November 2022 - Monthly Market Update

/Monthly Update || November 2022

“The market doesn’t know everything, but it doesn’t know nothing, and knowledge is cumulative. The market knows stuff now that it didn’t know forty years ago, so it’s harder to outperform.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our fiftieth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that already has and will continue to fundamentally change the world – continuing to create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, we came into October with a charcuterie board of macro risks on display. We discussed these at length in last month’s update and many of these factors had significant further developments in October. The Yen situation worsened in October. The Gilt market worsened and then got better. The Ukraine conflict is escalating but we staved off nukes for another month. Europe has stocked up so much on natural gas that at least at the moment the near-term risks of a gas crisis are diminished. Xi took a significant step towards authoritarianism this month. DXY did not make a new high this month, despite significant stress in multiple major currency markets. Big tech earnings were pretty bad, but the US consumer seems to be holding in OK at the moment. Inflation is still running hot but the Y/Y comps are set to get easier this coming month. The labor market is still running hot.

That covers macro developments in October in a nutshell. All that added up to a SPX +8%. How, might you ask, did that happen? Because positioning, especially from systematic AUM, was so bearish that even a “well the world didn’t end” kind of month was enough to send equities higher on the back of non-discretionary flows.

Fed mouthpiece Nick Timiraos at the WSJ floated a number of critical points of information in October. This one below, which was released only a few hours before the Bank of Japan stepped in to the Yen market for the second time in six weeks, was enough to rally the SPX 6% -

Source: TradingView. As of 9/30/22.

The next day, Timiraos followed that article up with this tweet –

Source: ultrasound.money. As of 9/30/22.

That was enough for the market to run with – Yields tighter, DXY down, equities up. NASDAQ would have been up a lot more if it weren’t for stunningly bad earnings from META and reasonably bad from GOOG and AMZN. META in particular seems to be in a really bad spot which just truly warms my heart… but I digress.

In a pseudo-reversal of these aforementioned dovish “balloons” released by Timiraos just a week prior, he wrote the below article on the 30th –

So at this point there’s quite a lot of tea leaves to try and parse through about what Powell is going to do. One day after this Monthly Update comes out, the Fed will almost certainly raise rates another 75bps and then Jay will have a press conference where he will try to thread a needle. I have been astounded this year by the degree to which Powell has nearly every asset price on Earth in a complete headlock. When Treasury markets get a bit wobbly, he can flick a couple texts to the WSJ and calm them. The price of debt, the price of equities, the price of crypto, the price of real estate, the price of money and the price of most commodities go in the direction Jay wants them to, which he and the rest of the FOMC governors communicate with a few choice statements on the margin in public commentary. So we’ll get another choice few statements from Jay on the 2nd that will likely swing the market one way or another.

It doesn’t make much sense to me that Jay would want to rally risk assets right now. Easing financial conditions at this point would be self-defeating. Yet it seems like the Fed, barring very high inflation readings in November, is set to decrease the pace of tightening from 75bps to 50bps in December and likely indicate a further step-down to 25bps in Jan. Thus, Powell is left trying to communicate a step-down while keeping financial conditions from loosening. It seems to me that will be rub at the FOMC meeting on the 2nd.

Whether he pulls that off remains to be seen. He made a mistake in July with being “dovish on the margin” and, when coupled with systematic buying, rallied risk assets and loosened financial conditions, which then had to be subsequently walked back with that brutal Jackson Hole speech. I doubt he wants to make that same mistake again.

He will however, be keeping in mind significant international stresses on the global financial system, and the somewhat dysfunctional Treasury market. I mean, Yellen has already floated starting up “not QE” QE, and that may be put into action this month. He will also be fighting what will likely be strong systematic buying in equities in the coming weeks, along with stock buybacks. Like I said last month, positioning is very bearish but there’s plenty of reasons to be bearish, so that will be the push/pull. I don’t know how the battle between Powell’s “step-down hawk” and systematic buying will play out, but it will likely be a defining factor for price action in November.

A week after FOMC, we will learn the outcome of the US mid-term elections. It appears the House is a done deal for Republicans –

While the Senate will be much closer –

There doesn’t seem to be a clear consensus view on the broad direction of asset price in the event R’s only win one or both houses. There are pockets that are positively correlated with changes in polls/prediction markets (e.g., Dems control senate = good for green energy). There are also the statistics that the 3rd year of a presidency is historically the best year for stock returns on average. So we’ll see how the broader market takes it. Honestly I think mid-terms will likely be overshadowed by all the other macro winds swirling at the moment.

That said, specifically for crypto, a Republican sweep would be strongly bullish. It would meaningfully increase the likelihood we get good, workable crypto legislation in place in the next two years and decrease the likelihood of strongly negative legislation or enforcement actions against crypto in the coming years. Crypto has become a significant issue for many politicians. Crypto lobbyists are backed by some major league dollars these days. Should the Republicans sweep, I believe smart money knows this will be bullish crypto and that should be reflected in crypto price action, barring any other major macro storm clouds (by no means a foregone conclusion).

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1ˢᵗ and 15ᵗʰ of every month.

Contact us to see if you qualify.

October Highlights

BNY Mellon Begins Crypto Custody for Select Customers

Fidelity Enables Ethereum Trading for Institutional Clients

Twitter To Allow Buying and Selling of NFTs Through Tweets

CashApp Adds Support for Bitcoin Lightning Network

Binance/CZ Invests $500mm with Elon to Buy Twitter

Google to Allow Some Customers to Pay for Cloud Services with Crypto via Coinbase in Early 2023

Google Cloud Announces Blockchain Node Service Starting with Ethereum

Apple Issues New App Store Rules for Crypto and NFT Payments

Accounting Standards Board FASB Allows for Fair Value Treatment of Crypto Assets, Ending Crypto Impairment Charges

Facebook’s Libra Spinout Aptos Launches Blockchain, Token Begins Trading, Receives Significant Criticism from Crypto Community

Uniswap Labs Raises $165mm Series B Led by Polychain

Celestia Labs Raises $55mm at $1bn Valuation Led by Bain Capital and Polychain

Blockchain Developer Platform Tatum Raises $41.5mm Led by Evolution Equity Partners

Blockchain Indexer Nxyz Raises $40mm Series A Led by Paradigm

Blockchain Gaming Startup Horizon Raises $40mm Led by Brevan Howard, Morgan Creek

Blockchain.com Raises Undisclosed Amount of Capital at Undisclosed Valuation Led by Kingsway Capital

Binance Launches $500mm Fund to Provide Loans to Bitcoin Miners

Blocktower Launches $150mm Venture Fund Backed by BPI France and Mass Mutual

DeFi Protocol MakerDAO Invests $500mm Into US Treasuries

Tether Launches Access to 24,000 ATMs in Brazil

Coin Center Files Federal Suit Against OFAC, Challenging Its Authority to Sanction Tornado Cash

DeFi Protocol Mango Markets Exploited for $114mm, Exploiter Comes Forward Publicly, Claims What He Did Was Not Illegal, Agrees to Return $67mm

Binance Smart Chain Hacked for $100mm, Chain Temporarily Frozen to Prevent Further Exploit

NEAR Foundation Establishes $40mm Fund to Bail Out USN Investors in Case of Collapse

PayPal Institutes $2,500 Fine for Users Promoting Misinformation

Huobi Founder Leon Li to Sell His Entire Stake in Huobi to About Capital Management

Crypto Community Pushes Back Against SBF for His Regulatory Proposals on DeFi, Debate Ensues

NYDIG CEO Robert Gutmann Resigns, NYDIG Lays Off One-Third of Staff

Public Bitcoin Miner Core Scientific Says It May Seek Bankruptcy

Bored Ape Creator Faces SEC Probe Over Unregistered Offerings

Bittrex Pays $30mm Fine for Sanctions Violations

SEC Settles Probe Against Kim Kardashian for $1.26mm for Publicly Shilling EthereumMax

Polkadot Co-Founder Gavin Wood Steps Down

Genesis Chief Risk Officer Leaves After 3 Months

| Asset Class | Oct | Sep | Q3-22 | Q2-22 | Q1-22 | YTD | Q4-21 | Q3-21 | Q2-21 | Q1-21 | 2021 | 2020 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 5% | -3% | -2% | -57% | -2% | -56% | 6% | 25% | -41% | 103% | 60% | 303% | BTC |

| NASDAQ | 4% | -11% | -5% | -23% | -9% | -30% | 11% | 1% | 11% | 2% | 27% | 48% | QQQ |

| S&P 500 | 8% | -9% | -5% | -16% | -5% | -19% | 11% | 0% | 8% | 6% | 27% | 16% | SPX |

| Total World Equities | 6% | -10% | -8% | -16% | -6% | -22% | 5% | -2% | 6% | 6% | 16% | 14% | VT |

| Emerging Market Equity | -2% | -12% | -13% | -11% | -8% | -30% | -3% | -9% | 3% | 4% | -5% | 15% | EEM |

| Gold | -2% | -3% | -8% | -7% | 6% | -11% | 4% | -1% | 3% | -10% | -4% | 25% | GLD |

| High Yield | 3% | -4% | -3% | -11% | -5% | -16% | -1% | -1% | 1% | 0% | 0% | -1% | HYG |

| Emerging Market Debt | -1% | -7% | -7% | -13% | -10% | -28% | -1% | -2% | 3% | -6% | -6% | 1% | EMB |

| Bank Debt | 3% | -4% | 0% | -7% | -1% | -6% | 0% | 0% | 0% | -1% | -1% | -2% | BKLN |

| Industrial Materials | -2% | -8% | -8% | -25% | 16% | -21% | 8% | 2% | 8% | 8% | 29% | 16% | DBB |

| USD | -1% | 3% | 7% | 7% | 3% | 16% | 1% | 2% |

-1% | 4% | 6% | -7% | DXY |

| Volatility Index | -18% | 22% | 10% | 40% | 19% | 50% | -26% | 46% |

-18% | -15% | -24% | 66% | VIX |

| Oil | 10% | -11% | -19% | 8% | 36% | 32% | 3% | 5% | 23% | 23% | 65% | -68% | USO |

Source: TradingView. As of 10/31/22.

A Cursory Glance At The State Of The NFT Market

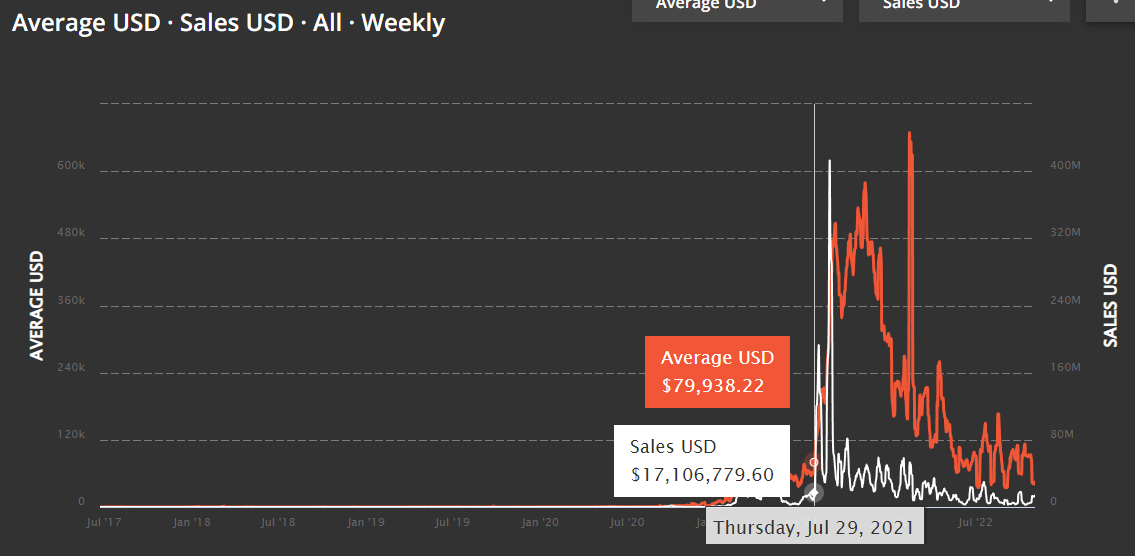

NFT’s have been the hottest use case for blockchain technology over the last 18 months, point blank. These JPEGs captured the hearts and minds of millions worldwide and onboarded an entirely new type of user into crypto. Ironically, NFT mania was kicked off in earnest on July 30, 2021 by none other than Three Arrows Capital, when 3AC swept the Cryptopunk floor and bought 100 Punks for ~$6mm in a single ETH block. Six months of mania ensued, with the average weekly Punk sales price reaching $652k and total weekly sales volume reaching $413mm.

Source: Nonfungible.com. As of 11/1/22.

It’s apparent from this chart above what happened after those six months of mania, as the Fed’s tightening campaign took ahold of nearly every asset price on planet Earth – not the least of which was JPEGs. The shape of this chart is going to be a familiar sight in the discussion below.

Next up was Bored Ape Yacht Club. Bored Apes took off right alongside punks, and their rise lasted several months longer, reaching $109k average sales price and $445mm of total weekly sales volume.

Source: Nonfungible.com. As of 11/1/22.

The BAYC team did more to build community and create utility for Ape holders than the Punk team. Or any other team for that matter. There were Mutant Apes and other spinoffs. There was all sorts of merch. There was ApeCoin. There was the Otherside metaverse. Yuga Labs, the creator of BAYC, raised an absolutely insane $450mm at a $4bn valuation in March and immediately acquired CryptoPunks. Yuga has thrown the kitchen sink at driving utility for Ape holders, setting the standard for NFT projects everywhere about what it looks like to go all-out for your project. No other NFT collection has come close to date. It remains to be seen what value will be created for the BAYC project and how much of that value will accrue to Ape holders.

Over the back of 2021 and into the first part of 2022, the pace of new NFT launches was astronomical. NFT flipping became a full-time job and the job paid well. Many crypto market participants left low-cap Alt trading for NFT land, where money was pouring in, and no one had to pretend to care about the tech. Which, to my mind, is a good way to frame most NFT projects – it’s trading Alts where you don’t have to pretend to care about “the tech”. Worthless Alts have been actively traded for many years at this point and it doesn’t look to be going away any time soon. So this progression into JPEGs lines up well with that precedent.

But there is something else going on here besides JUST that. I’m honestly not here to lambast the JPEGs, but to argue in defense of them. But I’m not exactly sure what’s going on. The dollar volumes are still amazingly high even after declining 90%. But then again there is a ton of wash trading and bot trading and arb trading. My guess is there’s probably a few hundred thousand users globally that are actively engaged in the NFT market right now, with a heavy Pareto skew of the dollar volume towards the whales in the space. That number could likely flex up by a factor of 10x if the broader macro environment were to be risk-on. It’s not going away. It’s going to progress and become more intertwined with our everyday lives. Just think about it – digitally representing yourself. That as a concept. That’s def not going away. You’d be crazy to think otherwise in my opinion. The world is so clearly moving in that direction. If crypto continues to be important, which it will in my opinion, there will continue to be a fair amount of wealthy individuals that will seek to express themselves digitally in ways that will cost a lot of money. So I think NFTs as a concept will exist at the mass distribution level like Zara and exist at the high end like Chanel. There’s no way you would’ve guessed Uber when the iPhone came out. There’s no way you’ll guess how digital representation will play out a decade from now. But it’ll be fun to watch…

For the moment, NFT sales and trading volumes have collapsed back to their levels right before 3AC kicked off the mania. NFT USD volume declined 97% from the January 2022 peak of $17.2bn. Quite the fall from grace -

Source: Dune Analytics. As of 11/1/22.

Google Trends confirms the picture painted above, people seem to care a lot less about NFTs now than they did at the beginning of the year.

Source: Google. As of 11/1/22.

NFT’s are more than just collectibles and PFPs. We also had a surge in gaming NFTs, with Axie Infinity leading the charge and Loot also putting up big numbers. Gaming NFT weekly sales peaked in early September 2021 at $383mm. Over the last two months, that number has averaged ~$18mm.

Source: Nonfungible.com. As of 11/1/22.

Fine art has been another use case for NFTs that saw legit traction. Beeple sent this trend into high gear with his record breaking $69mm sale of Everydays: The First 5000 Days at a Christie’s auction. A subsector within fine art emerged in 2021 with generative art – art that is created by AI. Art Blocks and Fidenzas were the two most popular generative art projects that generated billions in total transaction volume. At its peak, the entire fine art NFT sector produced an astounding $419mm of total weekly sales volume. This sector too has been hit hard over the last year, with most recent weekly sales totaling $8.3mm, which to be fair is still a very real number.

Source: Nonfungible.com. As of 11/1/22.

The large majority of NFT volume overall has occurred on Ethereum, but the Solana NFT ecosystem has made decent progress. Unfortunately, that positive trend very recently reversed course. Whenever we get to the end of the bear market, the Solana NFT ecosystem will be worth keeping an eye on.

Source: The Block. As of 11/1/22.

On the back of the strength of NFT sales, the NFT industry has raised a LOT of venture capital over the last year. Some of that capital was indeed to back specific NFT projects (e.g., $450mm to Yuga Labs), but much of it was for NFT infrastructure - marketplaces, wallets, “NFT finance” and more. That venture funding number totals in the billions over the last twelve months.

Source: TradingView. As of 9/30/22.

You can see NFTs included in the broad Web3 bucket in black below. It’s a huge amount of total venture investment –

Source: TradingView. As of 9/30/22.

So What?

Whether you’re a JPEG owner or a Metaverse land titleholder or not, if you’re long crypto or you’re thinking about being long crypto, what is happening in the NFT space matters. If you’re long ETH, the state of the NFT sector REALLY matters to your investment. As does the state of DeFi. And the state of Metaverse/gaming. They’ve all gone pretty much one way, on account of It’s All One Trade. Which honestly makes the assessment of JPEGs primarily a macro one, hilariously. But the micro does matter here. NFTs have “Fundamentals”, however primitive they may be.

The sheer dollar volume of venture funding being shoved into the NFT sector should produce at least a few things that gain very real traction. I wish I had the imagination to know exactly what that ‘s going to look like, but I don’t. We are paying close attention though. We’re looking for incremental innovation.

It remains to be seen what will come from raises like Yuga Labs’ $450mm. That’s a lotta dough. In lieu of multi-hundred-million-dollar marketing campaigns, we expect NFT projects to become more inventive around driving utility for holders. Smart people need to make up cool reasons to own these things. I believe that innovation is occurring, even if it does feel pretty slow/misguided at times. I realize it is much easier to sit back and criticize than to provide real, valuable ideas. So I won’t do that, but instead just state my hope that Ikigai can contribute in some small way in this area in the coming years. I’ve got to get my head out of macro for a minute so I can focus on JPEGs, but I’ve got a great team around me helping out and we talk about this stuff often. You’ll be hearing more from us on NFTs in the quarters to come.

Market Update – Liquid Crypto Asset Investing

Guest Author: Ikigai Trader Asher Montague-Warr

| Symbol | Oct | Sep | Q3-22 | Q2-22 | Q1-22 | YTD | Q4-21 | Q3-21 | Q2-21 | Q1-21 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 5% | -3% | -2% | -57% | -2% | -56% | 6% | 25% | -41% | 103% | 60% | 303% |

| ETH | 19% | -15% | 24% | -67% | -11% | -57% | 23% | 32% | 19% | 160% | 399% | 469% |

| XRP | -3% | 46% | 45% | -59% | -2% | -44% | -10% | 31% | 23% | 161% | 278% | 14% |

| BCH* | -4% | 1% | 7% | -67% | -13% | -71% | -13% | -6% | -11% | 45% | 6% | 71% |

| EOS | -3% | -14% | 28% | -67% | -7% | -63% | -23% | -5% | -14% | 85% | 17% | 1% |

| BNB | 14% | 2% | 30% | -49% | -16% | -37% | 32% | 28% | 0% | 708% | 1269% | 172% |

| XTZ | 0% | -6% | 0% | -62% | -14% | -67% | -28% | 100% | -37% | 142% | 116% | 49% |

| XLM | -4% | 10% | 2% | -51% | -15% | -59% | -4% | -1% | -31% | 220% | 108% | 184% |

| LTC | 3% | -1% | 0% | -57% | -16% | -62% | -4% | 6% | -27% | 58% | 17% | 202% |

| TRX | 3% | -4% | -6% | -12% | -2% | -17% | -16% | 31% | -26% | 244% | 181% | 101% |

| Aggregate Mkt Cap | 9% | -4% | 7% | -58% | -5% | -53% | 13% | 33% | -23% | 146% | 186% | 301% |

| Aggregate DeFi* | 4% | 3% | 25% | -74% | -8% | -69% | 29% | 64% | -27% | 339% | 581% | 1177% |

| Aggr Alts Mkt Cap | 10% | -4% | 12% | -58% | -7% | -52% | 19% | 40% | 1% | 246% | 479% | 274% |

Source: CoinMarketCap. As of 10/31/22. BCH includes SV. Aggregate DeFi from Coingecko.

Every market bottom I have experienced have been notoriously choppy, and this one is no different. Derivative traders seem to be playing against themselves. The algorithms are desperately trying to squeeze whatever juice they can from the minor moves, with bears and bulls celebrating every time it goes in their desired direction only to discover that the next day they are back at their entries or getting stopped out. For experienced swing traders, they know that patience is their best friend. While these levels are not optimal for a full market cycle, we may see bear market rallies that shake out the pessimism before paving the way for further downside.

This is where it gets tricky as we’re in the most macro-driven environment I can remember. Every market movement seems to be fueled by decisions coming out of the Fed. Take the recent rally for example, just before the rally commenced Nick Timiraos, the Fed whisperer, hinted at a pause/pivot for the upcoming FOMC. Immediately after that narrative was set, we saw a rally in risk broadly, but of course nothing has really changed until Powell speaks. He has the last word and so the real question here is “can this rally be trusted?” So far, we have rallied off of poor earnings from AMZN, META and others alongside additional inflationary economic data. One would have expected the markets to have tumbled further, yet they did not. It speaks to the power the Fed has over markets and makes the upcoming FOMC a crucial event as markets digest a 75bps rate hike and then potential messaging of a slow-down in tightening.

Dogecoin led the rally this month after news that the Twitter acquisition was complete. A flurry of speculative buying occurred on the hope that Elon Musk has plans to integrate DOGE as a means of payment into Twitter. There has been no official announcement as of yet. Trading volume of DOGE actually surpassed BTC as priced exploded from $0.06 to $0.15 in a few days.

Looking immediately forward, I expect a volatile start to November. The FOMC is the most important event for the near-term direction of crypto and asset prices broadly. Should Powell lean dovish on the margin, we should see a risk-on rally in Bitcoin.

Key Points

Large decrease in miner selling power

Most cyclical bottoms end at the 0.861 Fibonacci, which is around $12,500

FOMC meeting will likely be the catalyst for market direction

Bitcoin dominance at all time low against alt coins and is likely due for a comeback

Bitcoin is in a possible Fulcrum pattern, which mean a long-extended bear market instead of more price capitulation

Markets have been #downonly for 12 months and we have had exactly one year of bear markets, a rally is long overdue

The indicator above is calculated as “total miner outflow” divided by “miner supply on-chain”. We can see that in the past, when miner selling power increases, it has been on par with market declines. We’re currently at the lowest point this year, which is surprising seeing as the hash rate is so high and energy costs are rising. I’m not certain what’s going on here, but miners may be betting on an overall bounce in the markets before selling off some of their inventory to cover overhead costs. It will be interesting to observe the point at which they begin selling again as it could pressure any ongoing rally.

Source: Ollari Consulting. As of 9/25/22.

The Bitcoin hash rate (shown above) is at all-time highs.

Source: TradingView. As of 10/31/22.

When using the Fibonacci retracement tool (shown above) we see that most cyclical market bottoms end around the 0.861 Fibonacci retracement, currently sitting at $12.5k. It doesn’t necessarily have to go down there. The market has been doing a lot of unique things lately. But it is worth noting.

Source: TradingView. As of 10/31/22.

BTC Dominance is currently sitting four points above all-time lows and is deeply oversold. While Dominance is a muddied metric, it is nevertheless noteworthy. Without a doubt, BTC has not been acting great and its narrative is not currently well supported or even well understood. We’ve never seen such a prolonged period of relative disinterest in Bitcoin relative to other cryptos, spanning both bull and bear markets. In my view, if we’re going to rally then BTC will likely take back some Dominance. When this happens, Alts will likely be punished further. The best position may be BTC or another top-tier coin like ETH once we find a bottom because Alts may receive another round of slaughtering.

Source: @PeterLBrandt. As of 9/26/18.

Source: TradingView. As of 10/31/22.

The pattern above is a Compound Fulcrum. It’s quite a rare pattern to see but we could be in the midst of it. This would mean that a small further rally from here would then give way to a further rally towards the $30k level and possibly even higher. Only to subsequently roll over and revisit the lows of the current range later in 2023, once everyone has been suckered into thinking that the bear market is over. This Fulcrum outcome would then be a time-based capitulation rather than a priced-based one. At the moment, this is the most optimistic scenario I can think of.

Source: TradingView. As of 10/31/22.

The rockier scenario (shown above) at this point would likely require a bearish catalyst. Perhaps this would be related to the war in Ukraine or a mega-hawkish Fed coupled with sticky high inflation. Either could easily be a serious cause for concern and send price plunging lower towards the Fibonacci targets, thus creating a “spring” for price to bounce off of and put the bottom in once and for all. Personally, I would like to see this scenario play out as it would mean we could bottom quicker, but I don’t make the rules!

To Summarize: While plenty of risk is still present in the market, I think the bears are running out of firepower as time goes by. In the next few weeks (days?) I believe we will finally resolve this range and have a volatile move, giving clarity over which scenario is likely to play out. All eyes on the FOMC meeting, we will be ready for both scenarios.

“Patience, n. A minor form of despair disguised as a virtue”

Closing Remarks

I just re-read the Closing Remarks from last month and they’re so good (if I do say so myself) I’m just going to paste them again. No way I could’ve come up with something better. Presented below without edits. See you in December.

This Monthly Update was about as macro as it gets because this market is about as macro driven as it can be at the moment. The risks are multifaceted, large and knocking on the door. It’s adult swim out there for sure. Most market participants are anticipating bad things to happen, but that doesn’t mean it’s smart to be contrarian just for contrarian’s sake. Bitcoin down 3% in September with NASDAQ down 11% is noteworthy outperformance, but it’s tough to have continued decoupling as your base case moving into October. If we thread the needle on macro and manage to sidestep a bunch of different landmines and somehow manage to deliver on some good macro news, Bitcoin could easily lead equities to the upside. It’s just tough to have that as your near-term base case.

But that’s just short-term price action and I’m highly convicted that this too shall pass. As investors you should be skating to where the puck is going which means you must look through the near-term macro stress to imagine what the world looks like on the other side. What does crypto look like with a treaty in Ukraine? What does crypto look like with Fed tightening on pause? What does crypto look like with the Fed cutting rates? That world could easily be much closer to now than it might feel at the moment. Now is an outstanding time to be DCA-ing into crypto exposure, and if you can find an active manager that you trust, that’s probably even better. The winds of change are constantly blowing in crypto and no time harder than bear markets. Bear markets are where narratives get tested under a microscope and many crumble under the weight of dispassionate examination. The willingness to ignore a lack of compelling value accrual mechanisms suddenly goes away when everything is down 70%+ from the highs. The market actually starts asking hard questions. This is a good and necessary thing. Bear markets are for change. For innovation. For advancement. For keeping what works and cutting what doesn’t.

From that perspective, you’d almost prefer this bear market to drag on longer. So we can separate even more wheat from the chaff. A couple more quarters or maybe even all of 2023. It’s not like the space is going to run out of money to fund startups. That’s a laughable prospect at this point. This ecosystem is buzzing with activity. Hundreds of millions of dollars of permanent capital is being injected into crypto projects every month from the cashed-up VC community. Many dozens of deals from pre-seed to Series C are funded each month and we’re years away from that dry powder being extinguished, with fresh capital being raised every day.

Make no mistake, the space isn’t going anywhere. If the British Pound blows up. If Putin drops a nuke. If QT implodes the Treasury market. Crypto isn’t going anywhere and it will continue growing and innovating. By the time we get through this macro stress to bluer skies, I’m hopeful we’ll have a fresh cycle’s worth of new ideas to bring to the world.

“One who smiles rather than rages is always the stronger.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2021 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS