February 2023 - Monthly Market Update

/Monthly Update || February 2023

“A good builder is able to avoid construction flaws, while a poor builder incorporates construction flaws. When there are no earthquakes, you can’t tell the difference.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our fifty-third Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

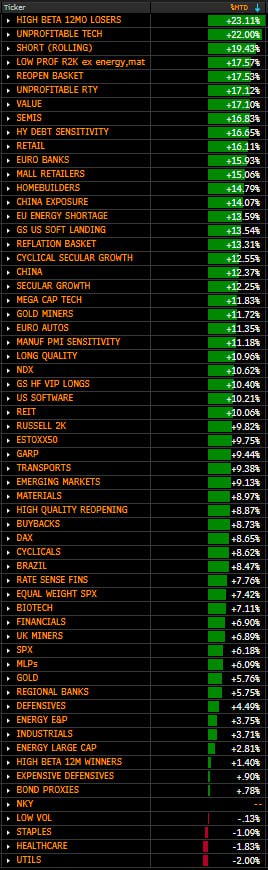

To that end, Bitcoin was up 40% in January, undeterred by more knock-on effects from last year’s collapse that came to fruition. That +40% performance was with the backdrop of “It’s All One Trade” firmly in place. Look no further than the below chart.

Source: Bloomberg. As of 1/31/23.

The biggest winners in January were the biggest losers last year, Bitcoin and crypto broadly were no exception.

The rally in macro assets in January was driven mostly by positioning, as the market digested an increased likelihood of a soft landing - a previously out of favor view. Consensus now seems to be rapidly coming to the conclusion that: 1) the Fed is nearly done hiking; 2) inflation is coming down rapidly; 3) the labor market can remain strong while inflation slows; and 4) the economy doesn’t have to spiral into a deep recession, or even a recession at all. As the saying goes, the consensus view is rarely correct, so one must examine where that scenario could be wrong. Ukraine and the accompanying energy costs could spike inflation. China re-opening could cause spillover inflation in the US. Economic data and company earnings could rapidly deteriorate. All are worth watching closely.

I wasn’t expecting crypto to able to perform so well in January, even with such strong macro tailwinds. I thought we’d still be too mired in our own idiosyncratic funk. But with hindsight, so much coin traded hands at the lows in November, and many Alts traded so weak into year-end, I think January was just a month of no sellers in crypto. If you were gonna sell, you already sold. The entire market making industry in crypto has been eviscerated over the last year, so spreads widen, and price gets gappy to the upside. Worth remembering that’s a two-way street.

We had a slew of negative news headlines for crypto in January. Just see the Monthly Highlights below. Genesis bankruptcy. All kinds of FTX stuff. Lots of enforcement actions. Lots of layoffs. It was a messy month. But prices travelled aggressively up, in lockstep with macro regardless. It’s worth noting that as we look out into the rest of this year for crypto, we can expect a lot more negative headlines. More Genesis/Gemini/DCG headlines. Lots of FTX headlines. More regulatory and enforcement headlines. Perhaps other crypto businesses shutting down. Perhaps more fraud. Almost certainly more hacks. But it’s also worth noting that not all of these may be immediately negative for price action. Sure they might be ugly, or captivating. But that doesn’t mean they’ll necessarily push the market immediately lower. Any kind of GBTC redemption that would cause BTC to be sold on the market would likely have an immediate significant negative price response. At the moment, that doesn’t look super likely. It looks like Mt Gox coins will be coming this year. That may have a negative effect on price, but it’s not a clear-cut answer. A lot of these other headlines will just be the type of headlines that remind us that we have a lot of egg on our face right now as an industry. They’re the kind of headlines that may keep large pools of institutional capital at bay, for fear of this unruly market wrought with fraud and bad actors. But that’s not the same as causing prices to crash. We may not have “crash the market” kind of news coming in 2023. That would be a welcome reprieve from the last year.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

January Highlights

Cameron and Tyler Winklevoss Get in Pissing Contest on Twitter with Barry Silbert Over Liabilities Between Gemini and Genesis/DCG; Nothing Meaningful Accomplished

SEC Charge Gemini and Genesis with Unregistered Securities Offering

Genesis Files for “Pre-packaged” Chapter 11 Bankruptcy, Said to Exit Bankruptcy in May 2023

Sullivan & Cromwell Release Slide Deck with New Information on FTX Bankruptcy, Claims to Have Possession of $5bn in Liquid Crypto, Alludes to Clawbacks of Historical Transactions, Reports Alameda Having a $65bn “Backdoor” on FTX

NYT Reports FTX Employees Discovered Alameda Using Hundreds of $mm of Customer Funds in 2020

New FTX CEO John J. Ray III Says He’s Considering Restarting FTX Exchange

FTX Bankruptcy Sues Voyager Digital to Claw Back $446mm Payment Made During Preferential 90-day Period

Sam Pleads Not Guilty to All Criminal Charges, Trial Set for October 2nd

FTX Bankruptcy Judges Orders Seizure of $93mm in Cash Held in FTX Account at Silvergate

Former FTX General Counsel Daniel Friedberg Cooperates with US Authorities on FTX Collapse

196 Congressmen Took Direct Contributions from Sam and Other FTX Executives

DoJ Seizing Robinhood Shares Held by Sam

DoJ Takes Enforcement Action Against Russian Crypto Exchange Bitzlato Over Money Laundering

Coinbase Reaches $100mm Settlement with NYDFS for AML/KYC Violations

Nexo Reaches $45mm Settlement with SEC Over Sale of Unregistered Securities

SEC Charges Avraham Eisenberg with Market Manipulation of DeFi Protocol Mango Markets

Ex-Coinbase Manager’s Brother Sentenced to 10 Months in First Ever Crypto Insider Trading Case

Alex Mashinsky Sued by NY AG for Making False Statement to Investors

Date For Oral Arguments in Grayscale’s Appeal of SEC’s Bitcoin ETF Set on March 7th

Binance Admits Stablecoin Pegged-BUSD Had >$1bn Collateral Hole, Claims It Is Now Fixed

3AC Founders Partner with Coinflex Founders to Attempt Launch of “GTX” Exchange Using Bankruptcy Claims from Celsius, Voyager and FTX as Collateral for Trading

Ethereum Sets Shanghai Upgrade Date for March

AWS Announces Node Services for Avalanche

USDC Announces Pending Launch of Cross-Chain Transfer Protocol, Allowing for Seamless Bridging Between Blockchains

Wyre Apparently on the Verge of Shutting Down, Receives Last Minute Rescue Financing from Unnamed Strategic Investors

Coinbase Lays Off 1,000 Employees, Reduces Operating Expenses 25% Q/Q

Blockchain.com lays Off 28% of Employees

Crypto.com Lays Off 20% of Employees

Huobi Lays Off 20% of Employees, Rumors Swirl of Solvency Issues

Mt Gox Repayment Deadline Pushed Back to September

Blackrock Reports 7.2% Stake in Silvergate

Prop Trading Firm “Group One” Reports 12.5% Stake in MSTR

Crypto.com Delisting Tether in Canada Due to Regulators

Voyager Digital Bankruptcy Receives Preliminary Court Approval For $1bn Sale to Binance, Subject to OFAC Approval

Leading Asian Crypto Fund HashKey Raises $500mm Fund III

Injective Launches $150mm Ecosystem Fund with Pantera, Jump, Kraken, Delphi, et al

Blockstream Raises $125mm for Bitcoin Mining

| Asset Class | Jan | Q4-22 | Q3-22 | Q2-22 | Q1-22 | 2022 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 40% | -15% | -2% | -57% | -2% | -64% | 60% | 303% | BTC |

| NASDAQ | 11% | 0% | -5% | -23% | -9% | -33% | 27% | 48% | QQQ |

| S&P 500 | 6% | 7% | -5% | -16% | -5% | -19% | 27% | 16% | SPX |

| Total World Equities | 8% | 9% | -8% | -16% | -6% | -20% | 16% | 14% | VT |

| Emerging Market Equity | 9% | 9% | -13% | -11% | -8% | -22% | -5% | 15% | EEM |

| Gold | 6% | 10% | -8% | -7% | 6% | -1% | -4% | 25% | GLD |

| High Yield | 4% | 3% | -3% | -11% | -5% | -15% | 0% | -1% | HYG |

| Emerging Market Debt | 4% | 7% | -7% | -13% | -10% | -22% | -6% | 1% | EMB |

| Bank Debt | 3% | 2% | 0% | -7% | -1% | -7% | -1% | -2% | BKLN |

| Industrial Materials | 13% | 9% | -8% | -25% | 16% | -13% | 29% | 16% | DBB |

| USD | -1% | -8% | 7% | 7% | 3% | 8% | 6% | -7% | DXY |

| Volatility Index | -10% | -31% | 10% | 40% | 19% | 26% | -24% | 66% | VIX |

| Oil | -1% | 7% | -19% | 8% | 36% | 29% | 65% | -68% | USO |

Source: TradingView. As of 1/31/23.

Is This A Fight Worth Fighting?

As has been discussed here in depth the last two months, Ikigai’s and my future are very much up in the air at the moment. We had the large majority of our assets on FTX at the time of collapse and so that event has proven to be a major turning point for both Ikigai and myself. Ikigai may continue as a standalone investing business or we may wind the fund down. We may join another investment firm and manage money there or we may decide not to manage outside capital for a period of time, or ever again. There’s even been a question in my head and my partner Anthony’s head about whether to remain professionally involved in crypto at all. Like I said, we find ourselves at a major crossroads.

At times like these, it’s important to deeply examine the core factors and motivations that underpin the decision tree laid out in front of you. Why would you pick one direction or another? In the decision tree described above, the most foundational question for me is, “is this (crypto) a fight worth fighting?”. If you’ve been reading these Monthly Updates for a while, you know I’ve been stating this question as a fact for some time – “it’s a fight worth fighting”. Let’s examine that.

Restating The Original Thesis

To set the stage for this discussion, let me first repeat what has essentially been my thesis on crypto for the past five years. Historically, my reasoning behind the statement “it’s a fight worth fighting” has been as follows – crypto has the potential to make the world a better place. And it can do it quickly, in a single generation. There are multiple worthwhile use cases for crypto (some further along than others) that can advance humanity in a positive direction. Critical to the underwriting of the statement “crypto is a fight worth fighting” is the existence of POTENTIAL. And for better or worse, crypto isn’t much more than potential at this point. As we sit here today in February 2023, some 14 years since the Genesis Block of Bitcoin, crypto doesn’t have all that much to show for itself in terms of making the world a better place.

It's not that there’s NO good that’s come from crypto. That’s simply not true. There are. Many cases. Of crypto helping make the world a better place. It’s just that, when examining “how has crypto made the world a better place so far”, it’s only fair to include the bad along with the good. And there’s been plenty of bad. The two biggest negatives in my opinion have been hacks and money laundering. The totality of both those buckets over the entire history of crypto amounts to many billions of dollars going towards evil, in many cases at the expense of good people. Netting all the good crypto has done against all the bad is mostly a qualitative exercise, so we can argue about the results. But in my opinion, it’s probably about a wash. There’s been about as much good done with crypto as there has been bad. Which is to say, as we sit here in February 2023, it’s really just all potential. A trillion dollars of market cap, billions of dollars of venture capital funding, tens of thousands of careers and 200mm+ users worth of… potential.

As I’ve said many times previously, and continue to believe today, whether crypto delivers on all of, some of, or none of it’s potential to make the world a better place will be entirely dependent on the individuals working towards these various outcomes. It goes without saying, there are many bad actors in crypto. If this wasn’t abundantly clear before, surely 2022 really drove home that point. People that care only about stacking as many dollars as possible in their bank account, regardless of who gets hurt in the process. People that are willing to lie, cheat and steal in the pursuit of that goal. Even people that aren’t necessarily evil. Just people that love to gamble and view crypto like horse racing or the casino. Leaving aside the argument of whether gambling is inherently evil, I think it’s safe to say that it’s not doing any good in this world. It’s an activity that exploits the brain chemicals of humans that developed over millions of years of evolution. It brings no good to society. At best, it’s a transfer mechanism of money from bad risk takers to good. Crypto is filled with 1) bad actors; 2) actors that are indifferent towards good in the world; and 3) good actors, that want to do their part in pushing this technology towards making the world a better place.

In that way, cohort #3 is in a fight against cohorts #1 and #2. So I ask again, is that a fight worth fighting?

I don’t think I’ve ever shared this publicly, and my mom is so upset with me about this, but I’ve never voted in an election. Not a single one. For some reason, by the time I was 18, I had concluded that my vote didn’t matter. At the age of 18, I felt that people in America with money and power decided what the rules were going to be and no one else mattered. As I got older, I realized that my approach to voting fell into what economists call the “Free-rider Problem”. I don’t vote, because the costs outweigh benefits to me. But if everyone took that approach, our democracy wouldn’t work. I came to the conclusion that if I ever lived in a place where the election results would be tight, I would probably vote. But I never have.

All of that to say, I somehow managed to adopt a deep distrust of institutions from an early age, and that view only strengthened as I continued further into adulthood. I graduated college in May 2008 and entered investment banking just in time to get the financial crisis right in the face. The government’s response to the GFC in the years that followed only further served to strengthen my distrust of institutions. By the time I got to Point72 in 2015, I felt strongly that the entire economy and capital markets system was rigged. And in the meantime, the political process in America just became more and more broken in my view. So when I finally got around to really digging into crypto in the summer of 2017, my draw towards it was heavily influenced by a backdrop of distrust of institutions.

Decentralized Money Is A Fight Worth Fighting

Money is a human coordination tool. It was made up by humans ~5,000 years ago to replace bartering. Money is a shared belief system. The human species is the most advanced species on Earth in part because of our ability to coordinate on incredibly complex tasks. Other animals can coordinate but nothing comes close to the complexity of human coordination. Humans are also the most advanced because we have a unique ability to project out into the future in our minds and make complex decisions in the present based on those future predictions.

Fiat currencies have been around for ~1200 years and without fail every one in existence has collapsed. The British Pound is the oldest fiat currency still in circulation and it has lost 99.5% of its value vs silver over its existence. Which is to say, the Pound is still around but it’s failed miserably as money. World reserve currencies have been around for at least 600 years. They’ve all come and gone and been replaced by another currency. There’s always been a “buildup” period while one currency is handing off the world reserve currency status to the next. If you took the average length of a world reserve currency’s reign before it’s demise and applied it to the US Dollar, time would be up around 2030. Behold one of my favorite graphics-

Source: @philosophyofmet.

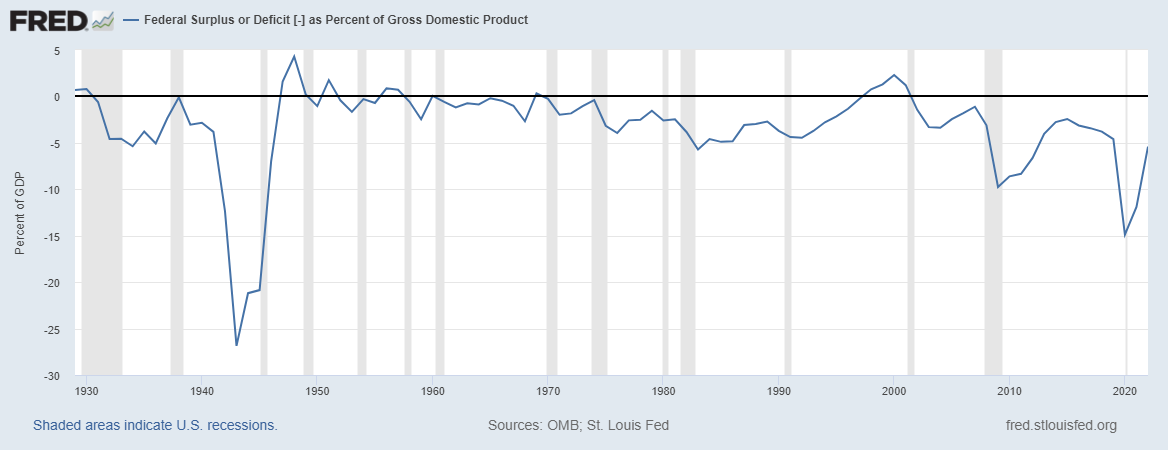

When looking objectively at the health of the US Dollar, there’s no way to come to the conclusion that it’s in good shape. Government debt to GDP has exploded to a level only previously seen at the peak of WW2.

Source: longtermtrends.net.

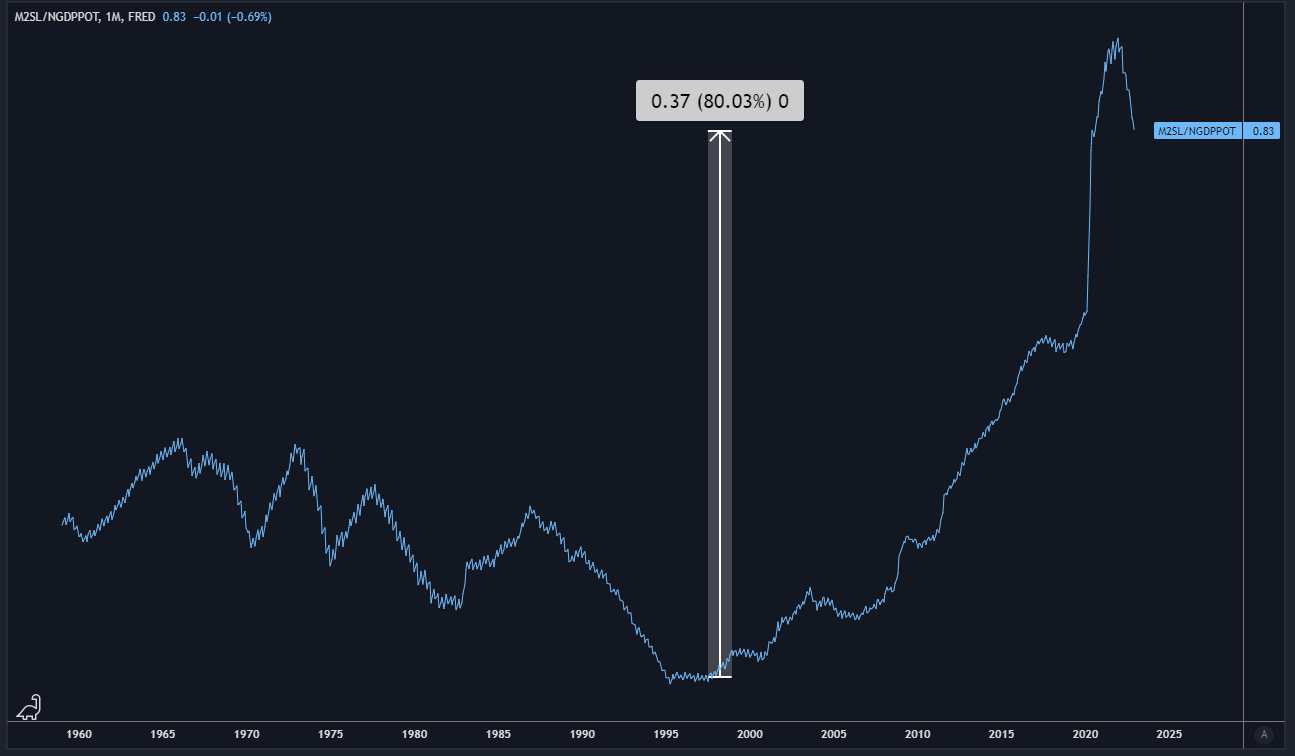

US M2 Money Supply to Nominal GDP has increased 80% in the last 25 years. Which is to say, there’s less and less economic output per dollar in existence.

Deficit spending as a percent of GDP is increasing, which means the situation is getting worse at an accelerating rate.

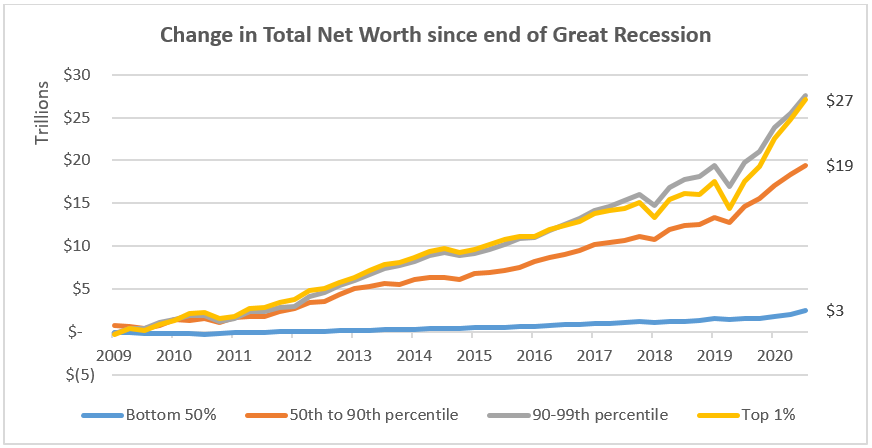

Finally, wealth inequality in the US has widened to a staggering degree. This is not entirely due to monetary and fiscal policies of the US government, but it is (in my view), the single largest factor. The wealth inequality situation is bad for humanity and likely unsustainable.

Source: opportunityinstitute.org

When looking objectively at how we got into this predicament with the US Dollar, you invariably arrive at a misalignment of incentives. The attack vector for these misalignments is so acute because all of the decision making is so heavily concentrated in such few hands. We don’t VOTE on the Fed Funds rate. We don’t VOTE on QE. We don’t even VOTE on the guys that get to decide that. They’re appointed. So guy named Jerome Powell, who got fired from Carlyle, decides the price of every financial instrument and the growth rate of every economy on planet Earth. That’s not hyperbole. That’s facts. It’s easy to see how this misalignment of incentives arises. It’s fundamental in the process. It’s. Just. Easier. For. Politicians. To. Print. That’s been true for as long as there’s been fiat currencies, which is way all fiat currencies have met the same fate. Fiat currencies are a fundamentally broken human coordination tool.

For a long time, we couldn’t do much about that. Then Bitcoin came along - a decentralized form of money totally unlike anything the world had ever seen. I’ve mentioned this here before, but I like the mental exercise of pretending an advanced alien civilization is observing Earth and how humans are coming along in their advancement. These aliens have progressed far beyond our current capabilities. They’ve innovated away suffering, pain and death and live in perfect tranquility through evolution and the use of technology. If that civilization took a look at how money works today on Earth, with the benefit of all their advanced knowledge, and then looked at Bitcoin, I think they would absolutely choose Bitcoin as the better form of money.

Bitcoin is a fundamentally better form of money than fiat currencies. I believe the very nature of Bitcoin removes the misalignment of incentives that have ailed fiat currencies throughout their history. A world where Bitcoin is the world reserve currency, or the collateral foundation of the global financial system is a very different world than we live in today. The journey from here to there will likely be bumpy and probably incredibly painful at some points, but the outcome would put humanity on a much more positive trajectory than the one we find ourselves on now with fiat currencies. I believe in the adage, “fix the money, fix the world”. I believe the world would be a better place if we slowly transitioned away from the dollar and towards Bitcoin. That is a fight worth fighting.

Decentralized Internet Is a Fight Worth Fighting

We can make this quick. Just read Chris Dixon’s 2018 blog post “Why Decentralization Matters”. If you haven’t read it before, you must stop right now and read it. Even if you have, I suggest reading it again. It had been a few years for me and re-reading it really still hits home. You either think the blog is (mostly) correct or you don’t, and that decides whether you think this is a fight worth fighting. Personally, I believe in this vision. Any crypto hater worth their salt needs to come up with cogent responses to the points Dixon makes. Further, any Bitcoin maximalist also has to read that blog and come up with a convincing rebuttal to Chris’ points about a decentralized internet, alongside a decentralized money. I think that’s hard to do. When I read that blog, I think that vision is a fight worth fighting for.

Just a few things I’ll add:

Property rights make the world a better place. Economies with stronger property rights protection tend to have higher levels of foreign direct investment (FDI) and entrepreneurship. Countries with strong property rights have an average per capita GDP that is more than double that of countries with weak property rights. Countries with strong property rights also have higher levels of entrepreneurship and a higher number of start-ups. Countries with robust protection of property rights have more efficient and transparent land markets, which can lead to increased access to credit and investment. Secure property rights can lead to increased conservation and sustainability of natural resources, as well as greater prosperity for local communities. Delivering property rights is something Bitcoin can do with regards to money, but it’s not solely about money. It’s about other forms of property rights. And delivering that in a decentralized manner appears destined to happen outside of Bitcoin.

Access to a stable currency makes the world a better place. Stable currencies encourage investment, increase economic growth and improve international trade. Life gets empirically better with a stable currency. A functioning banking system makes the world a better place. Two billion people currently lack access to basic financial services. 59% of adults in developing nations do not have access to basic financial services. More than half of sub-Saharan Africa is unbanked. Again, banking the unbanked is partially a Bitcoin story, but not entirely. Stablecoins and DeFi are set to play enormously important roles in providing basic financial services to the people that need them the most. And that is highly likely to be a future utilizing chains other that Bitcoin.

Other Relevant Points

Humanity is becoming increasingly more intertwined with technology. You’d be a fool to think otherwise. We have every indication to think that humans are going to adopt technology as fast as new, captivating things come out. A very safe, compelling Neuralink for everyday use may not be available for 30 years. But when it is, I’d strongly bet it will be rapidly adopted. Humans YEARN for progress. It’s deep in our DNA. Take ChatGPT. The world is blown away by it and it’s experiencing record-breaking adoption. The adoption of ChatGPT will propel humanity further into reliance on technology. You can imagine how rapidly (50-100 years?) this journey will unfold, because that adoption is increasing at an increasing rate. With ChatGPT, OpenAI claims that GPT-4 will have 100 trillion parameters, as opposed to the 175 billion parameters that GPT-3 is currently trained on. That’s increasing at an increasing rate. What will THAT be like? Run THAT out for 100 years. The coming decades/century are going to get WEIRD. Ask yourself, how do you feel about that power being centralized in the hands of a few opaque, profit-driven organizations?

As I’ve stated multiple times here before, I believe that abuses of power by centralized technology companies are causing societal problems. I think crypto has the POTENTIAL to alleviate these problems. If humanity becomes increasingly more tribal from current levels, we’re NGMI. If we trend in that direction long enough, we’ll legit blow ourselves up. Social media, in its current form, drives divisiveness because conflict drives more eyeballs and eyeballs pay advertising dollars. This a big reason why we are so divided as a nation right now. THIS IS A FUNDAMENTAL MISLALIGNMENT OF INCENTIVES RELATIVE TO WHAT’S GOOD FOR HUMANITY. Crypto has the potential to alleviate this.

The next part is gonna get a little cooky but I’ve been spending a lot of time down this rabbit hole and honestly it’s just the tip of the iceberg… The various misalignments of incentives we’ve been speaking of are rooted in the duality of man – our inherent tendency to sometimes do what’s good for the world but other times do things that are hurtful to others. That duality comes from a scarcity mindset and that scarcity mindset is a product of millions (and billions) of years of evolution. For the vast majority of humanity’s existence, a scarcity mindset kept us alive. It was an adaptive trait. But even all the way back in the cavemen days, a man and a woman needed to cooperate to keep a child alive. Humans wouldn’t have made it far at all with a strictly scarce mindset. Instead, over time, we’ve come to cooperate more. To a greater extent. In more complex fashion. And this has been to the great benefit of humanity. Increased cooperation is to the benefit of humanity - there’s no argument to that. Think about human cooperation today versus 500 years ago. It’s not even close. We’re now cooperating on a massive, global scale. THIS IS CRITICALLY IMPORTANT TO THE ADVANCEMENT OF HUMANITY AND IT NEEDS TO CONTINUE IN THE LEAST CORRUPTIBLE WAY POSSIBLE.

Along the lines of technology becoming increasingly intertwined with humanity, comes a discussion of the Metaverse. I’ve written enough about how I feel about the Metaverse here previously. Here. And here. When I go back and read those two main sections, it still resonates. The Metaverse is coming. We can argue about the pace - the pace at which humanity is existing digitally versus physically. But the direction is clear. There’s no particular reason to think that if you fast forward a hundred years or a few hundred years, that humanity will be LESS intertwined with technology. We will likely become increasingly MORE intertwined with technology as our lives exist increasingly more digitally, call it the Metaverse or whatever you want. Imagine that world where the Metaverse is centralized in the hands of a few opaque, profit-driven organizations. How do you feel about that world?

Lastly, I want to briefly touch on NFTs. A lot of Bitcoin maxis hate NFTs… Chill out. They are art. They are the first fluttering breaths of a new art form. That is a beautiful thing. Art is a beautiful thing. It makes life worth living. If technological innovation means we get more, better art, that’s a good thing for the world. Music is incredibly important to me. It is the form of art I’ve most connected with in my life. If NFTs deliver 10% of the joy to the world that music has brought to me, that’s a worthwhile endeavor. Yeah maybe this new art form doesn’t require many billions of dollars of venture capital investment at its current state. Yeah maybe those dollars aren’t going towards something as concrete or sobering as overthrowing a fiat currency regime. But it’s still a beautiful thing. In any case, art is a good thing and NFTs provide an entirely new avenue for artistic expression. I believe we’ll be better off for it.

So What?

A summary list of key takeaways:

The FTX collapse was a major event for Ikigai, and occurrences of this magnitude require a reexamination of core principles.

Crypto has a lot of potential to make the world a better place, but it’s mostly just potential at this point.

There are good actors and bad actors in crypto. Whether crypto delivers on all of, some of, or none of its potential to the make the world a better place will be entirely dependent on the people working towards the various outcomes.

Fiat currencies are likely doomed. The US dollar is likely doomed to be eventually replaced as the world reserve currency. Bitcoin has a legitimate shot at being a better solution. The next world reserve currency. The next collateral foundation for the global financial system.

Crypto can solve other use cases and alleviate other problems, as laid out in Chris Dixon’s blog post.

Property rights make the world a better place. Access to a stable currency makes the world a better place. A functioning banking system makes the world a better place.

Humanity is set to become increasingly more intertwined with technology and you need to be honest with yourself about what that world might look like in various outcomes. Decentralization can potentially alleviate problems that are set to inevitably arise.

This entire conundrum is a function of a misalignment of incentives. This is a big problem in many parts of human society. Humans are doing better than we’ve done but we can do better. Crypto can help us do better.

Decentralization and crypto have the potential to make the world a better place. It’s not going to happen by itself. Fulfilling that potential is going to take a lot of work from good actors. I am in a position to help in that process. Thus, this is a fight worth fighting for me. That’s the thesis.

Market Update – Liquid Crypto Asset Investing

| Symbol | Jan | Q4-22 | Q3-22 | Q2-22 | Q1-22 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|

| BTC | 40% | -15% | -2% | -57% | -2% | -64% | 60% | 303% |

| ETH | 33% | -10% | 24% | -67% | -11% | -67% | 399% | 469% |

| XRP | 19% | -29% | 45% | -59% | -2% | -59% | 278% | 14% |

| BCH* | 27% | -18% | 7% | -67% | -13% | -75% | 6% | 71% |

| EOS | 23% | -27% | 28% | -67% | -7% | -72% | 17% | 1% |

| BNB | 27% | -13% | 30% | -49% | -16% | -52% | 1269% | 172% |

| XTZ | 48% | -49% | 0% | -62% | -14% | -84% | 116% | 49% |

| XLM | 28% | -38% | 2% | -51% | -15% | -73% | 108% | 184% |

| LTC | 35% | 31% | 0% | -57% | -16% | -52% | 17% | 202% |

| TRX | 14% | -11% | -6% | -12% | -2% | -28% | 181% | 101% |

| Aggregate Mkt Cap | 32% | -16% | 7% | -58% | -5% | -64% | 186% | 301% |

| Aggregate DeFi* | 36% | -24% | 25% | -74% | -8% | -77% | 581% | 1177% |

| Aggr Alts Mkt Cap | 27% | -16% | 12% | -58% | -7% | -64% | 479% | 274% |

Source: CoinMarketCap. As of 1/31/23. BCH includes SV. Aggregate DeFi from Coingecko.

Bitcoin was +40% in January, a massive move that caught most, including myself, by surprise. That move was driven by a strong correlation between crypto and traditional. It was once again, all one trade in January.

Source: Tradingview. As of 2/1/23.

I write this just a couple hours after the FOMC raised rates by 25bps and Powell gave a press conference that leaned dovish relative to expectations and relative to past press conferences. The FOMC will be closely watching upcoming wage and inflation data releases, but Powell seems to be happy with the progress made so far. He expects to raise rates 25bps a couple more times and that will likely be sufficient tightening for this cycle. He does not expect to cut rates in 2023. He’s not super worried about the recent loosening of financial conditions (shown below), because it’s occurred as inflation has come down and wage growth has remained in check.

Source: Tradingview. As of 2/1/23.

Powell was pleasantly surprised by the strength of the labor market, because it’s been with a backdrop of lower inflation and subdued wage growth. He still believes that the labor market will need to loosen from current levels in order to get inflation back down to the 2% target, but his fears of a wage-price spiral due to a tight labor market seemed significantly subdued relative to other press conferences last year. Overall, Powell seemed pretty pleased with the direction of the economy and doesn’t seem worried about the strong rally in risky assets in January, a 180 reversal from his stance at Jackson Hole last August. Overall, it felt like a green light for continuation.

Undoubtedly, the record amounts of sidelined cash can serve as fuel for continuing the YTD rally, as investors come out of the safe-haven USD and back into the market in various ways. That cash pile is currently at all-time highs.

Source: @zerohedge. As of 1/29/23.

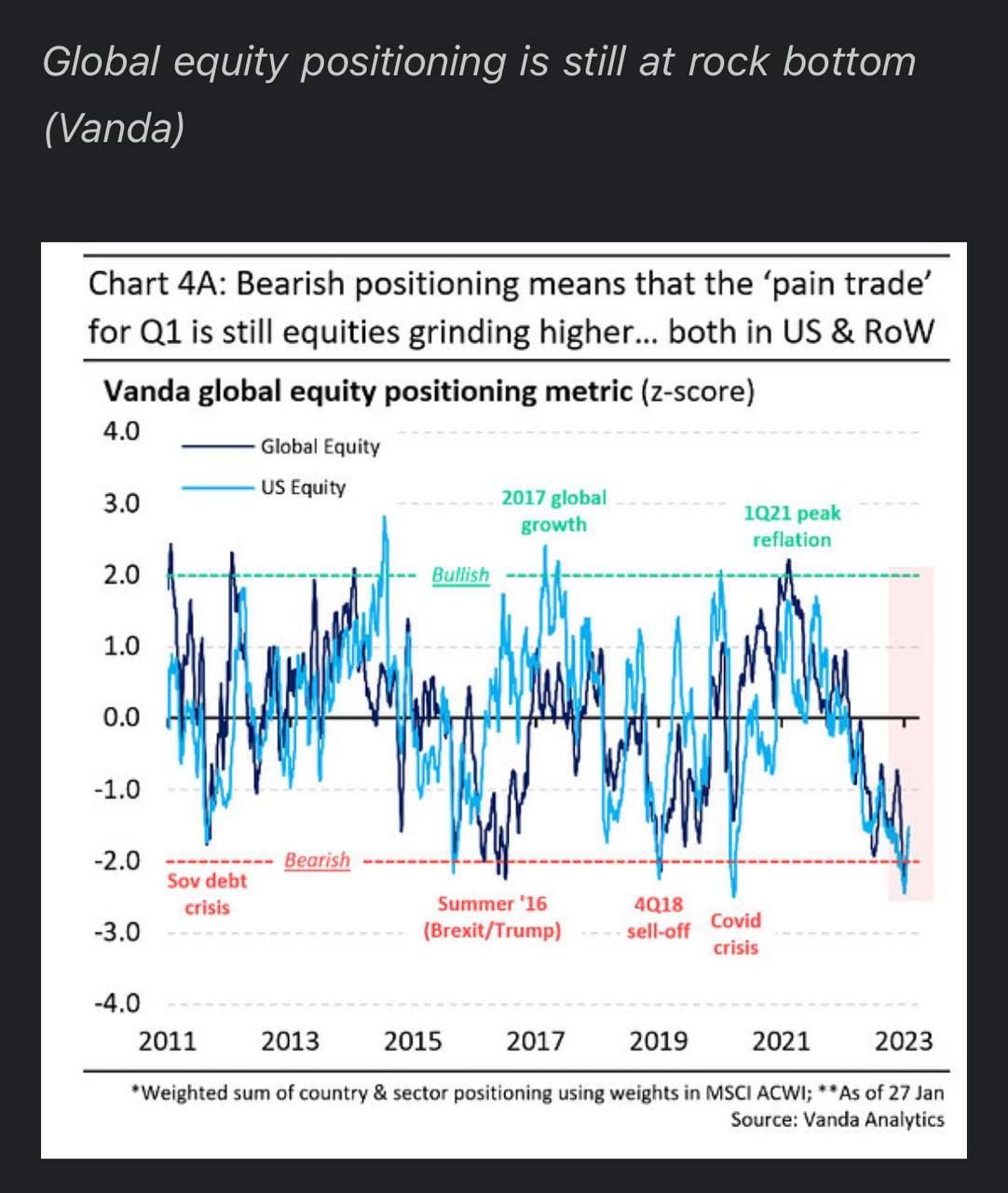

The flipside of the current “record levels of cash” coin is the current record level of bearish positioning in equities.

A collapsed VIX and MOVE serve as the goldilocks backdrop for a re-levering into risk assets.

Source: Tradingview. As of 2/1/23.

Everyone and their dog have been looking at this trendline on NASDAQ. At current juncture, it looks like a breakout, retest as support and confirmation. Next stop may be the August highs, +10% from current levels.

Source: Tradingview. As of 2/1/23.

So where does that leave Bitcoin? Well, 55% off the bottom and 65% off the top. And in the near-term my guess is it’s heading higher from here. Seems like the macro backdrop will be supportive for it.

Source: Tradingview. As of 2/1/23.

You can see how much volume traded at the lows in November and December. And you can see the volume gap immediately overhead current price in the high $20’s. Price has spent very little time in the high $20’s. It moved through that area very quickly on the way up and very quickly on the way down. So there’s decent reason to think the same may happen again here. I could imagine that $29k resistance level getting front run a bit, seeing as it’s such a major point of resistance (prior support). But again, it’s looking like it’s all going to be one trade. So perhaps this $29k resistance will line up with that August resistance on QQQ shown previously and that’s where a pullback will occur.

Beyond that, it’s hard for me to have much confidence in where we’re headed. It’s still my base case we’ll see $20k Bitcoin again this year. It may take months or quarters, but I don’t see significant new inflows coming into crypto this year to sustainably carry us much higher. I think there are sellers higher in crypto assets and at some point this year that supply will overwhelm demand and we’ll get a significant pullback. Perhaps from that ~$29k level. Right now, there is a “Fed pause” macro trade ongoing and a “soft landing” macro trade ongoing and those will take time to play out. But I could imagine those trades running their course pretty quickly, say over the next few months and a sort of malaise hitting the market as the Fed is no longer hiking but also not cutting – just waiting while high interest rates squeeze the economy into slowing, so as to bring inflation down to their+2% target and loosen labor conditions along the way.

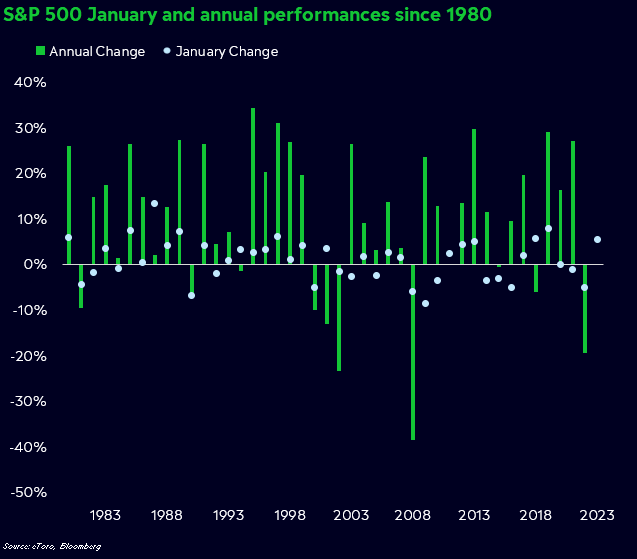

Since 1950, 73% of annual performance of the S&P 500 went in the same direction that year as it did that January (i.e., positive January = positive year). The S&P 500 just gained 6.2% in January. It hasn't gained that much in a January, then gone on to close the year negative since 1946.

ETHBTC has been consolidating in a 40% band for the last 20 months.

Source: Tradingview. As of 2/1/23.

My gut is ETHBTC goes in the direction of risk broadly this year. If DXY is down and Q’s are up, ETHBTC is probably positive on the year. It is still my base case that ETHBTC eventually breaks out of this long-term range and heads for ATH’s. But it’s not my base case that will be this year. I think that breakout happens in concert with a large increase in Ethereum on-chain activity and I don’t think that will be 2023. 2024, perhaps 2H, makes more sense to me.

There are 28 cryptos that are up >100% YTD. Most of these names were absolutely horrendous performers last year. APT was -64% from listing in late October 2022 to YE. SOL was -94% in 2022. RNDR was -91%. GALA was -95%. DYDX -85%. LDO -66%.

Source: Tradingview. As of 2/1/23.

So I think it’s hard to take January’s crazy performance for some Alts in a vacuum, seeing as these names were all down so much last year.

It’s pretty easy for to me to imagine BTC dominance (shown below) being at current levels or higher by the end of this year (yellow circle). Although eventually, likely 2H-24 or 25, I expect this multiyear range to break structurally lower.

Source: Tradingview. As of 2/1/23.

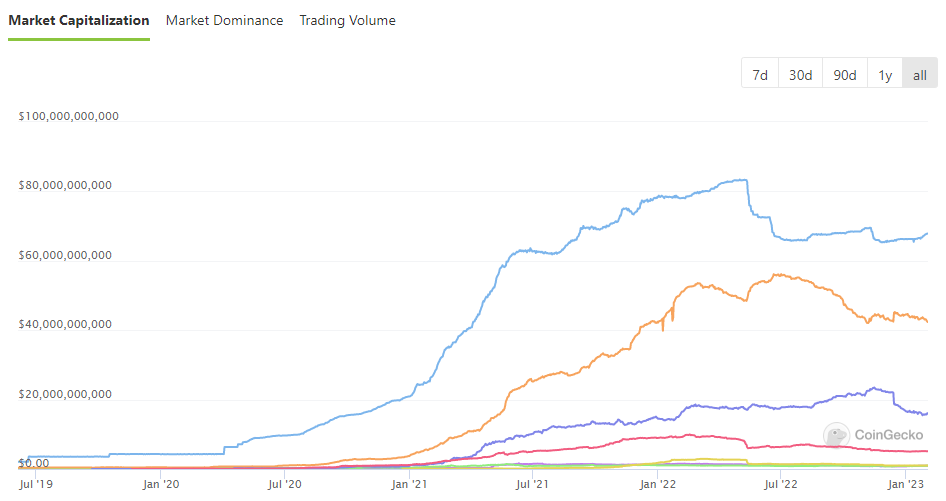

Aggregate stablecoin market cap is currently $138bn, only down 14% from a May 2022 high of $161bn. That’s honestly impressive.

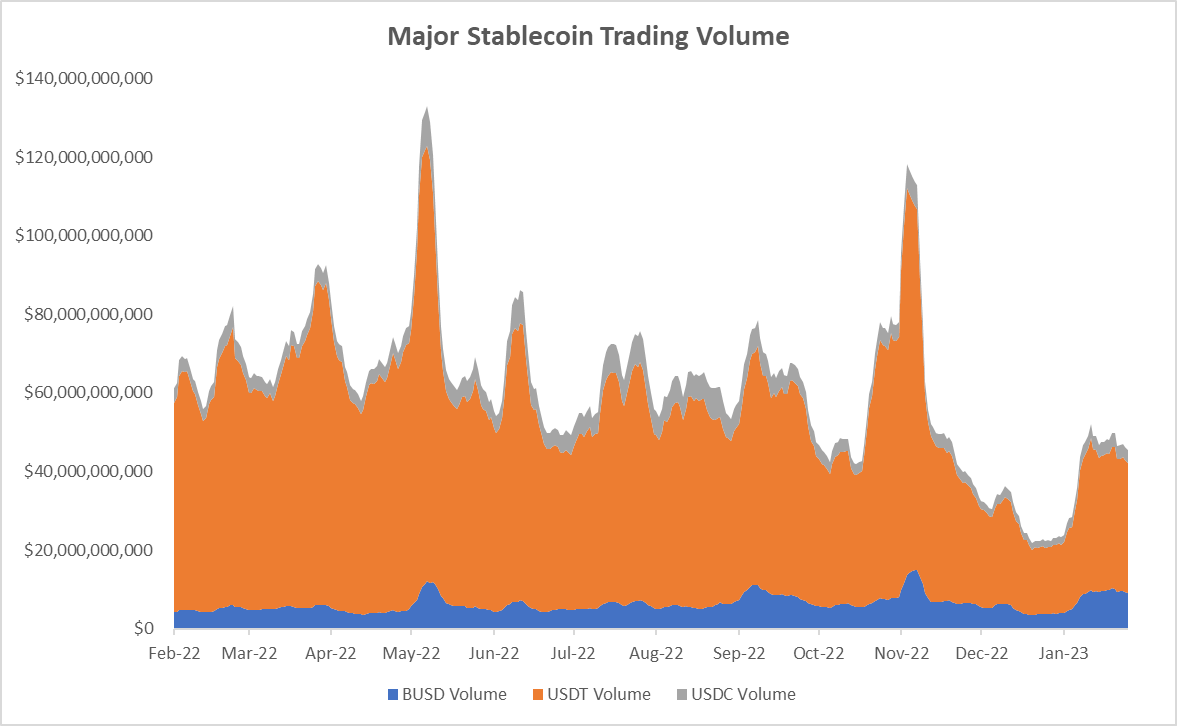

The chart below shows daily trading volume across the three centralized major stablecoins – USDT, USDC and BUSD. You can see the massive spike in volume on the FTX collapse, and then the extremely low trading volumes into year-end, followed by a large ramp in trading volume YTD.

Source: Coinmarketcap. As of 2/1/23.

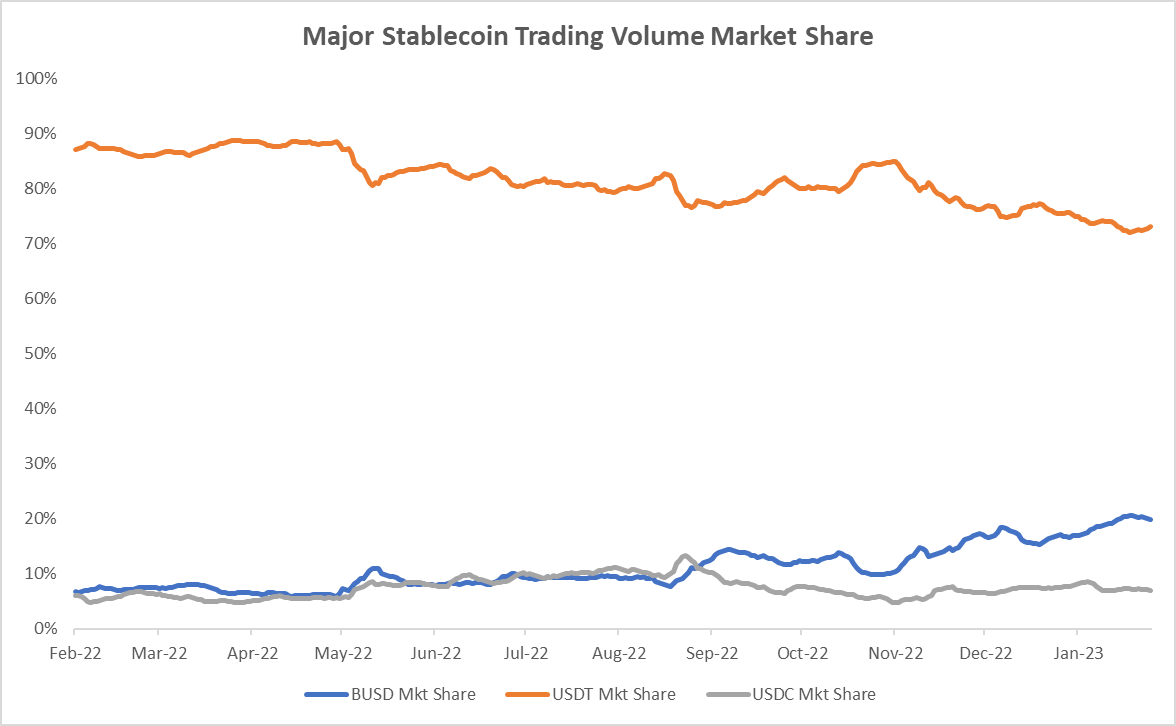

What is somewhat hidden in the above chart is BUSD’s gain in trading volume market share since the FTX collapse. BUSD trading has gone from 10% to 20% of total stablecoin volume over that time.

Source: Coinmarketcap. As of 2/1/23.

This increase in BUSD dominance is particularly noteworthy given BUSD is CZ’s stablecoin. And it’s brother, the so-called “Binance Pegged BUSD” was just uncovered to have had multiple $1bn+ holes in its collateral value in the past. Binance has assured the public that the problems are fixed, but it’s still super shady. If you’ve been following me on Twitter, you know I’ve been speaking out publicly against Binance for the last two months. There is an incredible amount of smoke there to be no fire. I doubt I’ll ever trade on Binance again, and I wouldn’t advise holding any assets there of any kind. Coinbase is much safer in my view. Binance currently has more than half of all trading volume across all centralized exchanges. That’s a scary level of dominance for such an untrustworthy counterparty.

Finally, I want to conclude this section by saying my confidence in being able to read the crypto market right now is low. 2022 was a complete nuke and it uncovered the enormous magnitude of “reckless lending, intertwined with massive fraud, used to heavily lever long, to speculate on vaporware” present in the market. Most of that is now gone. That makes this a COMPLETELY different market. As I’ve said here for the last two months, I really don’t know what kind of market we’ll actually have going forward. So I could be way off on my thoughts in either direction. It’s a period that warrants caution in the market.

Closing Remarks

Writing the main section for this Monthly Update served as the re-underwriting of my belief in crypto and my desire to continue working in it. It was honestly refreshing to re-read Dixon’s blog. There’s a clarity to the theses presented there that strengthens my resolve to stay in crypto. I can certainly understand why others would feel differently. I understand how a person working in crypto could be so disgusted with this space after last year’s events that they throw up their hands entirely and walk away. I get it. In the first days after the FTX collapse, I felt like that too. But over the last couple months, with a lot of prayer and contemplation, I’ve found the resolve to stay. The Main Section this month helped me remember what’s here that’s worth staying for. I hope it helped you as well.

Over the coming months, I’ll get more specificity around what exactly Ikigai and I will be doing in the space. One thing is certain. I will be more vocal. I will be more pointed in doing my best to call out bad actors in the space. I will push harder towards being a trusted voice in the space. I’m stating it here now as a declaration, and to serve as a point of future accountability.

I went on Peter McCormack’s What Bitcoin Did podcast a couple weeks ago. It was the first time I’d spoken publicly since the FTX collapse. It was a difficult, raw conversation. I got a lot of positive feedback on it, but also received a decent amount of criticism, which is totally ok. Seeing as the podcast is a Bitcoin podcast, a lot of that criticism centered around my “shitcoining”, which is to say, me not adopting a Bitcoin-only stance. I do have empathy for that view. There is some amount of truth in the statement “none of this would have happened in a Bitcoin-only world”. If I took a Bitcoin-only approach to this market, both in investing and communication, it would be cleaner, easier and more straightforward. And I do believe Bitcoin’s investment case is clearer than any other crypto asset. Bitcoin is less rife with scams and scammers than the shitcoin ecosystem. Yes your Bitcoin can be hacked if your custody practices aren’t sound, but Bitcoin can’t be rugged. Bitcoin is the only non-venture bet in crypto. Every other crypto asset has classical venture risks and associated potential returns. The value accrual mechanisms for Bitcoin are more concrete than any other crypto asset. But all of that still doesn’t lead me to believe that everything else in crypto should be abandoned, by me or anyone else. The main section of this Monthly Update letter included me re-underwriting that view. And it is the view I will hold going forward, reserving the right to change my mind at any point in the future.

When wading into the crypto ex-Bitcoin ecosystem, it’s important to remember that 99% of these projects will fail to achieve their vision and gain significant adoption. This fact must be embraced and a market participant must act accordingly. It’s also important to remember that speculation will remain a large driver of price action. It’s not a good strategy to just wish that people wouldn’t speculate on vaporware. You must be honest with yourself – speculation will be rampant in crypto for the foreseeable future. Act accordingly. You can accept this fact and still fight scams, scammers and vaporware. We must more effectively ride the line between optimism and skepticism than we have in the past.

Overall, I’m excited about what the future holds, even though I’m not exactly sure what that is. Crypto is a fight worth fighting. We must fight it differently than we have in the past. I’m here for it.

“Friends show their love in times of trouble, not in happiness.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS