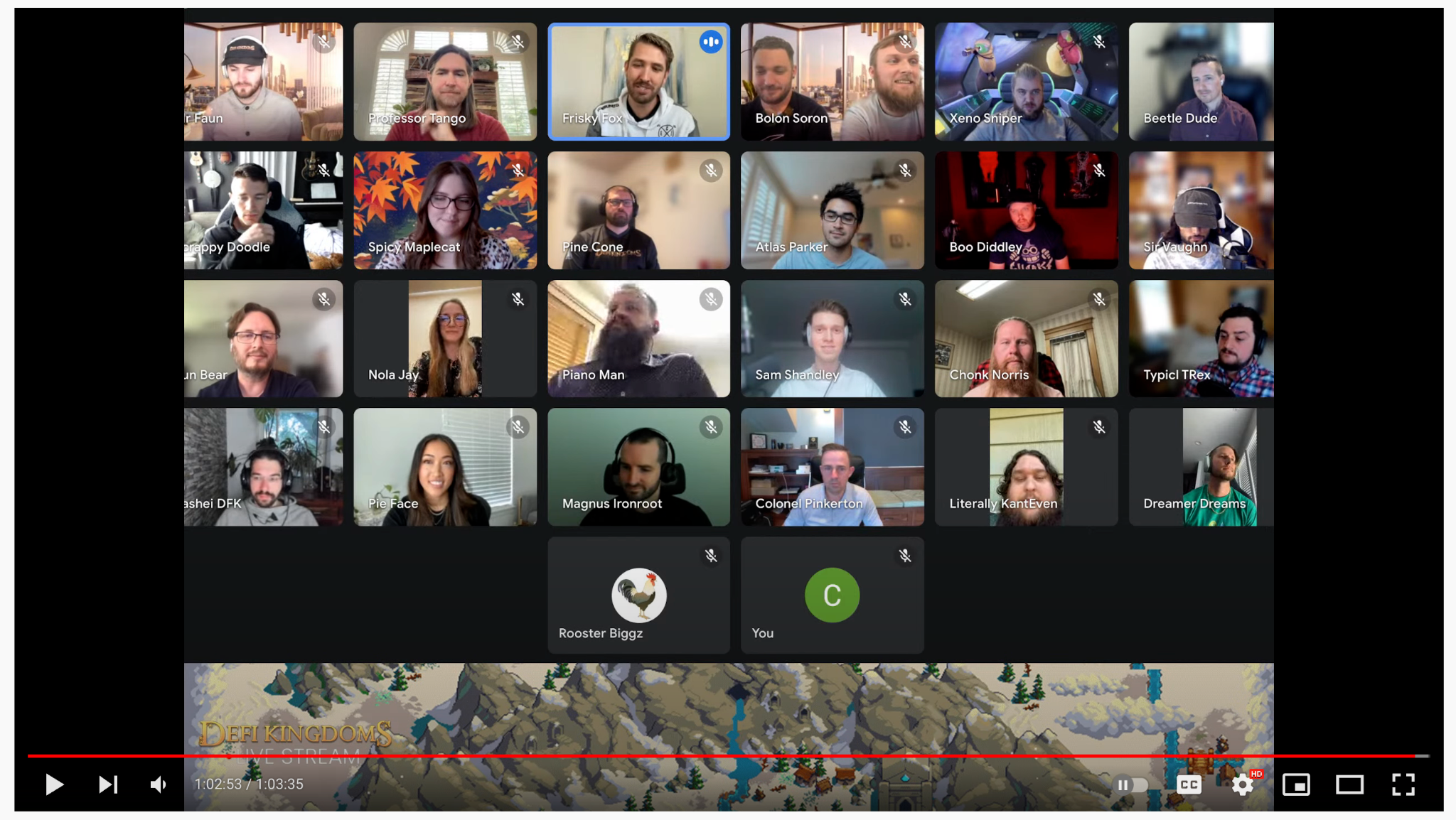

Since this time, there have been meetings held with the community and plans are being made to find the best path forward. Some of the suggestions are that an advisory board be created and that the team members who are core to the project reveal their identities if they so choose. At the time of writing this, there will in fact be a meeting later this week in which several team members who were previously anonymous will reveal who they are on camera. This reveal will include FriskyFox, who founded the project.

*An update since I wrote this, the overwhelming majority of the team did Doxx themselves, revealing their faces and names on YouTube*

In a community panel someone asked if the project had enough funds to keep building after the massive price decline. For context, when the game was created, two-million Jewel were minted to support development. Fortunately, DFK was designed with a token economic model that allowed them to build from day one without ever having to dip into these funds. This buffer meant that only after a 90% price decline in a single month would the team use these funds for the first time. Translation, there’s a lot of runway and building will continue just as before.

In retrospect, there were a certain set of circumstances that could have led to a loss of confidence in the team. These were not those circumstances. In fact, to have come through this series of events in a market like this shows that there is in fact a very strong community behind this project. During this drama, delivering updates did not stop or even slow down. And I would say that if there are two things you cannot do without in this space it’s the ability to deliver and having a strong community. DFK had both and still does.

In the grand scheme of things, the scale of this situation pales in comparison to with the ETC fork, the BCH fork, the Wormhole exploit, the Parity Multisig fiasco, the Ronin hack, and many other events that have shocked and awed the cryptoverse. It should be noted that in each of these cases, it was the ability of a project to deliver and the strength of the community that pulled Ethereum, Bitcoin, and even SkyMavis through.

With all that being said, I will continue to be involved in DFK and I do support their founder as someone with a powerful vision and the ability to get results and bring new ideas to market. However, we will be monitoring this situation closely for any further developments.

Thank you,