October 2020 - Monthly Market Update

/Monthly Update || October 2020

“Randomness contributes to (or wrecks) investment records to a degree that few people appreciate fully. As a result, the dangers that lurk in thus-far-successful strategies often are underrated.”

Opening Remarks

Greetings from inside Ikigai Asset Management¹ headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-fifth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, I sit here writing this less than 24 hours after the first presidential debate between Donald Trump and Joe Biden. Broad expectations going in were low, and yet the event was still deeply disappointing to most everyone that watched. CNN’s Jake Tapper called the debate a “hot mess inside a dumpster fire inside a train wreck”. Regardless of the candidate you’d prefer to be President, most would agree with that assessment.

It’s difficult to say who “won” the debate last night because that is likely the wrong way to frame the situation. Betting markets would tell you Biden won.

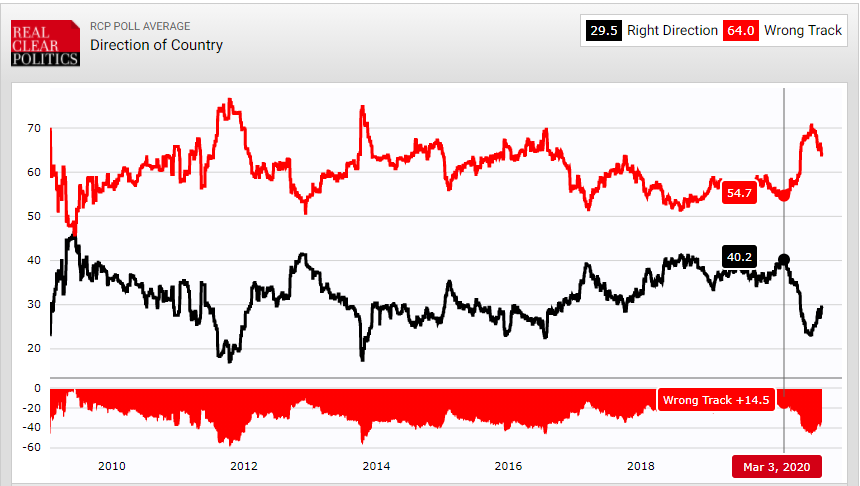

Source: Real Clear Politics. As of 9/30/20.

But the more broadly accepted stance on the debate last night, which you can’t bet directly on, was that no one won. We all lost. America lost. This feeling, that America is losing, is not new. More and more of us have been feeling this way for longer and longer. But like so many other factors, Covid greatly accelerated this feeling that too many Americans are losing. The response to Covid shined a spotlight on our leadership’s inadequacies – in the White House, in Congress, in Governors, in Mayors and in the scientific community.

Source: Real Clear Politics. As of 9/30/20.

How have we arrived here? To a state of such broad discontent across the country? It’s multifaceted to be sure.

Many politicians have probably been at least a bit crooked for a long time, but it does seem they’ve become more crooked over the most recent decades. And because of the information age, the ability to identify and call out the crookedness has certainly increased. The war in Iraq and the 2008 financial crisis in particular, seemed to have seeded a deep distrust that our government was not serving the best interests of its people. Social media, and the echo chambers it creates, has furthered discontent. The lack of a sense of community has driven discontent. Rising education and health care costs have driven discontent. But above all, I believe this has driven discontent –

Source: NYT. As of 4/10/20.

Now to be clear, I don’t want to come off as an advocate for socialism or communism. Democracy is the worst form of government besides all the others and free market capitalism is the most efficient allocator of resources in human history. And I also don’t want to place all the blame on our elected officials and their appointees, because technology fundamentally takes jobs and wealth away from middle-class Americans and gives enormous wealth to a very select few. But the states of American democracy and American capitalism are ones of utter brokenness. The former was on full display Tuesday night. The latter is on full display every day as financial markets hang on the words of Jay Powell, one hawkish policy decision away from a market collapse.

Simply put, this rotted democracy we find ourselves in today is not what hardly any of us willingly signed up for, and yet here we are. I’ve posed this question before, and I’ll pose it again now – “what are we, the people, to do about the situation we find ourselves in”? We certainly can vote in our democratic elections for the candidates we believe can affect the change we wish to see in the world. Perhaps as the years turn into decades, the ship can be righted in that manner. But even assuming we CAN elect politicians that will fight for the best interests of the people, they face a daunting task inside the swamp to actually make a real difference. If you nail up one new 2x4 inside a rotten and crumbling house, is the house actually that much better off?

As for the crony, administered capitalism we currently have in place, I’m afraid the outlook is even more dire. Interest rates cannot be raised, and QE cannot be removed – the result would be the most severe asset price collapse in at least 100 years that would produce the greatest level of social unrest we’ve seen since the Civil War. Our system and policies have been so wrong for so long, we’ve simply cut off all the exits except one. Print more money.

These two crises – rotted democracy and rigged capitalism, are virtually assured to be the defining, overarching challenges of the coming decades in America. They will be challenges faced not by those whose actions caused them, but by their children and grandchildren. So it’s fair to assume the solutions brought to bear against those challenges will not be those of Boomers, but those of Gen X, Millennials and Gen Z. After all, we didn’t get to the moon by horse and buggy.

Distributed Ledger Technology (DLT) has the potential to be the platform on which to drive societal change for the good. At its core, DLT removes the requirement for trust. If the world were more trustworthy, removing the requirement for trust would be less necessary. That is not where we find ourselves today. This is the thesis for what we broadly refer to as the Trust Revolution. We, the people, have lost faith in our institutions because we have seen unchecked power fail time and time again at every level. The world feels that a little more strongly today than they did on Monday, because that failure was so acutely on display during the debate.

DLT has many use cases, but none more paramount than a non-sovereign money. A non-sovereign digital money puts pressure on administered capitalism and in turn on rotten democracy. Fix the money, fix the world. That’s why we’re here. That’s Ikigai.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors. Contact us to see if you qualify.

September Highlights

BitMEX Charged by CFTC and DoJ For Illegal Trading Operations and AML Violations

MicroStrategy Buys $175mm More Bitcoin, Brings Total to $425mm

Bermuda Stock Exchange Approves Listing of World’s First Bitcoin ETF

US State Bank Regulators Agree to Blanket Set of Rules for Money Transmitter Licenses

Kraken Wins Bank Charter in Wyoming, First Ever for Crypto Company

OCC Allows Federally Chartered Banks to Custody Stablecoin Reserve Accounts

Gemini Announces Support for Shielded Zcash Withdrawals

BitMEX and Binance Both Update Trading Operations To Prevent Spoofing

Asian Crypto Exchange KuCoin Hacked for $150mm in Crypto

Libra Co-Founder Morgan Beller Leaves Libra to Join VC Fund

| Asset Class | Sep | Aug | July | Q3-20 | Q2-20 | YTD | Instrument |

|---|---|---|---|---|---|---|---|

| Bitcoin | -8% | 3% | 24% | 18% | 42% | 50% | BTC |

| NASDAQ | -6% | 11% | 7% | 12% | 30% | 31% | QQQ |

| S&P 500 | -4% | 7% | 6% | 8% | 20% | 4% | SPX |

| Total World Equities | -3% | 6% | 5% | 8% | 19% | 0% | VT |

| Emerging Market Equity | -1% | 3% | 8% | 10% | 17% | -2% | EEM |

| Gold | -4% | 0% | 11% | 6% | 13% | 24% | GLD |

| High Yield | -1% | 0% | 5% | 3% | 6% | -5% | HYG |

| Emerging Market Debt | -2% | 0% | 4% | 2% | 13% | -3% | EMB |

| Bank Debt | -1% | 1% | 1% | 2% | 4% | -5% | BKLN |

| Industrial Materials | -3% | 6% | 8% | 11% | 10% | 1% | DBB |

| USD | 2% | -1% | -4% | -4% | -2% | -3% | DXY |

| Volatility Index | 0% | 8% | -20% | -13% | -43% | 92% | VIX |

| Oil | -7% | 5% | 4% | 1% | -17% | -72% | USO |

Source: TradingView. As of 9/30/20

A Dynamic but Narrowing Set of Potential Outcomes

For the last three Monthly Updates, we unpacked the following critical large macro factors that are currently advancing in various directions:

Inflation/deflation

US/China relations

Fed balance sheet expansion

Fiscal stimulus

Gold

Stock market weirdness

Pace of economic recovery

Coronavirus

The 2020 Presidential election

Technology in Macro

Social unrest

While those all remain critical factors, we’re going to buck the trend a bit this month. We’ll touch on a number of these topics as well as others, but with the specific fulcrum of the upcoming election November 3rd because so much of all of this hinges on the lead-up to, and outcome of, that event.

To set the stage, I’ll include the below chart, which we have discussed here for the past five months. SPX, VIX, DXY, Gold, Silver, Oil and Bitcoin since March 2020. It’s all one trade.

Source: TradingView. As of 9/30/20.

Before jumping into what might happen, it’s worth noting where we are currently. Last month I said:

“If it looks like Congress is going to play the politics card and block a deal into the November election, there’s a good chance markets will hate that. That would be equities down, oil down, gold and silver down, Bitcoin down, VIX up, DXY up. It’s a risk worth watching carefully."

That was the situation that broadly played out over September. Specific to equities, last month I said:

“Equities are vulnerable here. Their price levels are divorced from underlying economic health to a degree never before seen. Could it keep going from here? Absolutely. Will that require a lot of these other factors to thread the needle of bullishness in the coming weeks and months? Yes it will. Could that happen? Certainly. Would a 10% correction from here be healthy? Undoubtedly. What could cause that? No fiscal stimulus is a good bet."

That too was the situation that broadly played out over September, with NASDAQ retracing 10% through the first three weeks of September before rallying into month-end on fiscal stimulus hopes to close down 6%.

An important factor that effected financial markets broadly in September was the September 16th FOMC meeting. While stocks had already traded off and the USD had already strengthened going into that meeting, both of those moves accelerated on Jay Powell’s lack of explicit guidance around yield curve control and long-term commitment to large-scale QE. Jay “Plain Language” Powell presented a notably more cryptic/confusing/non-committal discussion than in prior FOMC meetings. His point was clear: The Fed was not going to do anything meaningful in either direction before the election, so as not to meddle in its outcome through the movement of asset prices. Well, we already knew there was no way he would be even remotely hawkish, so a “less incredibly dovish than expected” discussion was met with disappointment. The Fed played politics against Trump. If you’re surprised by that, read this.

That puts monetary policy on ice between now and the election but that’s already priced in at this point. The next FOMC meeting is two days after the election. Highly unlikely we’ll have a decision on the election by then. Fed will again not want to rock the boat, so unless markets are under significant stress (which is possible under certain outcomes which we’ll get to), the Fed will stay as neutral as possible at that meeting as well.

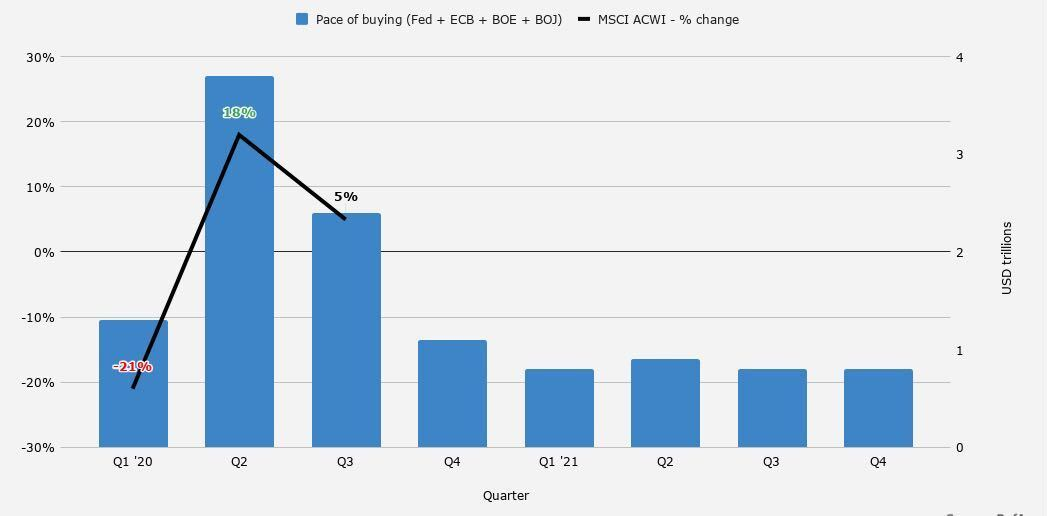

That said, the currently announced pace of QE across the four major central banks is unlikely to be sufficient to keep asset prices at current levels without significant fiscal stimulus alongside it. Said differently, if you want APPL P/E ratio to stay at 35x, we’re going to need checks in the mail and free money for zombie companies. The chart below by itself won’t get that done.

Source: Ollari Consulting. As of 9/27/20

Fiscal stimulus is the single most important macro factor to financial markets at the moment. As it relates to fiscal stimulus, headlines are flying around as I type this. The bid-ask is $1.62tn - $2.2tn. The sticking points are bailout money for state and local governments and the amount of weekly federal unemployment payments. It’s REALLY hard to call definitively at this point, but a deal looks likely. There are plenty of outcomes where a deal doesn’t get done but at this point it would be easy to imagine Mnuchin and Pelosi meeting at $1.8tn and greenlighting the bill.

Game theory and incentive structures dominate the analysis of this situation. We have highly incomplete information and the rules of the game are not perfectly understood.

Why wouldn’t Republicans just approve the original $3.4tn stimulus package proposed by Democrats? And why not approve $2.2tn now?

Does a $2tn stimulus package passed in early October hand Trump the election?

Is approving a $2tn stimulus package immediately prior to voting in the best interest of Democrats? Can Democrats somehow claim this as their victory and not Trump’s?

Is the Scotus appointment in play as a bargaining chip? Can Trump definitely get a Scotus appointment approved regardless of the election? What level of backlash against a Scotus appointment are Dems prepared to deploy? Will they pack the court?

Does Trump like where he is in the race after the first debate?

How critical is it to Trump’s re-election for the stock market to go up in October? How critical does HE think it is?

Do both sides assume the election decision will likely be drawn out? Do they assume they likely can’t get a fiscal deal done during that fight? Do they realize how damaging no fiscal deal will be to the economy and asset prices in Q4?

So you try and piece it together and think through different potential outcomes and how those various outcomes might affect asset prices, including Bitcoin.

The economy is almost certainly in big trouble without additional stimulus in Q4 and certainly by Q1. But with additional stimulus, the economy is actually probably in great shape. So what do you think politicians are going to do?

Source: @CharlieBilello. As of 9/16/20.

Source: St Louis Fed. As of 9/21/20.

There are outcomes that are very bad in the coming months, akin to a small-scale civil war. If you’re not familiar with this potential direction, it looks like this. Asset prices revisit mid-March levels and possibly make new lows.

There are outcomes where the highs for the year are already in for equities and Bitcoin. This would be no fiscal. No monetary. No vaccine. Bad economic data. A heavily contested election. Heavy social unrest. A second wave of Covid.

There are outcomes where the highs are in for equities and Bitcoin before the election, but they will make higher highs between the election and year-end. This could be fiscal stimulus alongside a quickly resolved election and improving economic data into year-end. A vaccine would help. No second wave would help.

There are outcomes where equities and Bitcoin make higher highs before the election. This would be a big fiscal deal ASAP and heavily lopsided election predictions in either direction. This outcome is looking increasingly less likely.

The big upside case over the next year is a blue wave immediately followed by massive fiscal and monetary stimulus in 1H-21 and rapidly diminishing Covid deaths. This is full blown UBI + MMT. A sort of Democratic spending jubilee. Social unrest gets a big win. The country feels unified under broad progressive oversight. This would take gold to $3k by YE-21. That would likely put BTC at $30k+ by then, if not higher. In order to achieve this outcome. you need headline CPI inflation to run *hot*, call it 4%+, generating exceedingly negative real yields. Interestingly, there is a state of the world where Trump is re-elected and you still get a similar outcome, but that needle is more difficult to thread. A blue wave is the most clear-cut bullish outcome in my opinion.

Still, a big question remains whether the dollar strengthens or weakens in various election outcomes. If we get small-scale civil war and the VIX goes to 60, does the dollar strengthen or weaken in that scenario? Strengthen against what? The Euro? Gold? Stocks? Bitcoin? Do we need an absolute spending jubilee to send the DXY to 84?

Source: TradingView. As of 9/30/20.

While the election is undoubtedly the fulcrum, other major factors encircle it. A useful mental framework for evaluating short-term expected asset price movements is the concept of “inflationary vs deflationary on the margin”. As new developments occur, do they push asset prices broadly in the direction of increased inflation expectations or decreased? You get that call right, you’ll get a lot of ancillary calls right. First introduced by Lyn Alden, this “inflationary vs deflationary on the margin” framework closely coincides with “it’s all one trade”. Both of these frameworks work until the correlations break down for some reason.

Thus, it’s a useful exercise to imagine the state of the world where "it’s all one trade" breaks down. What causes gold down and equities up? Gold up and equities down? Dollar up and equities up? Silver up and equities down? Then, when you imagine a big divergence in one of those major pairs, which direction do you imagine BTC will follow? Put differently, someday it won’t all be one trade anymore. When do you think that will happen and why?

This “all one trade” thing, I think it’s mostly liquidity driven. How much liquidity is in the market? Broad monetary and fiscal policies have an effect on liquidity to be sure, but not as acutely as just pure leverage. How many dollars can you borrow for every dollar of collateral in the system? Leverage is based on volatility. The less volatility, the more leverage. That’s a VAR-based risk model. The global financial system broadly manages risk like this. The Fed really wants to go control interest rate volatility, and by knock-on effect, equity volatility. The former they’ve done. The latter is underway but no guarantees.

As of 9/24/20.

Source: TradingView. As of 9/30/20.

If you’re expecting asset prices to run hot, you’ll need leverage in the system, so you have to expect volatility to collapse. To get that, the world needs to be in better shape than it is right now. Should that unfold, you’ll watch it happen in real-time and can act accordingly.

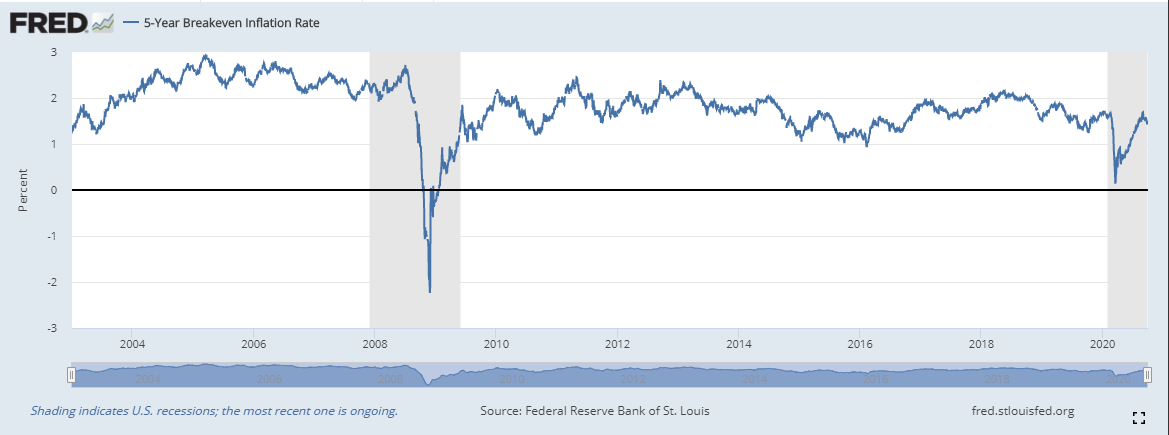

While asset price inflation may occur without headline CPI inflation, the two accompanying each other will be the real catalyst for a much weaker dollar and much higher equities, gold and Bitcoin. To that point, inflation expectations rolled over in September after briefly touching pre-Covid levels, which speaks to the “deflationary on the margin” framework. If elected politicians and their appointed officials are serious about generating CPI inflation, more fiscal is needed now.

Source: St. Louis Fed. As of 9/30.20.

Finally, at the moment US/China relations are on the *relative* back burner. Make no mistake, China will remain a central topic in debates, but actual action by the Trump administration between now and November 3rd is likely on hold. Should Trump be re-elected, it would be my base case that putting the screws to China will be his pet project for the next four years. Should Biden be elected, all bets are off, but directionally the US stance towards China should bend less hawkish.

And so we find ourselves in the middle of all these moving pieces. A number of factors can break one way or another in the coming days, weeks and months that will determine the eventual broad outcome of the situation as a whole, or at least take us to the next chapter of this saga. For now, it’s still all one trade. Should a certain combination of outcome materialize, those correlations may finally decouple.

Market Update – Liquid Crypto Asset Investing

| Symbol | September | August | July | Q3-20 | Q2-20 | Q1-20 | YTD | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|---|

| BTC | -8% | 3% | 24% | 18% | 42% | -11% | 50% | 92% | -46% |

| ETH | -17% | 26% | 53% | 59% | 69% | 3% | 178% | -3% | -75% |

| XRP | -14% | 9% | 47% | 38% | 1% | -10% | 26% | -45% | -94% |

| BCH* | -14% | -12% | 40% | 5% | -1% | 26% | 30% | 30% | -91% |

| EOS | -20% | 5% | 31% | 9% | 6% | -14% | 0% | 0% | -89% |

| BNB | 26% | 12% | 34% | 90% | 22% | -8% | 114% | 123% | 19% |

| XTZ | -33% | 15% | 20% | -7% | 46% | 20% | 63% | 192% | -44% |

| XLM | -23% | 0% | 45% | 12% | 64% | -10% | 66% | -60% | -92% |

| LTC | -24% | 5% | 40% | 12% | 6% | -5% | 12% | 36% | -88% |

| TRX | -10% | 49% | 20% | 61% | 41% | -13% | 97% | -29% | -91% |

| Aggregate Mkt Cap | -9% | 12% | 29% | 32% | 44% | -5% | 80% | 51% | -59% |

| Aggr Alts Mkt Cap | -10% | 27% | 38% | 58% | 45% | 4% | 139% | -1% | -74% |

Source: CoinMarketCap. As of 9/30/20. BCH includes SV.

For the last several months, we have discussed ETH’s outperformance in the context of the explosion of DeFi. Last month, we said:

“The near-term fate of ETH falls entirely on the shoulders of DeFi and yield farming, which have reached full-blown mania. Can yield farming get way wackier from here? 2017 taught us that yes, without a doubt, it can. But the risks are high. The manner in which yield farming has exploded over the last two months is like combining the ingredients of a ponzi, a perpetual motion machine and trans-fee mining all rolled into one scammy cannoli, but with some ingenious mechanism design dusted over the top.”

That bubble saw significant air come out of it in the month of September. The DeFi top, at least in the near-term was put in by the SUSHI rug pull. While a surprising turn events occurred to salvage the project, the damage to the hype and momentum around DeFi was already done. SUSHI traded down 80% in September. The DeFi Index -36%. YFI -33%. COMP -45%. This led ETH to finish -17% in September vs BTC -8%.

This correction was healthy and necessary. The mania surrounding yield farming had reached a fever pitch by late August. Greed was rampant and fear was nowhere to be found. As it does, the market smacked this behavior. That said, all is not lost. TVL continued to make new ATHs in September, despite the strong price correction. This is impressive.

Source: DeFiPulse. As of 10/1/20.

An important new trend skyrocketed higher in September – Wrapped BTC (WBTC). WBTC is an ERC20 contract that represents Bitcoin. It allows Bitcoin to be integrated into the Ethereum ecosystem, including use in DeFi protocols. WBTC has a number of benefits and interesting use cases and furthers BTC’s utility, albeit with an increase in smart contract risk. It’s a trend worth watching closely.

Source: DeFiPulse. As of 10/1/20.

Where does DeFi, and in turn ETH, go in the near-term? It’s hard to say for sure, but my gut says more washout is needed. Many DeFi investors got badly burned in one way or another in September. It’s a fair assumption that simply not enough time has passed since the top for DeFi to immediately resume its strong uptrend in October. There was also an ongoing issue in DeFi where the relative quality of projects was being largely ignored. The most scammy, least likely to drive long-term value accrual projects were pumping just as hard or harder than the DeFi projects with the brightest long-term future. This market behavior is rarely rewarded for long. It would be healthy in the coming couple months to see a bifurcation in price performance of high-quality vs low-quality DeFi names. We’re already seeing that to an extent, and I would expect it to continue.

It is clear to us that DeFi is unlikely to go away entirely any time soon. Many DeFi- focused funds are sitting on massive YTD gains and have raised significant new capital that needs to be deployed. Most of the largest crypto VC funds in the space are actively deploying capital into new DeFi projects. This trend is still in its early stages and should provide a buoy to the DeFi space as a whole in the coming months and quarters.

An important and related question is, if BTC performs well in the coming months while DeFi names broadly stay flat-to-down, what does that mean for ETH’s performance vs BTC? ETHBTC came into September heavily overbought. A good portion of that overbought-ness was worked off in September, but it’s still far from oversold.

Source: TradingView. As of 10/1/20

You could certainly imagine a world where ETH is flattish vs BTC while BTC performs well. There’s good reason to think ETH is broadly over-owned here vs BTC by many in the crypto community, as it has been a large YTD outperformer with a secular DeFi story to go with it. That leads me to believe there is less dry powder to buy the dip on ETH since so many are already long, especially if the wind is coming out of the DeFi sails. Should BTC pull back from here due to any number of macro factors previously mentioned, I would expect ETHBTC to underperform in that scenario.

While the “glass half empty” view of BTC’s recent price action is one of disappointment when compared to ATH’s in both gold and equities, that stance is myopic. While BTC was -8% in September, it made a heroic stand at $10k early in the month.

Source: TradingView. As of 10/1/20.

That defense of $10k came during a period of significant uptick in volatility from traditional asset classes. BTC (red) topped as VIX (inverted purple) bottomed. As the VIX went from 25 to 35, BTC price crashed more than $1000.

Source: TradingView. As of 10/1/20.

BTC price action down in the high $9’s was an all-out battle. Aggressive spot selling and shorting from bears to ram through lower lows with bulls holding the line. There is certainly a state of the world where we get a large fiscal deal passed, macro broadly rallies and BTC never again revisits four digits. We don’t want to jinx it, but if that turns out to be the case, the stand made in early September deserves a medal.

In fact, that successful dogfight at $10k puts BTC at a new record number of days closed above $10k. This has historically been a highly bullish signal. Could $10k really be gone forever?

Source: @jjcmoreno. As of 9/28/20.

Hashrate skyrocketed to new ATH’s in September. No other way to paint this picture other than bullish.

Source: Blockchain.com. As of 10/1/20.

Cross-coin correlation is now nearly five months into a secular downtrend. Healthy.

Source: Coinmetrics. As of 9/30/20.

One final note. I would be remiss to not mention the legal action taken against BitMEX this morning, October 1st, by the CFTC and DoJ. The CFTC alleges BitMEX offered U.S. customers illicit crypto trading services and the DoJ alleges violation of the Bank Secrecy Act concerning KYC/AML regulations. BitMEX Co-Founder Samuel Reed was arrested and is in custody.

For anyone following the situation, this should not come as a surprise. Bloomberg published this article in July 2019, and it was old news even back then. Everyone knows BitMEX has played it fast and loose with regulators for their entire existence. They have had several of the top law firms in the world as counsel for years, and rumors are their legal bills have been exorbitant. Importantly, BitMEX immediately released a statement denying the charges and announcing intention to fight the allegations. Even more importantly, BitMEX immediately began processing withdrawals from the exchange, rather than waiting for their normal once-daily batch withdrawals, so as to alleviate any concerns over customer funds. The exchange is still operating as normal and BitMEX announced no plans to change operations.

Most importantly, price dipped less than 4% on the news and has already bounced meaningfully, down only 2.3% compared to pre-announcement price levels. THIS IS VERY BULLISH PRICE ACTION. Two years ago, this announcement would have sent price down 25%. Bitcoin is growing up and that is welcomed.

Closing Remarks

America, and the world broadly, has undergone significant change in 2020. Covid was The Great Accelerator for many trends that were already in place and those trends continue to reshape our world as we speak. America, and the world broadly, is set to undergo further change about a month from now. I’m not making a call on a specific set of expected outcomes, but we have laid out the key factors at play and the paths that could be taken to arrive at a range of outcomes.

Bitcoin, crypto and DLT broadly require a backdrop of change to achieve mass adoption. By definition, they are contrarian bets. A world where they are widely adopted is a very different world than we live in today. For better or worse, Bitcoin specifically, as a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value, likely requires stress to incentivize adoption. I talk about this often. As an insurance policy against monetary and fiscal policy irresponsibility from central banks and governments globally, Bitcoin requires increasingly egregious irresponsibility to force people to look for an alternative. As the adage goes, if it ain’t broke, don’t fix it. The system needs to break further to compel the implementation and adoption of a fix – a new and better way.

This is why Bitcoiners often come off as doomers or preppers. They are early adopters of the view that the financial system as it currently operates is fundamentally flawed and deeply fragile and thus have become early adopters of a technology that has the potential to fix this flawed and fragile system. That fragility was on display in March of this year as financial markets collapsed before central banks and governments stepped in with unprecedented money printing, which only served to further Bitcoiners’ conviction that eventually this will end poorly and Bitcoin will be left standing.

As we sit today, just over a month away from one of the most divisive presidential elections in US history, the winds of change swirl around us all. With change comes opportunity. The opportunity to make the world a better place. That’s what we’re here for.

“Better to wash an old kimono than borrow a new one”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS