September 2019 - Market Update

/Monthly Update || September 2019

“Risk means more things can happen than will happen.”

Opening Remarks

Greetings from inside Ikigai Asset Management1 headquarters in Marina Del Rey, CA. We welcome the opportunity to bring to you our twelfth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, August was the quietest month for the crypto ecosystem since at least March, amidst a global macro backdrop that is showing increasing signs of instability. Bitcoin’s price declined 5% in August on anemic spot volume – a market structure shift that we initially introduced in last month’s Monthly Update which persisted in August. BTC is now >30% off its highs from June 26th – normal course of business for this volatile asset – but has made a succession of lower highs over the last 2+ months that bears careful analysis, which we’ll dive into deeper below.

For months now, we’ve discussed how the global macro landscape is “weird and getting weirder”. Those conditions were furthered in August. The Argentine Peso collapsed 26% this month. A Danish bank began offering 10-year mortgages at a -0.5% interest rate, meaning you pay the bank back less than you borrowed to buy a house. Siemens issued $1.6bn in bonds with a 0 coupon priced at a -0.315% yield, the lowest yield ever priced for a primary corporate bond offering. Germany issued €824mm of 30-year bonds with a 0 coupon at a -0.11% yield, the first time a Germany 30-year primary has ever priced negative. Other financial instruments are responding to this weirdness accordingly. Gold was +8% in August, reaching a 6½ year high. Silver was +13% in August, breaking out of a multiyear range. A chorus of the most well-respected investors on the planet are sounding the alarm bells. Druckenmiller is worried. Gunlach says the odds of recession before the 2020 election are 75%. Dalio is comparing today to the late 1930’s.

From a Bitcoin-specific perspective, we see compelling evidence to believe we are in approximately the top of the 2nd quarter of a cyclical bull market – an uptrend that will eclipse previous all-time highs by a wide margin in the next 12-18 months. In our view, the #1 risk to halting that Bitcoin bull cycle would be a global risk-off shift in the coming months. We believe that’s the only thing strong enough to stop the BTC train right now. If the VIX goes to 35, BTC price will likely decline significantly. However, should that occur, there is good reason to believe that price decline will temporary, perhaps lasting two months or less. Our main reason for this view is based on the willingness of central bankers to be accommodative with their monetary policy. On September 12, the ECB is expected to pull out a big bazooka of accommodative stimulus. But they’re not the only ones. The whole world is cutting rates and juicing QE. Note the anecdotal headlines.

The market is now implying a 100% probability of a rate cut at every Fed meeting over the next year.

As we’ve stated time and time again, Bitcoin is a hedge against monetary and fiscal policy irresponsibility from central banks and governments globally. It is an insurance policy. The more irresponsibility, the greater the need for that insurance policy. Bitcoin hates QT and loves QE. If there was no such thing as Quantitative Easing, if the Fed’s balance sheet was $800bn (like it was it 2007) instead of $4.5tn (like it is now), the need for a non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value might be lower. But that’s not the world we’re living in.

August Highlights

PBoC Announces Plans to Launch a State-backed Cryptocurrency

Bakkt Receives Final Regulatory Approval for Sept 23rd Launch

Binance Launches Peer-to-Peer Lending on BNB, USDT & ETC

Binance Announces Venus Stablecoin Platform as Competitor to Libra

Libra Facing EU Antitrust Probe

Square Announces $125mm of BTC Bought By Customers in Q2

NY Supreme Court Rules it has Jurisdiction Over NYAG/Bitfinex Case

| Symbol | August | July | Q2-19 | Q1-19 | YTD | % ATH | % Cycle Low |

|---|---|---|---|---|---|---|---|

| BTC | -5% | -7% | 164% | 10% | 157% | -52% | 200% |

| ETH | -21% | -25% | 105% | 6% | 29% | -88% | 106% |

| XRP | -20% | -19% | 28% | -12% | -28% | -93% | -1% |

| BCH | -14% | -20% | 154% | -1% | 73% | -90% | 261% |

| EOS | -25% | -23% | 38% | 63% | 30% | -85% | 109% |

| BNB | -23% | -15% | 86% | 182% | 245% | -14% | 400% |

| XLM | -25% | -20% | -3% | -5% | -44% | -93% | -15% |

| LTC | -34% | -19% | 101% | 99% | 112% | -83% | 181% |

| TRX | -31% | -30% | 36% | 25% | -17% | -94% | 42% |

| Aggregate Mkt Cap | -10% | -11% | 117% | 14% | 98% | -70% | 146% |

| Aggr Alts Mkt Cap | -21% | -19% | 68% | 18% | 27% | -86% | 71% |

A Canary In The Coal Mine?

Last month we talked about July showing a new market structure. This market structure was defined by lower exchange volumes, thin order books, choppy price action and Alt weakness. That market structure was furthered in August, and, as of time of writing, has led us to consider the possibility that a new crypto market regime may be unfolding.

There is a view, shared by legendary investor Jeff Gundlach, that crypto was a canary in the coal mine for risk assets globally in 2017. Risk assets rallied strongly in 2017: NASDAQ was +40%; Emerging Market equities were +30%; worthless Altcoins were +5000%. Crypto peaked first, in late 17/early 18, as the Fed began raising rates and shrinking its balance sheet. Over the course of 2018, as Quantitative Tightening began being implemented globally, one risk asset class after another began rolling over, punctuated by the Q4-18 dumpster fire across the board, including the 50% decline in crypto in mid-November. The S&P 500 bottomed on Christmas Eve, the day before Steve Mnuchin called the “Plunge Protection Team” from Cabo. Risk assets began to rally in January as dovish rhetoric was communicated from central banks globally. The Fed made their dovish capitulation at the end of January and on February 8th, crypto was off to the races, starting with LTC +30%. After all risk assets rallied strongly in the spring and early summer, the world started going risk-off, including crypto topping out on June 26th. For a period of time earlier this year, it looked like BTC was beginning to trade as a safe haven. But over the last month, those correlations have decoupled.

Why has that decoupling occurred? Why did BTC trade with Gold and CNH to a certain point, but has been unable to continue recently? Is it just the summer lull? Will the ECB fire both barrels in September, Bakkt will launch its Bitcoin futures product, and we will be sitting here a month from now with BTC +30%? That is certainly possible. But it is also possible we are gearing up for a very volatile September and October for traditional asset classes, and the crypto market structure shift we have witnessed over the last 6 weeks was the canary in the coal mine – a harbinger for stress that’s right around the corner.

There are a number of places from which stress could emanate and subsequently metastasize across risk assets. Trump would be a good bet for that, and he’s certainly gone from bad to worse as of late.

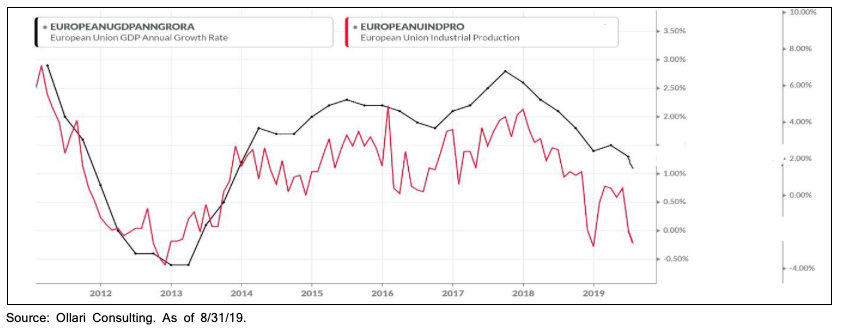

But, it’s not just the instability of our President in the context of China trade wars and the Fed’s monetary policy. Growth around the world is slowing down and people are worried.

If traditional asset classes are indeed gearing up for pain in the coming months, how is that showing up in crypto?

Anemic volumes.

Particularly spot volumes.

Bitcoin has now begun forming a multi-month descending triangle pattern, causing flashbacks to 2018’s price action.

As mentioned earlier, a further collapse, say to the $4k-$5k range, would be at odds with where we are in BTC’s bull cycle. Essentially all the multiyear analysis of BTC’s history points to us not correcting to those levels at this time, but instead moving higher. Something would need to go VERY wrong for BTC to see that type of crash. But if the VIX goes to 35, that could indeed happen.

We believe a higher likelihood outcome could be a short-term, further correction down to the $7.5-$8.5k range. This would still be within the range of historical pullbacks in an overall cyclical uptrend for BTC when looking at past cycles.

To be clear, if it weren’t for this market structure shift we’ve witnessed over the last 6+ weeks, we would place a higher likelihood on BTC having a strong performance on deck for September. Gold, Silver, Copper/Gold, Oil/Gold, CNHUSD, JPYCNH, Yields, 2s10s, et al are telling you that there are problems in the world. If BTC had continued to trade with Gold and CNH over the last month, we would be approaching new ATH’s. Instead BTC has decoupled as risk has increased. It would be unwise to blindly ignore that.

We still believe central banks are going to be highly accommodative with their monetary policy. The ECB will lead the charge with increasingly more exotic forms of QE. The Fed is behind the ball right now, but we believe they will catch up – the yield curve is certainly telling you they will. So, it is our base case that stress in traditional markets, should it increase in the coming months, will be assuaged by helicopter money from around the world. Bitcoin is a risk asset. But it is a risk asset with a certain set of investment characteristics that become increasingly more attractive the more irresponsible monetary and fiscal policy becomes. From this lens, the overall outlook is exceedingly bright, even if there are hiccups in the near term.

Market Update – Liquid Crypto Asset Investing

After pulling back 7% in July, BTC price declined an additional 5% in August, ending up 30% off the highs from June 26th. August saw a 28% unabated rally to start, which actually began the last day of July and topped out at $12.3k on Aug 6th, before pulling back the rest of the month to end in the exact same spot it was at on July 29th. As previously mentioned, this was on anemic spot volume. Levered trading on BitMEX drove the majority of price action in August - a good recipe for chop. One thing we now know to be true, without significant direction either way from spot buying/selling, levered traders can push price $2,000 in either direction based on nothing more than positioning.

After a bad July, Alts again fared meaningfully worse than BTC in August – with the Aggregate Alt Market Cap declining 21% on the month. That puts Alts up 27% YTD vs BTC +157%. The Alt landscape is barren, and that is disappointing. When I jumped headfirst into this space in summer 2017, ETH couldn’t scale and there were 15+ “Ethereum killers” coming to eat ETH’s lunch. Since then, a tremendous amount of financial and human capital has been poured into smart contract platforms. Several of those “Ethereum killers” never launched. Several more still haven’t launched and appear to be floundering at best. Here we are two years later - ETH still doesn’t scale and doesn’t have much of a viable plan to do so (the execution risk on Eth 2.0 is tremendous, and a multiyear timeline at best). And, the only thing worse than ETH network activity statistics, which are abysmal, are ETH’s competitors’ network activity statistics, which are nearly nonexistent.

I don’t come from a tech background. So I don’t have a great frame of reference for gauging what the appropriate pace of development for these projects should be. I know this stuff is hard. I know regulatory uncertainty has been a hindrance. But why can’t hundreds of millions of dollars and hundreds of thousands of developer manhours produce anything the world actually cares about?

There are many use cases for DLT. But simply, when evaluating each of those use cases and the projects bringing them to market, we ask ourselves:

1. How ready is the tech for the world?

2. How ready is the world for the tech?

3. What do you need decentralization for?

4. How decentralized is decentralized enough?

Money, and specifically SoV, is the killer app for DLT right now. Bitcoin ACTUALLY WORKS. And it’s apparent the world needs a non-sovereign money now. The rest of the use cases we find compelling have a harder time answering those four questions in a way that leads us to the conclusion that we need to be long now. We believe smart contracts as a use case for DLT is compelling and one-day smart contracts will be ubiquitous. We believe gaming is a compelling use case. We believe prediction markets are a compelling use case. But when answering those four questions, it’s not clear that now is the time. And when looking at the current landscape of crypto assets that aim to deliver those use cases, it’s not clear any of the existing projects have clear cut answers to those four questions.

The good news for Ikigai is that we have courtside tickets to this basketball tournament. We’re not sure which team is going to win yet. The team(s) that end up as winners may not have even been born yet. But we have our finger firmly on the pulse of this ecosystem. We know what to look for and we believe we’ll know it when we see it. That’s a key part of our value proposition here.

Case-in-point, a look at Alt performance vs BTC in the 2017 run-up and subsequent collapse. Note the log scale – so Alts have generally lost 90-99% of their value relative to BTC.

We got a lot of questions about IEO’s earlier this year. We get a lot less now. And for good reason. This is relative price performance of Binance IEO’s vs BTC since listing. Note the price here starts at the first traded price, which is typically meaningfully higher than the price Launchpad participants actually paid in the IEO. Even so, this is ugly.

Bitcoin has collapsed after a parabolic advance (increasing at an increasing rate). That is to be expected. Fibonacci Retracements are helpful in determining areas to expect a bounce. Depending on how you draw the lines, we have not yet closed below the 23 Fib. If that level breaks, which right now feels reasonably likely, it opens the door for the 50 Fib in the low $8k’s. That could be a good level to expect a bounce. We believe a sustained pullback to levels lower than that would only come with a significant pickup in stress in traditional asset classes, which as we mentioned, is on the table.

We have written previously at length about the aggressiveness of the move off the bottom early this year - the historic nature of that velocity. We talked about why there’s good reason for that to be the case this time around relative to prior cycles. But the below chart shows the 21-week EMA during the last bull cycle. Note the multiple touches along the way during the prior bull run of 2016/2017. This view also supports lower prices from here, into the high $8k’s with a wick potentially lower.

Another view that this correction is still within normal course of business for a BTC bull cycle, as shown by the monthly RSIs plotted, using a color gradient. Where we are right now looks a lot like mid-2016.

Bitcoin has had consecutive negative monthly returns twice during previous bull cycles. It has never had three in a row during a bull cycle.

After a series of higher highs during the runup in the spring, realized volatility peaked with price and has collapsed lower to the bottom of the range.

As we have been saying for several months, on-chain metrics look pretty bad. August helped a bit but not much. Market prices appear to be too high relative to on-chain activity. We have discussed this relationship at length, so you know we believe there is good reason for this to be occurring - an increasing price that is outpacing an increase in network activity. But, it’s still worth closely monitoring. This is a publicly available example of this.

Cross-coin correlation remains in a healthy range.

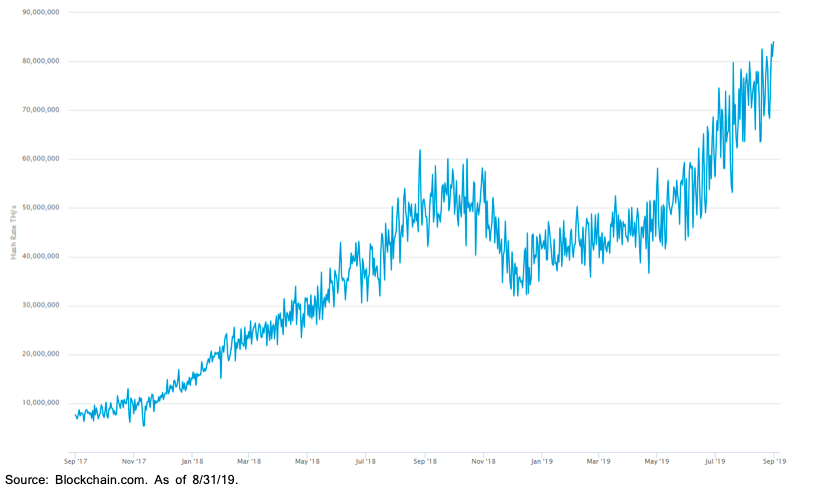

Hashrate continues making new ATH’s. We are witnessing an increasingly more secure network. This is bullish.

Another way to look at hashrate is through the lens of difficulty. Below is the Difficulty Ribbon, a series of moving averages of difficulty. Every time you’ve seen a compression of the ribbons, it has been a great buying opportunity. This is an example of a long-term analysis telling us we still have a lot of room to run to the upside.

Closing Remarks

The crypto market pulled back again in August, with Alts performing much worse than BTC. Anemic spot volumes and thin order books were the hallmarks of August, just as they were for the back half of July. This has led us to pay close attention to this new market structure and acknowledge the possibility that a new market regime is taking hold. This new market regime could be a canary in the coal mine for traditional asset classes, which have the potential to see significant stress in the coming months.

If traditional markets end up relatively subdued, BTC could end up having strongly positive price performance in the coming months. Specifically, ECB accommodation + Bakkt is exactly the backdrop you’re looking for to take prices higher. But even then, risks remain high. For example, we continue to view Bitfinex/Tether as a significant source of potential risk - hard to gauge, but potentially systemic.

Our goal at Ikigai is to generate attractive risk-adjusted returns for our investors. Risk management is of paramount importance here. Crypto is an inherently risky asset class but has historically produced compelling returns that justify exposure to the risks present. Even within that setup, the relationship between risk and potential returns ebbs and flows. There are periods when risks are higher than others and we believe now is one of those times. Especially close attention needs to be paid during these periods because in crypto the risk factors can swing meaningfully on a dime. That’s our job here.

“The gods just laugh when men pray to them for wealth.”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

Invest

Ikigai is currently fielding interest from new investors. Contact us to see if you qualify.

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Timothy Lewis, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2019 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS