November 2020 - Monthly Market Update

/Monthly Update || November 2020

“What’s clear to the broad consensus of investors is almost always wrong.”

Opening Remarks

Greetings from inside Ikigai Asset Management¹ headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-sixth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, October brought an absolute tidal wave of events, both on the macro front and crypto-specific. Just one month ago, I was sitting here writing the last Monthly Update after a deeply disappointing initial presidential debate. Since then, Trump tested positive for Covid and then had a miraculous recovery in four days. Politicians refused to come to terms on fiscal stimulus. Vaccine approvals were delayed. A Covid second wave emerged. Amy Coney Barrett was sworn in to the Supreme Court. Blue Wave odds spiked, declined and spiked again. Iran and Russia meddled in the election. Twitter exercised censorship. Hunter Biden had a laptop from hell. All-in, the VIX was +44% in October, although SPX was only -3%. The crypto news flow was equally torrential but decidedly more positive and it showed in price action, with BTC +28% in October (see below for highlights).

Next week, we will have an election, although it’s in no way clear we’ll also have a President-elect next week. Polls and prediction markets would tell you it’s not going to be close, yet many feel the race is much closer than polls and prediction markets suggest. I will refrain from making election predictions here, as I have no more edge on it than anyone else. All I’ll say is TRUMP is trading at 35c and that feels cheap to me.

Last month, we discussed a range of potential outcomes for asset prices going into year-end based on various outcomes with the election, fiscal stimulus, vaccine, economic data and Covid cases. Currently, varying degrees of risk remain present around each of those factors. Current asset price levels have baked in some amount of expectations on each of those factors. Those expectations may be off by a little, or a lot or just wrong entirely. It seems that many investors are at least partially, if not mostly, on the sidelines currently - waiting for the election to see which way asset prices break and then deciding what to do from there. That likely means a pickup in realized volatility for November, with overall direction of prices TBD.

In the very near-term, I’ll leave you with this election night cheat sheet, courtesy of Credit Suisse.

The macro backdrop in October was hardly the backdrop you’d expect for BTC to move up 28% in a month, and yet here we are. For six months now, we’ve been talking about how it’s “all one trade”, and how BTC was very much wrapped up in this. Well it gives me great pleasure to announce that, at least for BTC, it is no longer “all one trade” as of now.

Source: TradingView. As of 10/31/20.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors. Contact us to see if you qualify.

October Highlights

PayPal & Venmo Introduce Cryptocurrency Buying, Selling & Shopping

Public Company Square Buys $50mm of Bitcoin on Balance Sheet

Singapore’s Largest Bank DBS Announces Crypto Exchange & Custody

PayPal Rumored To Be Acquiring Leading Custodian BitGo

JPMorgan Launches Digital Asset Business Unit, Rumored to Buy Custodian

Franklin Templeton Invests in Series A Round of Crypto Custodian Curv

Stone Ridge’s NYDIG Raises $50mm, Announces 10,000 BTC in Custody

Chairman Powell Says CBDC Could Improve US Payments

CFTC Chairman Makes Highly Positive Public Remarks About Ethereum

US Attorney General Releases Cryptocurrency Enforcement Framework

US National Security Council Names DLT As One of Twenty Focus Areas

FCA Bans Sale of Crypto Derivatives to UK Retail Customers

OKex Founder Arrested by Chinese Government, Withdrawals Suspended

BitMEX Implements Strict KYC Regulations After CFTC & DoJ Charges

FinCEN Fines Bitcoin Mixing Operator Helix $60mm

Iran Government to Use Iranian-Mined Bitcoin For Payments

2017 $257mm ICO Filecoin Launches

| Asset Class | Oct | Sep | Aug | July | Q3-20 | Q2-20 | YTD | Instrument |

|---|---|---|---|---|---|---|---|---|

| Bitcoin | 28% | -8% | 3% | 24% | 18% | 42% | 50% | BTC |

| NASDAQ | -3% | -6% | 11% | 7% | 12% | 30% | 31% | QQQ |

| S&P 500 | -3% | -4% | 7% | 6% | 8% | 20% | 4% | SPX |

| Total World Equities | -2% | -3% | 6% | 5% | 8% | 19% | 0% | VT |

| Emerging Market Equity | 1% | -1% | 3% | 8% | 10% | 17% | -2% | EEM |

| Gold | -1% | -4% | 0% | 11% | 6% | 13% | 24% | GLD |

| High Yield | 0% | -1% | 0% | 5% | 3% | 6% | -5% | HYG |

| Emerging Market Debt | -1% | -2% | 0% | 4% | 2% | 13% | -3% | EMB |

| Bank Debt | -1% | -1% | 1% | 1% | 2% | 4% | -5% | BKLN |

| Industrial Materials | 3% | -3% | 6% | 8% | 11% | 10% | 1% | DBB |

| USD | 0% | 2% | -1% | -4% | -4% | -2% | -3% | DXY |

| Volatility Index | 44% | 0% | 8% | -20% | -13% | -43% | 92% | VIX |

| Oil | -11% | -7% | 5% | 4% | 1% | -17% | -72% | USO |

Source: TradingView. As of 10/31/20.

The Big Picture In Pictures

Real GDP saw it’s worst ever decline in Q2 and its best ever bounce in Q3.

Source: FRED. As of 10/29/20.

Continuing jobless claims are trending down but remain at very high levels.

Source: Ollari Consulting. As of 10/29/20.

Unemployment is affecting different job markets in different ways. City size and severity of lockdown appear to be key components.

Source: @CharlieBilello. As of September 2020

Initial jobless claims are leaking lower, but it’s worth point out that 751k number is still the highest ever prior to Covid. We are dealing with an unprecedented economic situation.

Source: Ollari Consulting. As of 10/29/20.

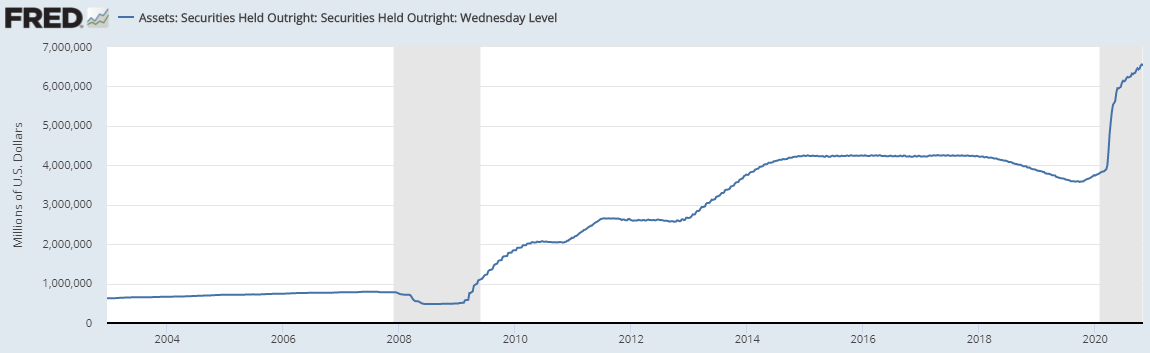

Unprecedented economic situations call for unprecedented monetary policy.

Source: FRED. As of 10/28/20.

And unprecedented fiscal policy.

Source: longtermtrends.net. As of 3/31//20.

Which drove, incredibly, Americans’ income to be HIGHER than where it was pre-Covid because of transfer payments from the government.

Source: FRED. As of 10/30/20.

That has driven pockets of the economy to be drastically stronger than you’d otherwise expect seven months into an ongoing global pandemic.

Source: FRED. As of 10/16/20.

But this level of government spending is not without consequences on the other side.

This unprecedented fiscal policy is set to continue, one way or another. We can argue about the future pace of expansion, but the direction is clear.

When governments issue this much debt, they have no choice but to set interest rates really, really low.

Speaking of Italy, the EU is in the midst of a full-blown second wave which is massively worse than their first, which has led to full-blown lockdowns in Europe and the UK.

Worldwide, we are likely to see a new high in daily deaths in November. This is not going away any time soon.

Back to those low interest rates because you have so much debt. Sometimes, you have so much debt a zero interest rate isn’t low enough.

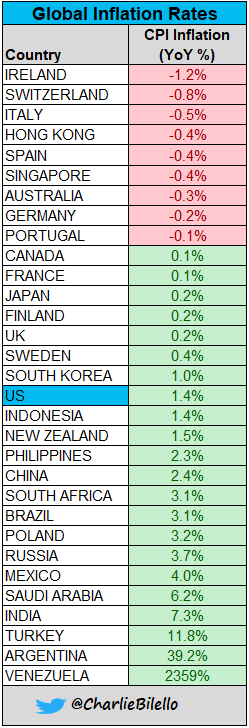

The United States, along with most developed nations, are in sore need of inflation, so as to grow nominal GDP faster than debt and thus lower Debt/GDP. That inflation is hard to come by at the moment.

Even after all that monetary and fiscal stimulus, inflation expectations are only just now back to where they were pre-Covid, which were already meaningfully below the Fed’s target rate. The seven-year downtrend of inflation expectations remains firmly in place.

Real yields (nominal yields less inflation) are negative, but not nearly as negative as the Fed would like in order to have confidence the economy can grow its way out of current enormous debt levels. 1-year real yields (shown in blue) are only marginally negative at the moment. Note real yield levels during the 10+ year period immediately following WW2. That’s how you inflate your way out of debt.

There’s certainly an argument to be made that SPX (red) and expected 10-yr inflation (white) have been “all one trade” since Covid. Any decoupling here is worth watching carefully.

Speaking of equities, the unprecedented level of liquidity injected this year is undoubtedly the culprit for equities being as high as they are currently.

Where has all this money printing left the dollar relative to other fiat currencies? Well, about 2% below the middle part of a six-year range. Which is to say, meh.

On the other hand, the dollar relative to the world’s oldest SoV tells a very different story.

And the dollar relative to the world’s newest SoV looks like it’s in big, big trouble.

Market Update – Liquid Crypto Asset Investing

| Symbol | October | September | August | July | Q3-20 | Q2-20 | Q1-20 | YTD | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 28% | -8% | 3% | 24% | 18% | 42% | -11% | 92% | 92% | -46% |

| ETH | 7% | -17% | 26% | 53% | 59% | 69% | 3% | 198% | -3% | -75% |

| XRP | -1% | -14% | 9% | 47% | 38% | 1% | -10% | 24% | -45% | -94% |

| BCH* | 7% | -14% | -12% | 40% | 5% | -1% | 26% | 39% | 30% | -91% |

| EOS | -2% | -20% | 5% | 31% | 9% | 6% | -14% | -2% | 0% | -89% |

| BNB | -3% | 26% | 12% | 34% | 90% | 22% | -8% | 107% | 123% | 19% |

| XTZ | -10% | -33% | 15% | 20% | -7% | 46% | 20% | 47% | 192% | -44% |

| XLM | 4% | -23% | 0% | 45% | 12% | 64% | -10% | 72% | -60% | -92% |

| LTC | 20% | -24% | 5% | 40% | 12% | 6% | -5% | 34% | 36% | -88% |

| TRX | -2% | -10% | 49% | 20% | 61% | 41% | -13% | 94% | -29% | -91% |

| Aggregate Mkt Cap | 16% | -9% | 12% | 29% | 32% | 44% | -5% | 110% | 51% | -59% |

| Aggr Alts Mkt Cap | 1% | -10% | 27% | 38% | 58% | 45% | 4% | 141% | -1% | -74% |

Source: CoinMarketCap. As of 10/31/20. BCH includes SV.

On August 1st I said:

“Bitcoin’s price is likely to reach a new ATH precisely when the Risky Whales want it to. Not before. Not after.”

Well, we’re not quite there yet, but the air is getting pretty thin up here!

Source: Pladizow. As of 10.31.20.

We knew it was going to take a Herculean effort to get Bitcoin to decouple from “it’s all one trade”. Just go back up top and read this month’s Highlights section. That will give you the decoupling you’re looking for. BTC in red and VIX (inverted) in purple.

Source: TradingView. As of 10.31.20.

We’ve discussed Bitcoin’s reflexivity many times here previously. Reflexivity and momentum go hand in hand. One way to measure momentum is via moving averages. The below chart denotes periods when price is above an upward sloping 50DMA, which is above an upward sloping 100DMA, which is above an upward sloping 200DMA. Hard to deny the track record on this indicator.

Source: Pladizow. As of 10.31.20.

Where else could you look for signs of momentum in demand for Bitcoin exposure? GBTC is a good spot.

Source: Grayscale. As of 9.30.20

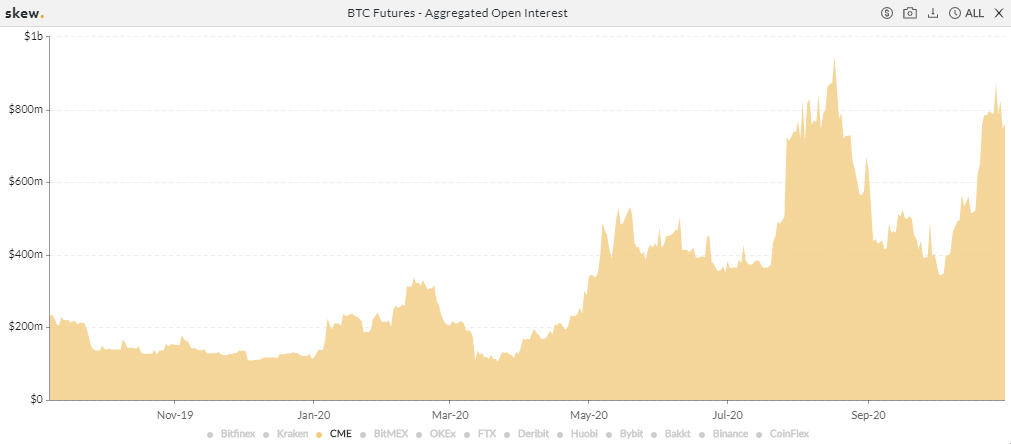

CME open interest is another spot.

Source: Skew. As of 10.31.20.

Especially when that increase in CME open interest steals market share from less trustworthy exchanges.

Source: Skew. As of 10.31.20.

A big knock on BTC from institutional investors in the past has been the volatility. That stance is getting harder to defend.

Source: BlockFi. As of 10.26.20.

It can’t all be good news though. As an especially rainy season in Szechuan has now ended, miners have pulled down hashrate at an especially alarming rate. There are backtests you can do that would show you a near-term price decline after a hashrate decline of this magnitude is likely imminent. It’s worth watching carefully. Should it occur, it will likely be a great buying opportunity.

Source: Blockchain.com. As of 10.31.20.

Bitcoin’s strength in October came at the expense of Alts, as BTC Dominance bottomed on September 12th and rocketed higher in October. This bodes close watching.

It would be remiss to talk about Dominance without talking about ETHBTC, a subject of discussion here for the last several months. My gut says this is likely going lower.

ETH is up 198% YTD vs BTC +92%. That’s massive outperformance. The reason behind that outperformance is clear – DeFi. DeFi is still deflating. Unclear where this bottom, but from a purely time perspective, we likely need more time.

That said, TVL in DeFi has remained relatively strong and only topped out a week ago. This is a trend worth watching carefully. The innovation in the DeFi space is not going away, regardless of a deflating price bubble.

One last specific point I want to make. The nature of Bitcoin price discovery is changing in real time. BitMEX was ground zero for BTC price discovery from early 2018 through March of 2020. Their role in price discovery was diminished after the Black Thursday debacle and further diminished after charges were brought by CFTC and DoJ. It is unliklely BitMEX will ever regain its prior level of involvement in BTC price discovery. The founder of OKex is still in jail as far as we know. Withdrawals are suspended and there is no expected timeline for those to come back online. OKex users are selling their accounts for 80c on the dollar. OKex is intimately involved in price discovery. The argument can be made their BTC Quarterly Future is the most important instrument in all of Bitcoin. Change is afoot. With change comes both opportunity and risk.

Closing Remarks

The world has experienced a high degree of change this year. Yet, the world sits on the precipice of further change still.

Bitcoin is on a precipice as well.

There is alignment between the change Bitcoin is on the precipice of and the change the world is on the precipice of. It’s becomingly increasingly clear the world will never go back to the way it was pre-Covid. That’s true for work from home. That’s true for movie theaters. That’s true for brick-and-mortar shopping. That’s true for monetary and fiscal policies.

Bitcoin is poised to be a central part of the broad change that is occurring in this world. I’m biased, but I try hard to keep an objective viewpoint. It’s a big part of my job to do so. Bitcoin is extremely well-positioned for the change we are faced with in this world. You need to do the work to decide Bitcoin is good at storing value. I’ve done that work and I’ve concluded that it is. Then you need to do the work to decide the world is going to need good stores of value in the future more than they’ll need them today. I’ve done that work too.

More and more people are doing that work and arriving at the same conclusion. Signs of increased adoption are everywhere. Signs of maturation are everywhere. We’re nearing three years since the prior all-time high. Bitcoin is poised.

“Dumplings over flowers”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS