March 2025 - Monthly Market Update

/Monthly Update || March 2025

“In investing, what is comfortable is rarely profitable”

Opening Remarks

Greetings from Ikigai Asset Management¹. We welcome the opportunity to bring to you our seventy-eighth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, February was a pretty shit month. Also just a weird month. Bybit got hacked by North Korea to the tune of $1.4bn in ETH. Apparently that’s the largest heist of any sort in human history. Whoah. The Central African Republic launched and immediately collapsed a memecoin. Dave Portnoy launched and immediately collapsed MULTIPLE memecoins. Changpeng Zhao launched a memecoin about his dog that immediately collapsed. And then the crescendo (God willing) of this absurdity - Javier Milei launched a memecoin with some autistic crypto scammer no one’s ever heard of. That memecoin also collapsed in hours, the scammer made off with $100mm (and then did an interview talking about his crimes) and tons of people lost money. Milei is under investigation in Argentina for it. Kanye West thought hard about running the same memecoin playbook but backed out ON MORAL GROUNDS. Let that sink in.

Macro was a bit messy as well, with Trump tariff fears rippling through the market a couple different times in February, combined with fears of significantly reduced government spending, and its impact on GDP. We even threw in a little weak economic data and lofty stock valuations for good measure. It’s unclear how much of the tariff stuff is just Trump posturing for negotiating leverage, because he announced tariff dates and then pushed them back a couple times. But the overall multifaceted uncertainty has macro broadly somewhat spooked.

It wasn’t all bad. You can check the highlights below. The SEC moved swiftly in keeping the promises made by the Trump campaign – immediately reversing course from all the damage Gensler did while at the helm. That was mostly expected (and “priced in”), but still impressive to see nevertheless. Overall, pretty choppy. BTC is probably fine, it’s off in its own world. Alts are in the midst of an ongoing come-to-Jesus experience around their value proposition, or lack thereof. Doesn’t look like it’s going to get resolved in March.

February Highlights

North Korea Hacks Bybit for $1.4bn of ETH, Immediately Launders It

Bybit Says It Borrowed Money to Make Customers Whole, Withdrawals Processed

Javier Milei Partners with Crypto Scammer, Launches LIBRA Memecoin, Runs to >$4bn Market Cap and Collapses in Hours, with Scammer Taking >$100mm

Central African Republic Launches CAR Memecoin, Runs to $600mm Market Cap and Collapses in Hours

Changpeng Zhao Launches Memecoin of His Dog, Immediately Collapses

Dave Portnoy Launches and Immediately Collapses Multiple Memecoins

MSTR Purchases 28,000 BTC Totaling $2.5bn in Two Tranches

SEC Issues Statement That Memecoins Are Generally Not Securities

SEC Dismisses Multiyear Legal Action Against Coinbase

SEC and Binance File to Stay Legal Case for 60 Days

SEC Closes Investigation on RobinHood with No Action

SEC Closes Investigation on Uniswap with No Action

SEC Closes Investigation on Gemini with No Action

SEC Closes Investigation on Consensys with No Action

SEC Significantly Scales Back Crypto Enforcement Unit

CME To Launch SOL Futures on March 17th

OKX Pleads Guilty to Unlicensed Money Transmitter, Settles for $500mm Fine

Trump Nominates a16z’s Brian Quintenz as Head of CFTC

Hester Peirce to Lead Crypto Task Force, to Focus on Securities Classifications, etc

Trump Signs Executive Order to Create Sovereign Wealth Fund, Rumors of Crypto Buys Whirl

Rumors That Trump Won’t Create Executive Crypto Council, Will Only Hold Summits

Ethereum Foundation Executive Director Resigns Amidst Scrutiny

Bitwise Raises $70mm from Electric Capital, MassMutual, MIT, et al

Senator Bill Hagerty Introduces Stablecoin Legislation Bill

Binance.US Resumes USD Capabilities

Crypto Payments Firm Infini Loses $50mm of USDC in Hack

| Asset Class | Feb | Jan | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | -18% | 10% | -100% | 121% | 48% | 1% | -12% | 69% | 155% | -64% | BTC |

| NASDAQ | -3% | 2% | -1% | 25% | 5% | 2% | 8% | 8% | 54% | -33% | QQQ |

| S&P 500 | -1% | 3% | 1% | 23% | 2% | 6% | 4% | 10% | 24% | -19% | SPX |

| Total World Equities | 0% | 3% | 3% | 14% | -2% | 6% | 2% | 7% | 19% | -20% | VT |

| Emerging Market Equity | 1% | 2% | 3% | 4% | -9% | 8% | 4% | 2% | 6% | -22% | EEM |

| Gold | 2% | 7% | 9% | 27% | 0% | 13% | 5% | 8% | 13% | -1% | GLD |

| High Yield | 1% | 1% | 2% | 2% | -2% | 4% | -1% | 0% | 5% | -15% | HYG |

| Emerging Market Debt | 2% | 2% | 3% | 0% | -5% | 6% | -1% | 1% | 5% | -22% | EMB |

| Bank Debt | 0% | 0% | -1% | -1% | 0% | 0% | 0% | 0% | 3% | -7% | BKLN |

| Industrial Metals | 2% | -1% | 1% | 3% | -9% | 3% | 12% | -2% | -6% | -13% | DBB |

| USD | -1% | 0% | -1% | 7% | 8% | -5% | 1% | 3% | -2% | 8% | DXY |

| Volatility Index | 19% | -5% | 13% | 39% | 4% | 34% | -4% | 4% | -43% | 26% | VIX |

| Oil | -4% | 3% | 0% | 13% | 10% | -13% | 1% | 18% | -5% | 29% | USO |

SOURCE: TRADING VIEW. AS OF 2/28/25.

You Thought The Vibes Were Bad A Month Ago?

Last month’s main section was entitled “Hilariously Shitty Vibes For BTC $100k”. You thought the vibes were bad a month ago? Like I said at the beginning of this letter, February was a pretty shit month.

The hack just sucks - a reminder of the magnitude of this type of risk that’s present 24/7/365 in crypto. I’d say the memecoin stuff was worse though - worse for ecosystem overall. Embarrassing. Pointless. Distracting. Nihilistic. Max extractive. All bad. No good. Paints crypto in a terrible light (as if it could get worse to the outside world). Price action matched how shitty the headlines were. BTC had its second worst February ever. Alts had it much worse. SOL was -36% in Feb.

Nearly 4 months since the election, what is now crystal clear is that there is not significant, sustained inflows into Alts broadly. We had a big pump in the wake of the election – Alts did about a double in a month. But that Alt pump was broadly over the first week of December and has now retraced more than half of that up move (and looks to likely be heading lower). SOL is currently ~10% below its election day price. So what we now know with a few months of hindsight is that a Trump win, and all the positivity for crypto associated with it, was not sufficient to bring a lot of new capital into Alts. And all those Alts still have bagholders and a lot of them have unlocks and VC token holders that got in early that need to return capital to LPs.

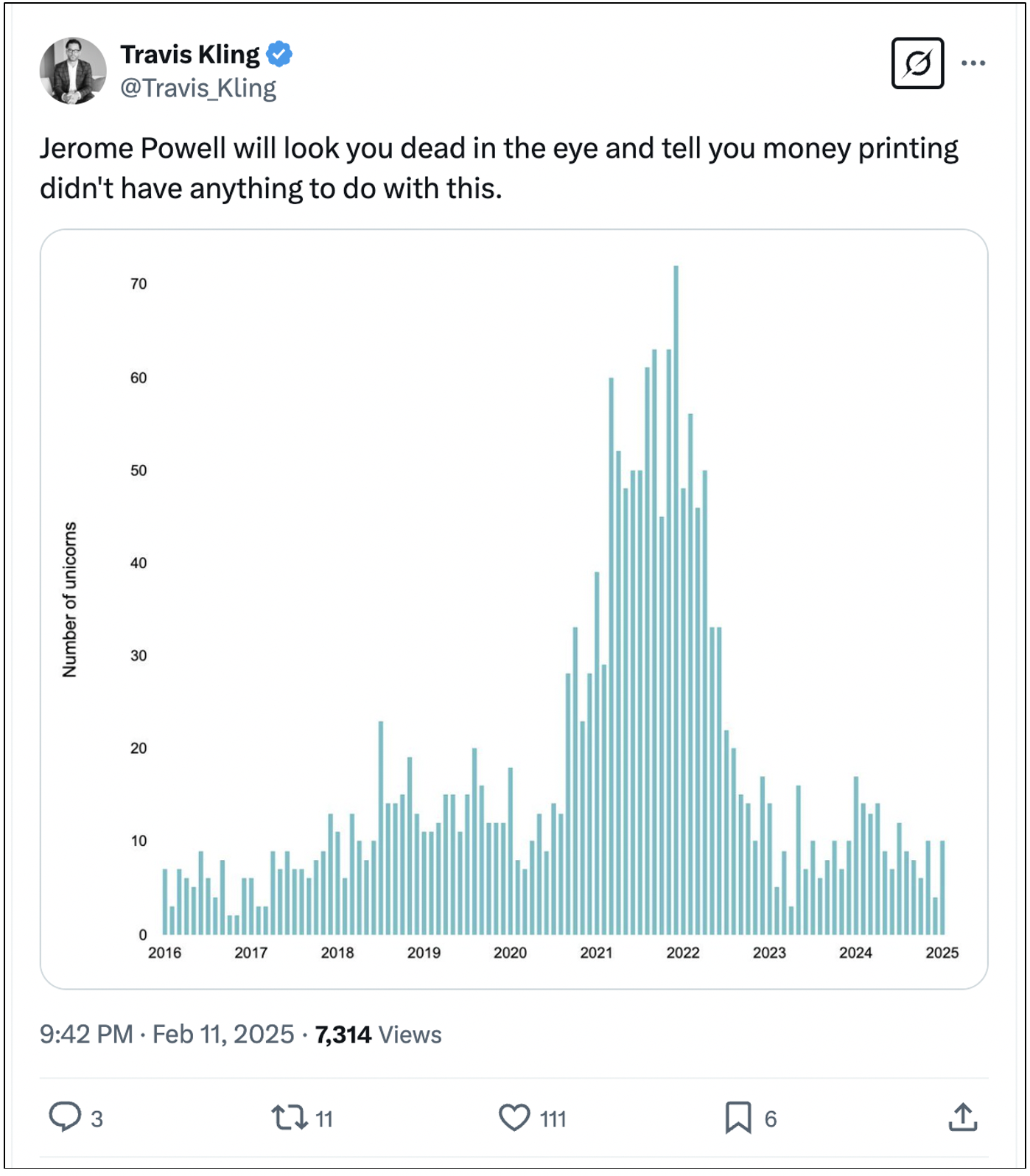

Why didn’t a Trump win and all the positivity for crypto associated with it drive significant inflows into Alts broadly? Why has the market been such strong sellers for months now, even with a backdrop of tremendous support from the US government? Because of “a lack of pretense that any of this shit does anything or will ever do anything” – a topic that’s been discussed here consistently for over a year and incrementally updated over that time as well.

On 11/1/24 I said-

My guess is, a Harris win will elicit a sort of identity crisis in crypto, or rather exacerbate an already existing identity crisis in crypto, which we’ve been talking about here for a while. If Trump wins, the immediate excitement will wash away those identity crisis feelings, at least for a period of time. And we will get helpful regulatory clarity and a much more supportive government in general and that will basically be a new hand of cards to play with. Doesn’t mean a Trump admin is the blanket panacea for what ails us, I don’t think that’s true. BTC and stablecoins will still have product-market-fit, and that PMF will likely grow in a Trump admin. But there will still be a lingering “core utility” issue with Alts. Solutions looking for problems at best, vaporware grift at worst, and a whole lot somewhere in the middle.

On 12/1/24 I said-

What about the rest of crypto? Crypto in 2025 will likely be defined by a MUCH more favorable regulatory environment. Settlements and no action letters from the SEC and CFTC. Executive orders from Trump. Various edicts out of the Crypto Czar. I think that all happens rather quickly, and legislation gets nailed down over a longer timeframe, perhaps the next year or so, before passing in 2026. This is highly likely to open up crypto to more capital inflows, as the US regulatory risk becomes massively diminished. I would expect to see token structure changes start to occur in 2H-25 – incorporating security-like features that drive more compelling value accrual. Out with the worthless governance tokens, in with the yield-bearing, token burning pseudo-securities. I think having US regulatory clarity will open the door for major traditional/Web2 companies to get involved in crypto – think GTA6 including crypto in its release, that sort of thing. There were plenty of rumors in 21 of these sorts of things – big companies on the precipice of getting involved in crypto in one way or another. Then 22 killed all that. I think we actually see some of those rumors come to fruition in the next 18 months. We will likely get more spot crypto ETFs. SOL and DOGE may be first up, but we may very well get a whole bunch of them.

I’ve spoken about this many times here, but just to reiterate – Alts broadly have a “core utility” problem. There are some who would argue that an adversarial US regulatory backdrop has been A, and perhaps THE main driver of this “core utility” problem. And now that we’re going to clean up all those regulatory issues and have a nice clean backdrop for crypto, this “core utility” problem is going to magically vanish as numerous compelling use cases that gain significant mass adoption finally just appear. I would be wary of that view. A good regulatory backdrop is going to be helpful, without a doubt. But Alts broadly have a bigger issue than that. Outside of Bitcoin and stablecoins, the overwhelming majority of crypto projects are somewhere between solutions looking for problems and vaporware grift. I don’t think that fact magically changes with supportive regulations. But it’s certainly a great start.

On 1/1/25 I said–

So there’s your answer – the same drum I’ve been beating for a long time. Alts by and large don’t do anything. The curtain was pulled back on that with the damage that was done in 2022. 2+ years later we’re still living in the aftermath/shadow/hangover of the collective realization that Alts just don’t have much to show for themselves - certainly nothing that would even come close to justifying their current $1tn aggregate market cap (even after the 30% decline in Feb). Fast forward to March 2025, it’s clear the billions of dollars of capital on the sidelines watching crypto, waiting for compelling reasons to buy, have not been induced to step in.

Since the election, there has been a hope trade in Alts – “Trump wins. Tons of capital comes into Alts. That capital buys my bags from me. I ride off into the sunset”. MANY market participants were in this trade. In real time, I think that hope trade is dying. The market is collectively realizing Alts are not getting bailed out by the Trump win. There was strong price action the first month after election. And then chop for the next ~6 weeks and now in February we had a breakdown.

This situation is actually exciting to me. I’m excited right now because I can feel crypto maybe capitulating in a way that can POTENTIALLY lead to more positive things down the road. Milei may have been a crescendo moment, and we are currently in the immediate wake of that crescendo – the market letting go of all the memecoin insanity and the vaporware grift. Crawling out of the malaise that we’ve been stuck in. Painful now, but this is a good thing longer term. We can begin to move on to the next thing and hopefully that will be more positive. TBD on how long that takes.

Market Update - Liquid Crypto Asset Investing

| Feb | Jan | YTD | 2024 | Q4-24 | Q3-24 | Q2-24 | Q1-24 | 2023 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | -18% | 10% | -10% | 121% | 48% | 1% | -12% | 69% | 155% | -64% |

| ETH | -32% | -1% | -33% | 46% | 28% | -24% | -6% | 60% | 91% | -67% |

| XRP | -29% | 46% | 3% | 238% | 240% | 29% | -24% | 2% | 81% | -59% |

| BCH* | -26% | -2% | -27% | 36% | 25% | -12% | -44% | 121% | 157% | -75% |

| EOS | -29% | 2% | -27% | -8% | 50% | -11% | -48% | 30% | -2% | -72% |

| BNB | -13% | -3% | -16% | 124% | 24% | -3% | -4% | 94% | 27% | -52% |

| XTZ | -30% | -15% | -40% | 28% | 82% | -11% | -43% | 40% | 39% | -84% |

| XLM | -31% | 25% | -14% | 157% | 237% | 8% | -35% | 9% | 81% | -73% |

| LTC | 0% | 24% | 24% | 42% | 54% | -11% | -28% | 44% | 4% | -52% |

| TRX | -8% | 0% | -8% | 136% | 63% | 25% | 1% | 14% | 98% | -28% |

| Aggregate Mkt Cap | -21% | 7% | -15% | 96% | 46% | -4% | -14% | 63% | 119% | -64% |

| Aggregate DeFi* | -29% | 11% | -21% | 50% | 52% | -15% | -21% | 47% | 132% | -77% |

| Aggr Alts Mkt Cap | -20% | 4% | -18% | 72% | 47% | -13% | -15% | 58% | 90% | -64% |

SOURCE: COINMARKETCAP AND COINGECKO. AS OF 2/28/25. BCH INCLUDES SV.

At first glance, BTC looks like it double topped in Dec and Jan and then broke down in late Feb–

For expected support, there’s been a focus on the low $70’s-

Low $70’s would be a 30-35% pullback from the top. Currently the pullback has been 25% from the top-

The current pullback is right in line with prior pullbacks since the FTX bottom-

Low $70’s would make this the largest pullback since the FTX bottom, although still pretty light by historical BTC standards. In the last bull, we did an approximate double top (or failed breakout) that was spread across 10 months and had a 55% drawdown in between-

There has been a lot of conjecture (as well as some evidence in Sam’s trial) that the second top in late 21 was significantly driven by Alameda/FTX, desperately using customer funds to manipulate the market higher so they wouldn’t implode. So I’m not entirely sure how relevant that price action is this time around. That’s even more true now with spot ETFs, which have caused significant changes to price discovery for Bitcoin.

You may recall this chart and commentary from Sept 1, 2024-

A series of three failed breakdowns caused by buyers stepping in when BTC is 20-25% off the top. I would characterize this as new behavior for BTC, and it would make all the sense in the world that this dip buying is a new type of deep-pocketed, patient, long term buyer that as of ~13 months now has safe access to buy the BTC dip in big size through Blackrock and Fidelity. That’s a gamechanger.

It is worth noting that since we’ve had the ETFs (Jan 2024), the macro backdrop has been directionally supportive. We’ve had macro hiccups (namely Yen carry trade unwind in August), but they’ve subsided quickly, and risk assets have generally grinded higher. NASDAQ is +22% since IBIT launched, so the macro backdrop has been supportive-

Thus, we haven’t actually seen BTC price action with ETFs AND with a negative macro backdrop. If that were indeed what we’re seeing the beginnings of right now, will we still get those dip buyers down 20-25% that put bottoms in?

IMO it would depend on how negative the macro backdrop is – what type and expected duration of negativity are we talking about here? Our current flavor of macro fear is a hazy, nondistinctive one. It’s fair to label it mostly as different types of Trump uncertainty. Will D.O.G.E. cut so much spending that it pushes the economy into recession? Will the tariffs drive inflation to uncomfortably high levels? Will inflation be driven high enough that the Fed will have to eventually raise interest rates?

The answer to that last question strikes me as the answer to whether: 1) dip buyers will show up in size down 20-25%; or 2) sellers overwhelm at those levels and we go do a down 40% or greater. If the Fed has to do an entire about-face and embark on a new hiking cycle to try and quell inflation, that strikes me as the kind of thing that could cause BTC to do a down 50% from the top. I wish I could say I have a strong view on the likelihood of that rate path, but I don’t. There are too many moving pieces with all of the initiatives of the Trump administration, and too much uncertainty around the likelihood, timing and degree of impact of those various initiatives. But this is a fear that is spooking markets broadly at the moment.

Short of an outcome that dire, I do think tariffs could spook the market further in the near term, perhaps sending BTC to the high $60s, which would be nearly a 40% decline from the top. Seems like that would align with a ~15% decline in the NASDAQ, which happened last year at the apex of the Yen stress-

Is there a chance the BTC high is in for the year, or even multiple years? Sure. If the Fed ends up raising rates later this year, it would be my base case the 2025 highs are in for BTC. I just don’t have a good sense of how likely that is. Let me know if you have a strong view.

I do think what we now know, is a $2tn market cap on BTC is a pretty heavy load to carry. It simply requires a LOT of buying to drive BTC up over $100k, and there are plenty of sellers at that level. For all the good that happened for BTC between Dec and Feb. For all the Saylor buys and ETF inflows, BTC has not spent much time at all over $100k-

BTC may just need to consolidate in the $80s for some number of months while all the Trump moving pieces get some clarity. If/when that uncertainty abates in a reasonably positive manner, BTC makes another run at $100k and beyond. At some point along the way, we’ll likely get news from David Sacks on a Digital Asset Stockpile. If he announces the US government will no longer sell seized BTC, we should get a decent pop but probably nothing crazy. If he announces the US government will be buying BTC through the Treasury, BTC will immediately go much higher. But I don’t think that’s going to happen.

Alts took a beating in February and it’s not clear to me they’re out of the woods yet. As mentioned earlier, there’s a Trump Alt Hope Trade that’s likely dying in real time. Not sure what would change that in the next month or two.

ETHBTC had a nasty wick in early Feb on Trump tariff tweets and is continuing to trade weak after trading weak for 2 ½ years. ETHBTC is now back at Dec 2020 levels-

“Total3” (Aggr Mkt Cap - BTC - ETH) did a clear double top from last cycle and has now retraced 65% of the move up immediately after the Trump win-

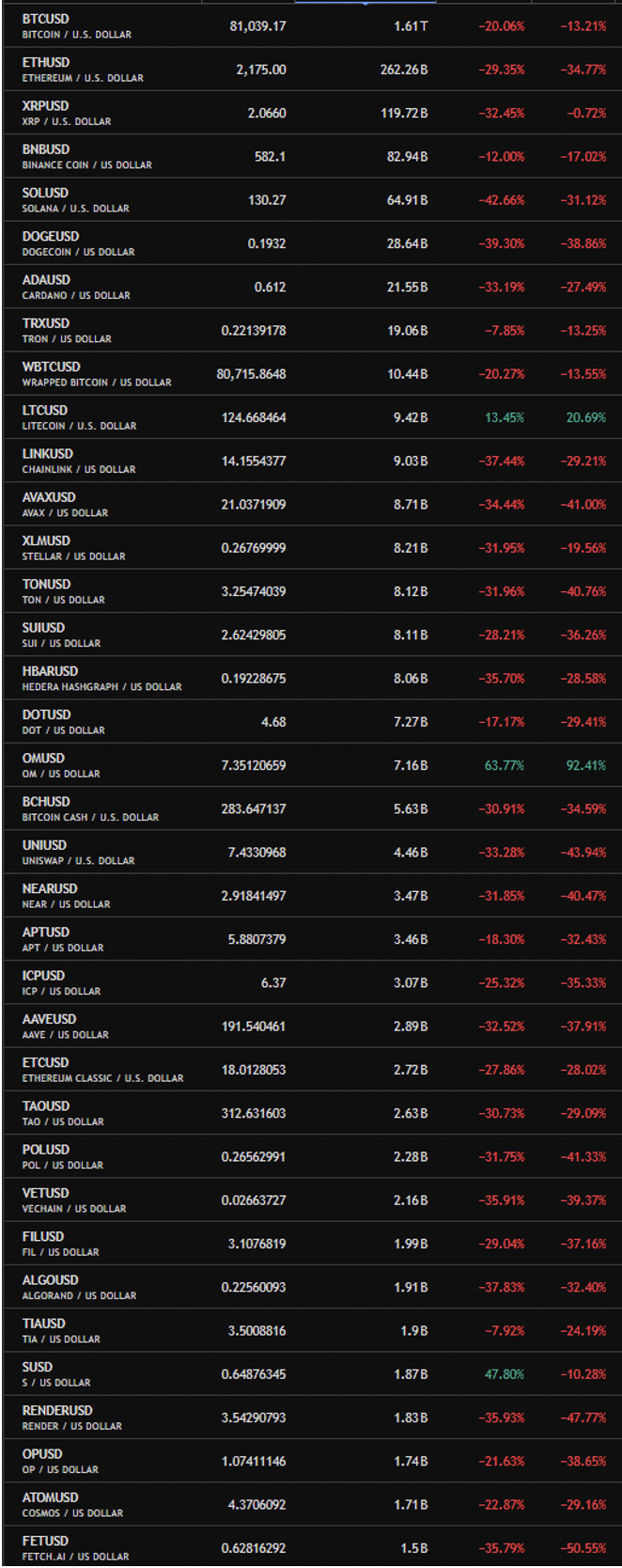

Just to drill down into the makeup of this chart, here’s the monthly and YTD performance for the top coins-

SOURCE: TRADINGVIEW AS OF 2/27/25

Excluding BTC, those names are down 26% YTD on average. I don’t see anything on the horizon that would lead me to believe a significant, broad-based Alt rally will materialize. We could get some brief pumps and we could certainly have some individual names do well for all sorts of reasons. But the 21-style Pumpfest I just don’t think is on the table. Not this year at least. We can’t convince the capital the required to cause that kind of price action to actually come in.

SOL got the worst of it in Feb. Down 55% in a straight line from the moment Trump launched and collapsed the TRUMP and MELANIA memecoins -

A major driver of this price action is likely the upcoming March 1 FTX estate unlock, to the tune of 11.2mm units of SOL. That's a big number. The buyers of the locked FTX SOL are sitting on big UPNL, even after this price correction. They want to hedge that and then realize it. It would not be surprising at all if many of those 11.2mm SOL were going to be sold in bulk via OTC. And that the price for that sale would be calculated as a discount to TWAP and that TWAP period would be going on right now. So buyers are incentivized for price to be lower.

On the positive side, spot SOL ETFs should be coming pretty soon. CME is officially launching SOL futures March 17th. So maybe spot SOL ETFs are in the next 1-3 mos. Maybe 6. Maybe YE on the longer side of things. IDK. But pretty soon. And just two months ago I would have said there is likely significant demand for spot SOL ETFs. More than ETH... But that may be changing in real time.

The pitch to institutions over the last 18 months has been "you want to own the casino". I've heard it repeated hundreds of times - by well-respected senior tradfi types and by the most degen of degens. BUY SOL. OWN THE CASINO. Well, over the last 5 weeks we got TRUMP/MELANIA. Then Central African Republic. Then Changpeng's dog. Then Dave Portnoy. And then the Javier Milei crescendo.

So obviously, ridiculously extractive. Pointless. Nihilistic. Embarrassing. All bad. No good.

THAT'S "THE CASINO".

So what you may be seeing in real time is a dismantling, and unraveling of this investment thesis to "own the casino". The casino is too damaging to its customers. The games the casino empowers are quite literally killing the customers. I'll leave you an analogy-

Imagine a casino that puts just a pinch of fentanyl in every cocktail.

Short term, this looks like a great strategy. Customers can't stay away!

But pretty quickly you start losing customers. Soon, it's just fent dealers and a few zombies left.

Wanna own THAT casino?

Closing Remarks

Yeah. Probably not great near term. If the macro backdrop doesn’t immediately escalate further, BTC should get a decent bounce and Alts prob get some kind of lift to go along with it (off of very oversold levels). But I think Alts will continue to struggle in general in the coming months. There is an outcome where we are in the midst of a multiyear re-rating of Alt market cap relative to BTC.

You’ve seen a version of this chart here before. Adjusted Alt Dominance. The purple box is the Alt mania of early 2021. That’s the trade so many were waiting on in Q1-25, four years later-

It seems pretty clear at this point that nothing like that purple box is happening any time soon. The fundamentals for Alts simply aren’t there, and the market seems generally unwilling to bid them a lot higher in the absence of more positive fundamentals. This is, while painful for Alt bagholders, a healthy thing.

The yellow squiggly line would be an Alt reckoning. It’s an outcome over the next two years where Alts just keep bleeding, IMO because they can’t find traction with use cases that justify their lofty valuations. It’s not that Alt experimentation would die. I don’t think that’s happening any time soon. It would just be a reset of valuation levels. It’s not all worth a trillion. It’s worth half that. Or a quarter of that. And it gets there over the next two years while the whole Alts industry shifts to more legitimacy and firmer footing with a backdrop of regulatory support. IDK if that’s my base case but I could def see it happening.

"It's dark under the lighthouse."

-Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS