June 2021 - Monthly Market Update

/Monthly Update || June 2021

“Skepticism and pessimism aren’t synonymous. Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our thirty-third Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, Bitcoin finished May as its third worst monthly price performance ever - down 35% and slightly better off than the November 2018 crash. This is in stark contrast to ETH down 2% in May, putting the YTD performance difference at a massive +29% for BTC vs +268% for ETH. That is a stunning divergence. The month of May brought a firestorm of negative news events for Bitcoin with a strength rarely, if ever, previously seen. ETH, which had been trading very strongly going into the downside price volatility, underperformed BTC during peak market stress but bounced much harder into month-end while BTC languished.

The two main factors in the market during May were Elon/ESG and China - topics we’ll discuss in detail here. Both are rapidly evolving situations with incomplete information and unclear outcomes. The near-term price action for BTC, and likely the rest of the crypto market, hangs in the result.

Bitcoin’s antifragility was tested in May. This concept - Bitcoin’s antifragility - is one I’ve written about many times before. I went back and searched my prior Monthly Updates, and found this from October 2019-

“This is the ideal backdrop for a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value to gain mass adoption. However severe a BTC pullback may be – whether 1) the worst is behind us; 2) we find a bottom lower in the $6-$7k range; or 3) the unlikely event we retrace the full YTD move back to the $3k’s – that will present what is likely a generational buying opportunity for Bitcoin. Make no mistake, Bitcoin is deeply antifragile – perhaps its single most attractive characteristic. I liken Bitcoin to an X-Man toddler. Yeah you can push on it right now and it will tump over. And you can even kick it in the head while its tumped over. But it will be fine. It will get back up, no worse for wear. And when it grows up, it is going to kick your ass.”

That’s a comforting proclamation. Bitcoin being antifragile doesn’t mean the price doesn’t go down. It does go down and sometimes it goes down a lot - over a very short period or over a multi-month or multi-quarter timeframe. That downside price volatility has historically caused change in how the real world interacts with or perceives Bitcoin. While the actual underlying protocol has evolved relatively little over the last 12 years, the world around Bitcoin is constantly changing. Bitcoin is relentlessly fending off attacks and coming out stronger for it on the backside. An incomplete list of antifragility events-

Satoshi leaving

Silk Road

Mt Gox hack

Double spend and fork

Bitfinex hack

Losing Renminbi payment rails

US banking blockage

BTCC exchange shutdown

Block size debate

Bitconnect

Bitlicense

Warren Buffett “rat poison”

Tether reserve hole

BCH/BSV hash wars

Binance hack

PlusToken fraud

President Xi edict

Black Thursday death spiral

OKEx withdrawal freeze

BitMEX

Elon/ESG?

China mining ban?

So in the face of one relatively new risk (Bitcoin carbon emissions, led by Elon) and one very old risk (China doing something negative towards crypto), what’s to come of Bitcoin? If you base your projection on historical results, then Bitcoin will be just fine. It will grow to become bigger, stronger and more important than it ever has been previously. I think many market participants believe that will be the eventual outcome this time around as well. The main points of disagreement are 1) over what time period; 2) whether price will go lower first; and 3) what ETH and DeFi will do in the meantime.

In last month’s Monthly Update, I stated-

“There’s simply too much human and financial capital flowing into this space for the bull run we’ve been on to top out here, neither from a price nor time perspective.”

Rough call to have made considering the ensuing price performance and negative turn in current events. Yet I still struggle to disagree with the above statement. We’re in unchartered waters here for sure - never had a cyclical top look like this, yet never had an interim pullback look like this either. So in either case, we’re dealing with an unprecedented setup. Being an optimist is much less helpful than being a realist when managing risk, but I believe there’s a compelling case to be made that we’re not done growing here, over any timeframe.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

May Highlights

Ray Dalio – “I Own Some Bitcoin”

Carl Icahn “Wants to Get into Crypto In A Big Way”

Elon Meets with Newly Formed North American Bitcoin Mining Council to Promote Energy Usage Transparency and Sustainability

Point72, Millennium and Matrix Said to Be Entering Crypto Market

Galaxy Digital Acquires Crypto Custodian BitGo for $1.2bn

NYDIG Partners with FIS to Enable Banks to Offer Buying and Selling of Bitcoin Directly in Traditional Bank Accounts

Citibank To Launch Crypto Services

$8.7bn Market Cap Globant Purchases $500k of Bitcoin on Balance Sheet

Bridgewater CFO Leaves to Become CFO of NYDIG

Coinbase Announces DeFi Wallet Extension

One River Asset Management Files for Carbon Neutral Bitcoin ETF

FTX.US Hires Citadel Securities Executive as President

Justin Sun Purchases $153mm of Bitcoin at $36,868

Justin Sun Purchases $136mm of Ethereum at $2509

MicroStrategy Purchases $15mm of Bitcoin at $55,387

MicroStrategy Purchases $10mm of Bitcoin at $43,663

ARK Investment Purchases 639,069 Shares of Grayscale Ethereum Trust

Framework Ventures Raises $100mm Crypto Venture Fund

Tether Reveals Breakdown of Reserves

MoneyGram To Allow Bitcoin Purchases as 12,000 US Retail Locations

Facebook’s Diem to Launch US Stablecoin

eBay To Begin Offering NFT Markets

Tom Brady Publicly Endorses Bitcoin, Changes Twitter Profile to “Laser Eyes”

PayPal and Venmo to Allow Crypto Withdrawals

Palantir Accepts Bitcoin as Payment, May Invest in Bitcoin

Sony Files Patent for Service to Accept In-game Bitcoin Purchases

Grayscale Becomes Official Partner of the New York Giants

May Challenges

Tesla Suspends Vehicle Purchases of Bitcoin Due to Coal Usage in Bitcoin Mining

Elon Musk Has Case of Twitter Diarrhea as It Relates to Bitcoin and Crypto

China Vice Premier Liu He Announces Crackdown on Bitcoin Mining and Crypto Trading

Chinese Crypto Exchanges Huobi and OKEx to Scale Back or Suspend Certain Services and Products to Some or All Chinese Customers

Bybit to Close All Accounts with Chinese Mobile Phone Numbers June 15th

The Pope Implies Bitcoin Can’t Be Successful If Powered by Fossil Fuels in Tweet

US Senate Banking Committee Urges New OCC Head to Review Past Favorable OCC Crypto Rulings

OCC To Review All Prior Crypto Rulings

Treasury Calls for Crypto Transfers Over $10K To Be Reported to the IRS

Janet Yellen Pushes for New Crypto Regulatory Framework

OCC, FDIC and the Fed Said to Contemplate an Interagency Crypto Policy Team

FDIC To Issue Request for Information from Banks on Crypto Usage

SEC Chairman Gary Gensler Says Greater Investor Protections Are Needed for Crypto Tokens

WSJ Publishes Article That IRS Is Cracking Down on Crypto Tax Evasion

Binance Said to Face Investigations from US Justice Department and IRS

New York State Introduces Senate Bill 6486 to Halt Bitcoin Mining for Three Years While Assessing Environmental Impacts

Lawsuit Filed by Victims of OneCoin Scam Claims Ruja Ignatova Holds 230,000 Bitcoin

| Asset Class | May | April | Mar | Feb | Jan | YTD | Q4-20 | Q3-20 | Q2-20 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -35% | -2% | 31% | 36% | 14% | 29% | 169% | 18% | 42% | 303% | BTC |

| NASDAQ | -1% | 6% | 2% | 0% | 0% | 6% | 13% | 12% | 30% | 48% | QQQ |

| S&P 500 | 1% | 5% | 4% | 3% | -1% | 12% | 12% | 8% | 20% | 16% | SPX |

| Total World Equities | 2% | 3% | 3% | 3% | 0% | 11% | 15% | 8% | 19% | 14% | VT |

| Emerging Market Equity | 2% | 1% | 0% | 1% | 3% | 6% | 17% | 10% | 17% | 15% | EEM |

| Gold | 8% | 3% | -1% | -6% | -3% | 0% | 1% | 6% | 13% | 25% | GLD |

| High Yield | 0% | 1% | 1% | -1% | 0% | 0% | 4% | 3% | 6% | -1% | HYG |

| Emerging Market Debt | 1% | 2% | -1% | -3% | -2% | -3% | 5% | 2% | 13% | 1% | EMB |

| Bank Debt | 0% | 0% | 0% | 0% | 0% | 0% | 2% | 2% | 4% | -2% | BKLN |

| Industrial Materials | 5% | 8% | 0% | 11% | -2% | 23% | 14% | 11% | 10% | 16% | DBB |

| USD | -2% |

-2% |

3% | 0% | 1% | 0% | -4% | -4% | -2% | -7% | DXY |

| Volatility Index | -10% |

-4% |

-31% | -15% | 45% | -26% | -14% | -13% | -43% | 66% | VIX |

| Oil | 5% | 7% | -2% | 17% | 7% | 38% | 17% | 1% | -17% | -68% | USO |

Source: TradingView. As of 5/31/21.

Elon/ESG & China

There were two prongs to the downside price volatility experienced in May: 1) the Elon “flip” and Bitcoin mining carbon emissions; and 2) China crypto mining and trading crackdown. We’ll take them separately and at least pose the question of whether they might be related.

Elon/ESG

The ESG situation for Bitcoin mining has been around for years but reached a meaningfully louder tone earlier this year. I dedicated a section of my Monthly Update three months ago to the topic. Nic Carter, Meltem Demirors, Jack Dorsey, Cathie Wood and many others had been ardently arguing that the mainstream media and Bitcoin haters in general were mischaracterizing Bitcoin’s energy usage and its current or potential environmental impact. The ESG rebuttals leading in to May were well-presented and accurate. Elon EVEN AGREED that Bitcoin incentivizes renewable energy. And yet, the month of May brought us this-

Source: TradingView and Twitter. As of 5/31/21.

And it was painful - to the tune of Bitcoin’s 3rd worst monthly price decline ever. Questions of Elon’s motivations abound. Certain aspects of the fact patterns just do not make much sense, but I’ll do my best to lay out the possibilities-

How unstable is Elon? Was this just a bout of emotional instability? What in the actual hell is going on with the whole Dogecoin thing? Did Elon’s team know he was going to go ballistic on Twitter? Did his team know about Tesla not accepting BTC as payment but didn’t know the rest would happen?

What were Elon’s motivations for the flip? Surely Elon knew about BTC mining energy usage before buying $1.5bn, right? So why the flip? Was Elon feeling pressure from the ESG crowd? Does Elon’s business only exist because of carbon credits? Does Elon like Bitcoin and believe in Bitcoin, but views carbon emissions as a major roadblock to Bitcoin’s future success? Who did Elon consult with privately after ceasing to accept Bitcoin payments because of carbon emissions? Did Elon just use his platform and influence to ensure a more environmentally friendly future for Bitcoin? Would it be fitting for his personality that Elon would try to “save” Bitcoin? What are the chances one of Elon’s companies announces some sort of green Bitcoin mining solution? What are the chances Tesla buys more Bitcoin in the next 12 months? Finally, and perhaps most intriguingly, what are the chances Elon knew the China mining crackdown was coming? What are the chances he pre-empted it?

Answers to some of these questions may become clear in the coming months. Others may not. As the situation currently stands, in light of Elon’s “reflip” on May 24th, the likelihood additional events coming from this broad situation will be positive on the margin outweighs the likelihood additional events will be negative. There’s always the possibility Elon could flip again – cursing Bitcoin’s energy usage on Twitter or even selling the rest of Tesla’s Bitcoin. That would likely send Bitcoin to lower lows, but it’s not my base case.

My base case is the ESG narrative around Bitcoin will improve over the coming months. That could take any number of forms. The North American Bitcoin Mining Council could publish a study that shows coal usage isn’t that bad, and renewables usage is increasing. Elon could retweet this study and say something like “this looks good”. Perhaps new mining projects committed to clean energy or some sort of carbon credit purchase program from existing Bitcoin miners could be announced, and perhaps Elon could show public support for these. Less likely but still possible would be for one of Elon’s companies to announce a clean Bitcoin mining project or product of some sort. At this point, even a press release with a napkin sketch would be strongly positive. Most positive of all would be some or all of these events to occur, and then Tesla to buy more Bitcoin on the back of it. That would be a full send.

Undoubtedly many investors, both retail and institutional alike, are contemplating these range of outcomes in real time and making bets accordingly. Perhaps some have an information asymmetry - that would be a fair assumption. We should not downplay the significance of the problem Bitcoin currently has with being labeled environmentally unfriendly, regardless of the validity of that label. This was a material but workable problem before Elon flipped, but now with Elon calling out Bitcoin mining’s carbon emissions to his 56 million Twitter followers, the truth of matter is of little importance. It’s now a problem until Elon says it’s not anymore. You can hate that or love that, but it’s the state of things at the moment.

Institutional investors have no desire to run afoul of the ESG movement. It is a behemoth force, and many institutions will just cave to its pressures. Let’s be honest - many baby boomers at the helm of large pools of capital didn’t ACTUALLY want to buy Bitcoin anyway. They don’t like it. They don’t understand it. They think it’s drug dealer money. Bitcoin was in the process of forcing those hands to buy – the returns were too good and the narrative as a digital store of value was too strong. But that setup is called off for now. Those boomer CIOs have the cover they need to not have to deal with Bitcoin for now, and that’s a problem if BTC wants to get to $100k and beyond. There’s an argument to be made that if “number go up” hard enough, a lot of that ESG-wary capital will simply shrug off the ESG label and Elon debacle and buy anyway, but that’s a tough call to make. I think we will need material incrementally positive events to solve the problem we find ourselves in. TBD on if/when/how we get it.

China

To start off, we need to acknowledge that US-China relations is one of the most important global macro factors in existence today. I’ve been saying that for 18 months. Bitcoin and crypto broadly appear to be right in the middle of it. It is simply naivety to think the recent crypto announcements from the CCP have nothing to do with US-China relations. They must.

China has a storied history of negative announcements about crypto. Year after year, China has found a way to pressure crypto prices through various restrictions or threats of restrictions. Like many things in China, crypto exists in a gray area. What the government says and what they allow to happen are two very different things. Widely known loopholes to trade and mine crypto have existed for years, which makes interpreting these incrementally negative announcements that much more difficult. A totally valid question to pose is – is this time actually different with regards to how seriously China will crack down on crypto? It appears to some degree, this time is actually more serious. First off, the announcement came from the #2 guy in China. That in itself makes the announcement momentous. Secondly, the language was more explicit. Bitcoin mining was specifically addressed. Social stability was specifically highlighted. It came alongside additional restrictions in Hong Kong. Thirdly, there was follow-through at the regional level with Inner Mongolia announcing an eight-part crypto ban. Currently, it remains to be seen whether Szechuan and Xinjiang will also adopt Inner Mongolia’s proposed ban.

It also remains to be seen what, if any, additional restrictions will be put in place on crypto trading or CNH/crypto OTC. Any number of shoes could drop in those general areas that could cause near-term price weakness. Huobi and OKex could see withdrawals frozen and potentially assets seized by the CCP. The CNH OTC rails that currently exist and push large volume could certainly be cracked down on harder, although likely not eliminated entirely. A few dozen or a couple hundred crypto traders and investors could be publicly arrested with a full news cycle dedicated to the drama. These would all likely cause price weakness.

However, there is an overriding theme that over any medium-term timeframe is more important - if China more forcefully cracks down on mining & trading, this is strongly bullish for Bitcoin. It kills three birds with one stone: 1) BTC no longer so China-centric; 2) BTC mining uses way less coal (Elon); 3) Less highly leveraged speculation. If that ends up being the outcome, it is highly ironic that the CCP, which Western Bitcoiners view as one of the absolute worst actors on the planet, will have acted in a manner so strongly bullish for Bitcoin.

While the likelihood of additional negative headlines from this broad factor remains high (much higher than the Elon/ESG situation), the expected price reaction is more nebulous. Over the course of the last week, the general view is the risk of very heavy-handed regulatory action from the CCP has diminished, although far from eliminated. There is a view that many of the Chinese miners that would sell have already sold at this point, and the Chinese traders that would sell have already sold at this point. Such that, to drive prices to lower lows from here, MUCH heavier-handed actions will need to occur to incentivize the requisite mass spot selling. Perhaps the largest risk to that setup would be if those heavy-handed actions were to leak early, allowing insiders to load up large short positions and then aggressively sell spot Bitcoin in large size, so as to profit on their shorts on the way out the door. Being as this is crypto, that sort of outcome is always possible.

So Now What?

It’s a tough call, honestly.

The Elon/ESG situation is most likely to bring incrementally positive news, and there’s a spectrum of how positive that news might be. Very little positive news is currently priced in on this front. The China situation is likely to bring incrementally negative news. There’s a spectrum of how negative that news might be. What severity of negative news is priced in at this point is an open question. Certainly some amount of negative news is already priced in, and we could end up with a “better than feared” outcome. But there is a severity of announcement from China that could at least cause us to test to the range lows, if not make lower lows.

Derivatives have been obliterated. There’s little Open Interest left to go blow up from here. We’ve already seen aggressive spot selling. That’s how we got to where we are at the moment. Could you see additional aggressive spot selling, likely out of Asia? Yes. Could you see additional aggressive spot selling out of US investors? Potentially, but less likely.

If you’re a medium/long term investor, right now is an outstanding time to be dollar-cost averaging into Bitcoin. There’s a range of outcomes in these factors where price has already bottomed, and there’s a range of outcomes where it makes lower lows. There’s a range of outcomes where a new ATH occurs in 2021, and there’s a range of outcomes where a new ATH is 18+ months away. But the likelihood that Bitcoin will eventually become STRONGER from these two current factors and evolve into a MORE attractive asset as a result, is reasonably high here. As a reminder, Bitcoin is still a binary bet in a lot of ways. It could certainly still fail. You need to size it accordingly in your portfolio such that if it does fail, you’re ok. But if it succeeds, the price will be much, much higher than it is today. Historically, these types of tests have made Bitcoin more attractive as a store of value, not less. It’s my base case the same will hold true this time around.

Bitcoin’s antifragility as it relates to these two factors can viewed through several lenses. If you started with the assumption that Bitcoin is strongly antifragile – that what doesn’t kill it invariably makes it stronger – then how is that playing out right now? Go back up and re-read that list of prior antifragility events. Bitcoin shrugged ALL that off and came back stronger. What is Bitcoin shrugging off right now?

Is it shrugging off one man’s ability to strongly effect it? We know that’s bad for Bitcoin. Whether it’s Warren Buffett, Jihan Wu, Michael Saylor or Elon Musk, no one man should have all that power. But what if instead of Bitcoin’s antifragility evolving to remove a key man risk, Bitcoin’s antifragility is evolving to solve for the carbon emissions of mining? Perhaps Bitcoin realizes that in 10 years’ time, with the way the world is heading as it relates to ESG, it cannot be the foundation of the global financial system and still be powered meaningfully by coal. Thus, Elon may be acting as a conduit to further Bitcoin’s antifragility, rather than an enemy of it. Is it a worthwhile tradeoff for Elon to temporarily have an outsized effect on Bitcoin if it means that Bitcoin mining carbon emissions will be a solved problem in a few years? You could certainly make that argument. In many things in life, pain is often the catalyst to drive change. To quote Sri Aurobindo, “pain is the hammer of the Gods to break a dead resistance in the mortal's heart.” Is this what’s being brought to bear in Bitcoin?

Bitcoin’s antifragility as it relates to China is clear. China’s outsized influence on Bitcoin through concentration of both mining and trading is a problem for Bitcoin’s success long-term. This issue must eventually be improved in one way or another if Bitcoin is to truly succeed. Any movement in the direction of China having broadly less control of Bitcoin is bullish for the future of Bitcoin. Bitcoin, the honey badger that it is, has been slowly chipping away at this factor for years. It’s progress in diminishing this risk factor began accelerating about a year ago, as US investors began owning a larger percentage of the total Bitcoin float and US miners began growing their relative hashpower. The month of May brought further acceleration still. If we fast forward a few years and relative hashpower located in China is half of what it is today, relative trading volumes in China are half of what they are today, and mining with coal is half of what it is today, how much more attractive is Bitcoin as an investment?

Market Update – Liquid Crypto Asset Investing

| Symbol | May | April | Q2-21 | Q1-21 | YTD | Q4-20 | Q3-20 | Q2-20 | Q1-20 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -35% | -2% | 37% | 103% | 29% | 169% | 18% | 42% | -11% | 303% | 92% |

| ETH | -2% | 45% | 42% | 160% | 268% | 105% | 59% | 69% | 3% | 469% | -3% |

| XRP | -34% | 177% | 83% | 161% | 378% | -9% | 38% | 1% | -10% | 14% | -45% |

| BCH* | -33% | 73% | 16% | 45% | 68% | 31% | 5% | -1% | 26% | 71% | 30% |

| EOS | 3% | 34% | 38% | 85% | 156% | 1% | 9% | 6% | -14% | 1% | 0% |

| BNB | -43% | 107% | 17% | 708% | 848% | 27% | 90% | 22% | -8% | 172% | 123% |

| XTZ | -36% | 15% | -26% | 142% | 80% | -9% | -7% | 46% | 20% | 49% | 192% |

| XLM | -24% | 29% | -3% | 220% | 212% | 71% | 12% | 64% | -10% | 184% | -60% |

| LTC | -31% | 37% | -5% | 58% | 51% | 169% | 12% | 6% | -5% | 202% | 36% |

| TRX | -39% | 43% | -13% | 244% | 199% | 2% | 61% | 41% | -13% | 101% | -29% |

| Aggregate Mkt Cap | -25% | 17% | -12% | 146% | 117% | 122% | 32% | 44% | -5% | 301% | 51% |

| Aggregate DeFi* | -35% | 34% | -13% | 339% | 284% | 41% | 164% | 217% | 9% | 1177% | 77% |

| Aggr Alts Mkt Cap | -14% | 43% | 23% | 246% | 325% | 56% | 58% | 45% | 4% | 274% | -1% |

Source: CoinMarketCap. As of 5/31/21. BCH includes SV. Aggregate DeFi from Coingecko.

YTD, BTC is up a respectable but still disappointing 29%. YTD, ETH is up a mind-blowing 268%. Below is % change of ETHBTC by month. You can see ETH has outperformed YTD to a degree only surpassed during the peak of ICO mania and basically the beginning of ETH.

Source: TradingView. As of 5/31/21.

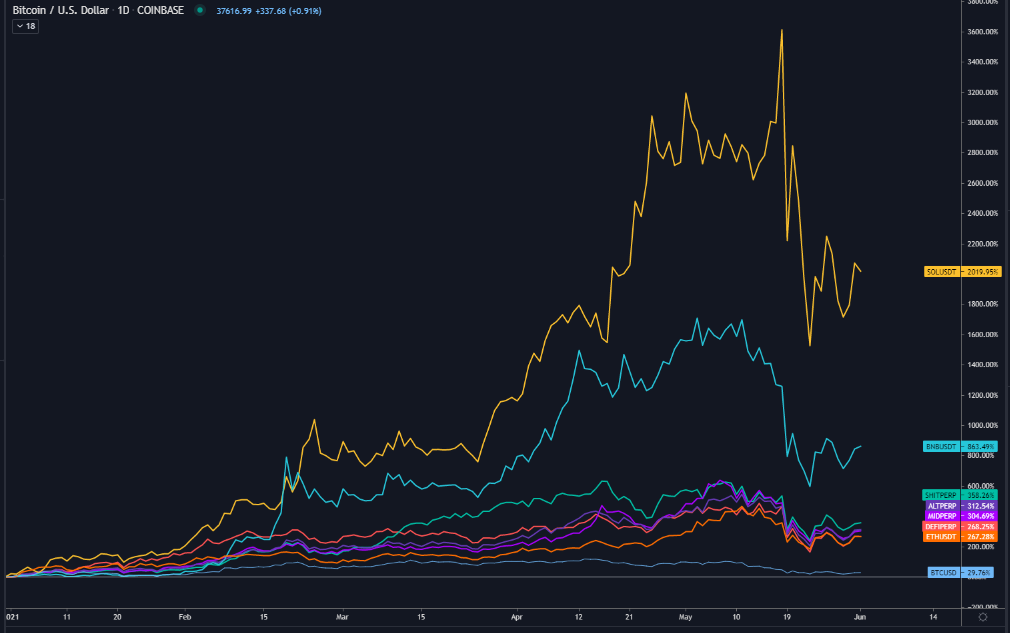

The below chart is clear, YTD BTC has lagged most everything. Badly.

Source: TradingView. As of 5/31/21.

Over a trailing 12m period, BTC’s underperformance is even more severe.

Source: TradingView. As of 5/31/21.

It’s a setup we’ve been discussing here for months now. Many investors feel like there’s not enough meat left on the bone for a BTC long. A double or a triple from $50k wasn’t enough juice. Many investors, both retail and institutional, were looking for a higher absolute return. Many feel they’ve found that in ETH. Last month we said-

“EIP-1559. ETH is going deflationary! And less fees! And Layer 2 scaling! When it transitions to ETH 2.0 Proof of Stake it will be ESG friendly! DeFi forever!”

It would have been a hard call to make to assume that these narratives would support ETH’s price exceedingly well during one of the worst Bitcoin selloffs of all time. But that was indeed what occurred. There is a path for ETHBTC to make new ATHs in the next 12 months-

Source: TradingView. As of 5/31/21.

The backdrop for a move like that would be easy to imagine – Bitcoin continues to be mired in the ESG narrative while the above-mentioned set of ETH narratives attract additional adoption from institutional capital. A move in ETHBTC to new ATHs would bring calls for a “Flippening” with a fervor not previously seen. DeFi regulatory action from the SEC or a massive hack of a blue chip DeFi project would be the occurrences most likely to derail that outcome from an ETH price appreciation perspective. A full 180 from Elon (e.g., TSLA buys more BTC) or a combination of other public blue chip BTC buyers (e.g., Oracle + Bridgewater) would be the occurrences most likely to derail that outcome from a BTC price appreciation perspective. Should BTC retest the lows or break down below $30k, likely due to strongly negative China announcements, I would guess ETH gives back some portion of its YTD outperformance vs BTC, but I could be wrong.

Which brings us to the topic of BTC’s unprecedented price decline, just barely missing out on the title for the worst two-week price performance in Bitcoin history, second only to October 2011.

Source: TradingView. As of 5/31/21.

Earlier I mentioned the unprecedented characteristics of the recent price action, should what we just witnessed indeed turn out to be a cyclical top. The following chart best exemplifies this-

Source: Pladizow. As of 5/31/21.

Put simply, BTC has never given you that much time to sell the top. Not even close. Bitcoin has never distributed a cyclical top, a la Wyckoff, it has only previously blown off. That’s not to say Bitcoin CAN’T distribute into a cyclical top. It’s Bitcoin – anything can happen. But it’s never happened before.

When looking at previous examples of >23% two-week price declines (i.e., a “crash”), the results are mixed. Nine instances. Four were good buys and five were good sells. The optimistic view is that the prior occurrences in bull markets were buys, and we’re currently still in a bull market. The bear view is that it’s over right now and you should be selling all bounces.

Source: TradingView. As of 5/31/21.

There are many market participants that hold the view the current setup is most similar to the “double bubble” of 2013 or the June 2017 pullback and thus buyable. Both instances have similarities to the current price action, although neither experienced multiple days’ failure into the 200d moving average - a key TA indicator for longer-term traders. We currently remain firmly under the 200DMA. Every sustained loss of the 200DMA has historically meant lower prices ahead.

Source: TradingView. As of 5/31/21.

Unprecedented times indeed. But look at the current slate of catalysts – should it come as any surprise that the current price action has little historical analogue? Imagine explaining to a 2013 or 2017 vintage trader the set of market dynamics we find ourselves currently faced with. They’d never believe you!

Over the last several months, we’ve discussed how several long-term cyclical indicators were running hot for BTC. That a multi-month consolidation period would be healthy for BTC – giving it time to recharge and reset oscillators before making a push even higher. Well, we got that in spades, and it’s scared the bajeezus out of everyone.

If that was a top, we never had one look like that before.

Source: lookintobitcoin.com. As of 5/31/21.

The below chart kinda looks like a more severe version of summer 2017, right?

Source: lookintobitcoin.com. As of 5/31/21.

Did we just kill Stock-to-Flow?

Source: lookintobitcoin.com. As of 5/31/21.

Never had a cyclical top this flat. Never had a pullback this deep.

Source: lookintobitcoin.com. As of 5/31/21.

Regardless of the eventual outcome, this is an unprecedented MVRV profile.

Source: lookintobitcoin.com. As of 5/31/21.

Never had a cyclical top with such a low percentage of old coins moving.

Source: lookintobitcoin.com. As of 5/31/21.

Reserve Risk, our own proprietary metric, shows an unprecedented profile.

Source: lookintobitcoin.com. As of 5/31/21.

Hashrate will be watched closely by the market in the coming weeks. The drop in hashrate began the second week of May. This is likely due to the China mining ban but also is seasonally the time of year where Chinese miners move operations and set up hydroelectric power in Szechuan as the rainy season begins.

Source: blockchain.com. As of 5/31/21.

Bitcoin Open Interest has declined to levels not seen since late January when price was slightly lower than where it is currently. This is not a levered market.

Source: bybt.com. As of 5/31/21.

This decline in Open Interest came primarily in one nasty crash on May 18th, as $7.6bn of liquidations occurred across all names and all exchanges. That this mass liquidation event could occur only a month after an even larger liquidation event in mid-April was a testament to how severe the crash actually was. If you were 5x, 3x or even 2x levered from the top of the market, you were liquidated on May 18th. That is an enormous forced selling event. Historically those have been good buying opportunities.

Source: bybt.com. As of 5/31/21.

From a purely TA perspective, serious damage was done to the Bitcoin chart in May. There is significant resistance in the low $40’s, mid $40’s and low $50’s. That’s a lot of wood to chop – plenty of supply will come for sale at those levels. For Bitcoin to punch through all that successfully, it will likely need significantly positive news events.

Source: TradingView. As of 6/1/21.

What is the expectation for Alts broadly and ETH specifically, should BTC be rangebound in the coming months – say from low $30’s to mid $40’s? Dominance, shown below in bold candles with BTC price in lighter candles, has fallen off a cliff YTD. After a single week spike higher at the peak of the volatility in May, Dominance has rolled back over and appears to be heading to retest the low, if not break down further.

Source: TradingView. As of 6/1/21.

There is a real possibility for Dominance to enter into a new era – making new all-time lows as ETH, competitor Layer 1’s and DeFi continue to gain traction amidst a strong set of narratives and a tainted BTC story. Assuming this will happen would be betting on something we’ve never seen before. But this is the wild world of crypto, it could certainly happen.

Closing Remarks

Last month I said, “this is a raging bull market. All the signs are there.” Oof. In hindsight, there were other signs as well. The COIN direct listing collapse was not great. TSLA selling 10% of their Bitcoin position was not great. The speculative mania of DOGE, SHIBA, ASS and CUMMIES is rarely rewarded for very long. But the specific catalysts that came to fruition in May, the timing and nature of those catalysts, and the resulting price divergences of BTC and ETH – there was no playbook for that. An extremely challenging market environment to be sure. In fact, if you take the above quote only in the context of ETH, is it not still true? That divergence is a critical component of the current market structure and how it plays out in the coming months will be one of the mostly closely watched factors for the remainder of this year.

Bitcoin has its antifragility work cut out for it at the moment. While ETH has managed to side-step the ESG problem by having a reasonably credible path to move to Proof-of-Stake, it could certainly still get caught up in any number of shoes that may drop on the China trading ban front in the coming weeks. In the near-term, price action for crypto broadly will likely be a function of incremental supply coming to market on the back of any additional negative headlines from China coming to meet demand from US buyers who are willing to look through the temporary sell-off and realize the medium-term picture is getting more attractive, not less. Market prices are established every minute of every day where supply meets demand. Both sides of that equation have their own set of dynamic factors that change as new information becomes available. Thus, the specific outcomes that occur in the coming weeks and months on both the Elon/ESG front and the China ban front, will play a pivotal role in price action.

Taking a step back, the industry broadly continues heading in a direction that will keep it at the forefront of investment and innovation. Carbon emissions were a problem that needed to be solved. China’s outsized influence on crypto was a problem that needed to be solved. Both issues were brought to a head in May. There’s good reason to think the eventual outcome of each will be a material improvement from the current situation. While many investors fled crypto markets in May in a fearful rush, others stepped in to buy the pullback they had been waiting for. One man’s panic sell is another man’s opportunistic buy. The overall interest levels from all sorts of investors is still very high. Go re-read the Monthly Highlights from this month and prior months. While new challenges emerged in May, the train of decentralization is still chugging down its path. We can argue about how fast the train is moving or the specific eventual arrival point, but the broad direction is undeniable. We’re honored to be doing our little part.

“Nothing so visible than what you want to hide.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS