September 2020 - Monthly Market Update

/Monthly Update || September 2020

“Bidding more for something is the same as saying you’ll take less for your money.”

Announcement: Ikigai Performance Update

Today is the one-year anniversary of Programmatic Discretionary. Over the last year, the vast majority of our AUM has been deployed into this strategy. It is a BTC-only strategy (for now), which is to say Ikigai has had limited exposure to Alts over the last year and is not actively investing in venture equity or newly-issued tokens. Programmatic Discretionary rarely uses leverage and when it does, it is conservative and for short periods of time. We think the results speak for themselves: Ikigai’s fund has significantly outperformed holding BTC over the last year through systematic exposure to BTC using limited leverage (2). We’re really proud of that.

Ikigai Value Proposition

We launched Ikigai in December 2018 as a long/short, multi-strategy crypto hedge fund. When the fund initially launched, we took a “quantamental” investment approach, and we considered the Top 150 cryptos by market cap as our investable universe. In June 2019, we began evolving our investment process and narrowing our focus. The result of that evolution was the strategy we call “Programmatic Discretionary”.

Programmatic Discretionary is systematic, models-driven exposure to BTC utilizing limited discretion. The goal of Programmatic Discretionary is to outperform BTC through-cycle on a risk-adjusted basis. BTC has a tendency to go up a lot and then pull back a lot. If you can build a strategy that can consistently catch the meat of the big up moves and avoid or profit from the meat of the big down moves, that compounding effect leads to massive outperformance vs just passively holding BTC, while lowering risk exposure.

We believe this is an outstanding risk-adjusted way to get exposure to crypto. In many ways, Bitcoin is still a binary bet. There are many ways in which Bitcoin could still fail, but if it works the price will be many multiples higher than it is today. As such, we believe a long BTC position is a fantastic risk/reward. But we also believe the results of Programmatic Discretionary over the last year make a compelling case that Ikigai can participate in the lion’s share of big up moves while avoiding or profiting from big down moves - removing the binary nature of a passive BTC long position.

To be clear, we’re not BTC Maximalists. None of this crypto stuff has been done before. So if you’re building a firm, a culture, and an investment engine without prudent flexibility, adaptability, and growth as pillars, you’re eventually going to fail. It’s not that we’re married to BTC. BTC could very well be Ask Jeeves and we haven’t seen Google yet. But BTC has presented us with quantitative data and a market structure that we can extract meaningful alpha from right now through our Programmatic Discretionary strategy. If/when that changes, our investment process will allow us to see that early and we’ll adapt along with the new market opportunity. The benefit of having greater than 99% of our portfolio in liquid crypto assets is we can change our mind at a moment’s notice. In a world as dynamic as this one, we want to be able to change our mind quickly.

We have grown our AUM considerably in the last six months and are actively accepting new subscriptions from accredited US and international investors. Click the link below if you’re interested in investing with Ikigai. And now, on to the main event!

Opening Remarks

Greetings from inside Ikigai Asset Management (1) headquarters in Marina del Rey, CA. We welcome the opportunity to bring to you our twenty-fourth Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that we believe will fundamentally change the world and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to help the world better understand the powerful potential of DLT and crypto assets, and to fund and be an ambassador for DLT projects that will change our lives forever.

To that end, the month of August brought significant advancements in a number of the global macro factors we have discussed here for the last several months, and which we will once again examine today. With that dynamic backdrop, Bitcoin booked a modest 3% monthly gain while DeFi, and in turn ETH, reached a full fever pitch. We’ll dive into that here as well.

The pace of positive crypto-specific news flow remained elevated in August. If you’re neck deep in all of this every day like we are, it’s easy to lose sight of just how much progress our ecosystem has made with regards to its outward appearance to the “real” world-

Public companies are buying $250mm of Bitcoin on their balance sheet in lieu of holding cash.

A woman named Crypto Mom is a commissioner of the SEC.

GBTC’s market cap is more than $6bn.

FDIC-insured banks are now allowed to custody crypto.

Many of the largest fintech companies are active in crypto. Many more are ramping their involvement in the space in real time.

CME Bitcoin futures open interest nearly reached $1bn.

Tether moves more value than Paypal.

Every central bank in the world is thinking hard about launching its own Central Bank Digital Currency. Many are already working on it.

Gold broke out to new all-time highs.

The “digital gold” narrative of Bitcoin has never been stronger.

And that’s just a part of what crypto is doing on the main stage!

Off on the side stage broadly labeled DeFi, there’s breakneck innovation. Truly fantastic mechanism designs. Turbocharged network effects. Interest levels are rabid, and returns are astronomical. It’s high risk to be sure, but the sheer excitement is something we haven’t seen in nearly three years. It remains unclear to us at the moment exactly what will come of DeFi that can stand the test of time, but the likelihood the answer is “nothing” is diminishing by the day.

Whether examining crypto on the mainstage of global presence or the side stage of innovation, there’s a lot to be excited about. That increase in excitement is palpable for those of us doing this every day. We’ve seen it before. It comes in waves. Several of those waves in the last two years have ultimately ended in disappointment for this ecosystem. That prior disappointment has caused many of us to develop a Pavlovian response – to want to “fade your emotions”. The four most dangerous words in investing are “this time is different”. Yet, this time is undoubtedly different, for all the reasons I mentioned above and many more. As always, we remain patient, objective, vigilant, and flexible. And excited. We’re excited too.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international and qualified accredited U.S. investors. Contact us to see if you qualify.

August Highlights

MicroStrategy Buys $250mm of Bitcoin, First Public Company to Do So

SEC Confirms “Crypto Mom” Hester Peirce As Commissioner Through 2025

FTX Acquires Blockfolio for $150mm

Square Reports Record $858mm of BTC Purchased in Q2 Via Cash App

Grayscale Reports Record $751mm of Inflows into GBTC in Q2

Coinbase Begins the Process of A Direct Listing IPO

Digital Currency Group Commits $100mm for North America Bitcoin Mining

IRS Releases Memo Saying Crypto Payments for Microtasking Is Taxable

Tether Daily Value Transfer Tops Paypal

Coinbase to Offer Bitcoin-Backed Loans to US Customers

Fed Partners with MIT to Develop “Hypothetical Digital Currency”

Goldman Hires New Head of Digital Assets, Contemplates Stablecoin Plans

USPS Files Patent for Blockchain-Based Secure Voting System

| Asset Class | August | July | June | May | April | March | Q2-20 | YTD | Instrument |

|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 3% | 24% | -3% | 9% | 34% | -25% | 42% | 62% | BTC |

| NASDAQ | 11% | 7% | 6% | 7% | 15% | -7% | 30% | 39% | QQQ |

| S&P 500 | 7% | 6% | 2% | 5% | 13% | -13% | 20% | 8% | SPX |

| Total World Equities | 6% | 5% | 3% | 5% | 10% | -15% | 19% | 3% | VT |

| Emerging Market Equity | 3% | 8% | 6% | 3% | 7% | -16% | 17% | -1% | EEM |

| Gold | 0% | 11% | 3% | 3% | 7% | 0% | 13% | 29% | GLD |

| High Yield | 0% | 5% | -1% | 2% | 4% | -10% | 6% | -3% | HYG |

| Emerging Market Debt | 0% | 4% | 3% | 6% | 4% | -15% | 13% | -1% | EMB |

| Bank Debt | 1% | 1% | 0% | 2% | 3% | -7% | 4% | -4% | BKLN |

| Industrial Materials | 6% | 8% | 5% | 4% | 1% | -10% | 10% | 4% | DBB |

| USD | -1% | -4% | -1% | -1% | 0% | 1% | -2% | -5% | DXY |

| Volatility Index | 8% | -20% | 11% | -19% | -36% | 33% | -43% | 92% | VIX |

| Oil | 5% | 4% | 8% | 35% | -43% | -55% | -17% | -70% | USO |

Source: TradingView. As of 8/31/20.

Monetary Policy Goes Brrr Forever, But What About Fiscal?

For the last two Monthly Updates, we unpacked critical large macro factors that are currently advancing in various directions. If you haven’t read either of those Monthly Updates, you can read them here. To be honest, we weren’t planning on keeping the big picture discussion centered around these themes for three months in a row, but they’ve proven to be useful frameworks for organizing the big moving pieces. If you nail a handful of these factors, you’ll probably nail the trade too. The specific factors were:

Inflation/deflation

US/China relations

Fed balance sheet expansion

Fiscal stimulus

Gold

Stock market weirdness

Pace of economic recovery

Coronavirus

The 2020 Presidential election

Technology in Macro

Social unrest

We’re going to give brief updates on each of these. Last month we discussed each of these in the context of dollar weakness. We’ll touch on that again here.

If you’ve been following along, you know I’ve been posting this chart and talking about how “it’s all one trade”. Welp, it’s still all one trade.

Source: TradingView. As of 8/31/20.

Inflation expectations have now fully recovered to pre-Covid levels. That’s an impressive push.

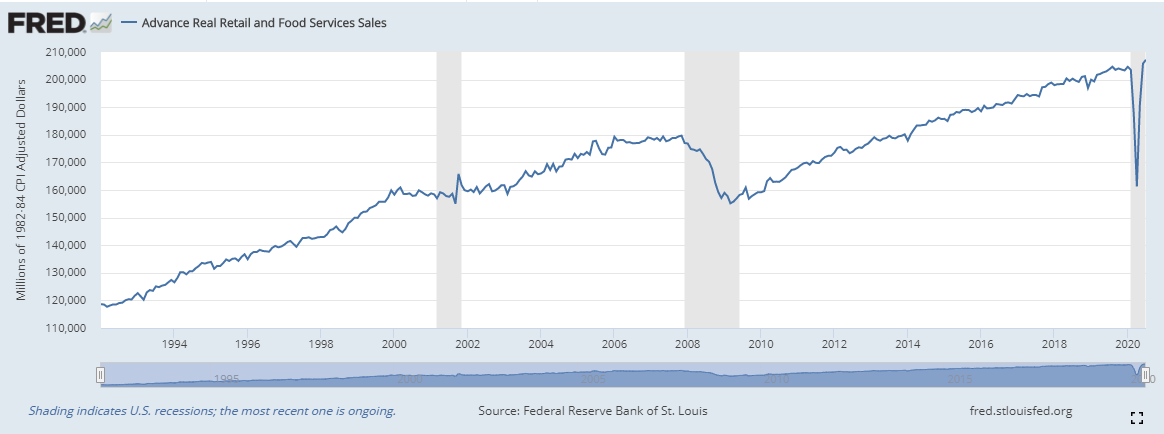

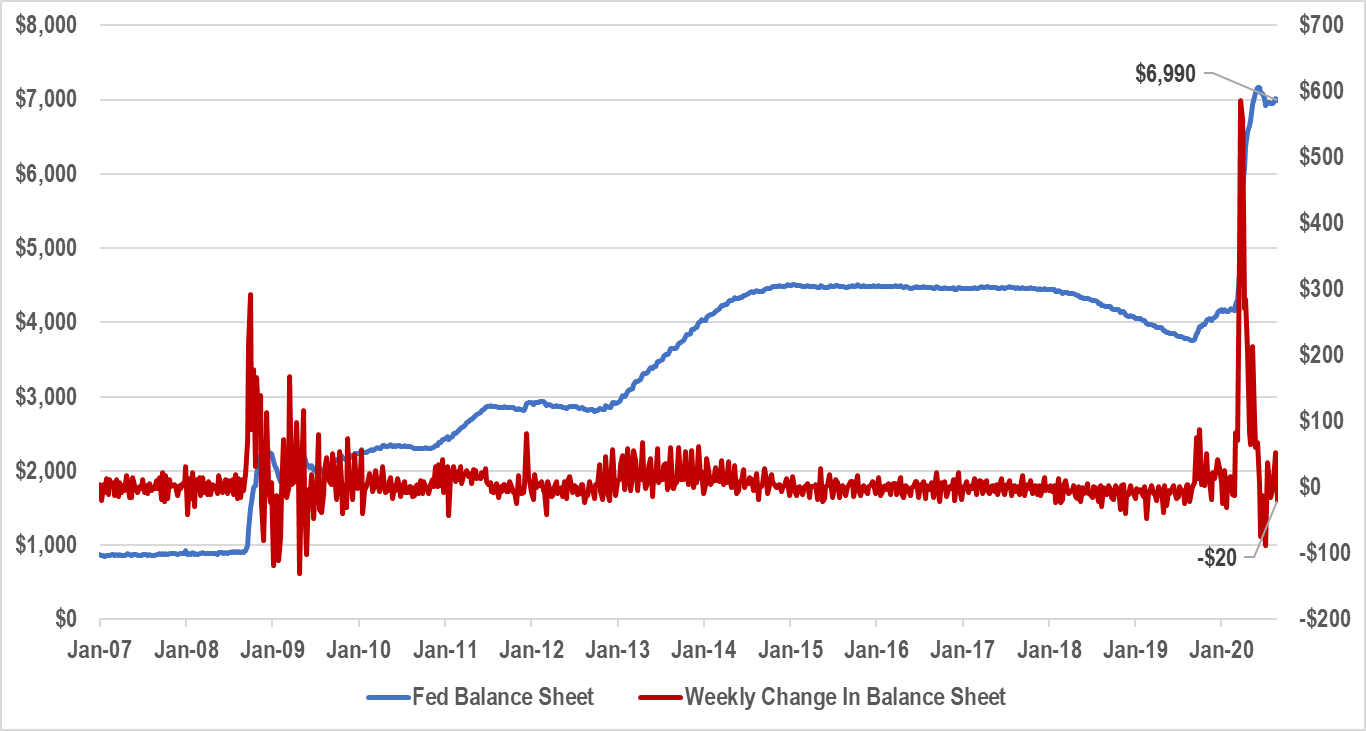

Why? How? Because when the government gives you money and you don’t have to pay rent, you spend the money.

Especially when the government gives you more money than you had when you had a job.

Because without that money from the government, the economy would be in the sharpest contraction in 60 years.

And one more, just to drive home the point. One of these is not like the other.

As of August 2020.

Where inflation goes from here is a function of fiscal policy. We’ll get to that in a second.

US/China Relations

After months of increase, the tension of this situation remained about constant in August, albeit at high levels. Trump seems to pick up the fight in this battle from time to time as he sees fit, and he likely had other battles to primarily tend to in August. Nowhere is Trump’s “Art of the Deal” more clearly on display than in US/China relations and moves like the statement below are strongly reminiscent of the tactics described in that book.

Source: LiveSquawk. As of 8/24/20.

If Trump thinks he can use China to help him win in November, rest assured he’ll crank this situation up to full blast in the next two months. China is likely to be one of the top 5 talking points in the debates. You’ve already seen it plenty at the RNC. Trump will paint Biden as weak on China and will use hawkish China rhetoric as a rallying cry for his base. We may see nothing more than talk on this front in the next two months. If a Trump second term occurs, I would expect that rhetoric to shift to action. If Biden wins, all bets are off with what his administration will do in this relationship.

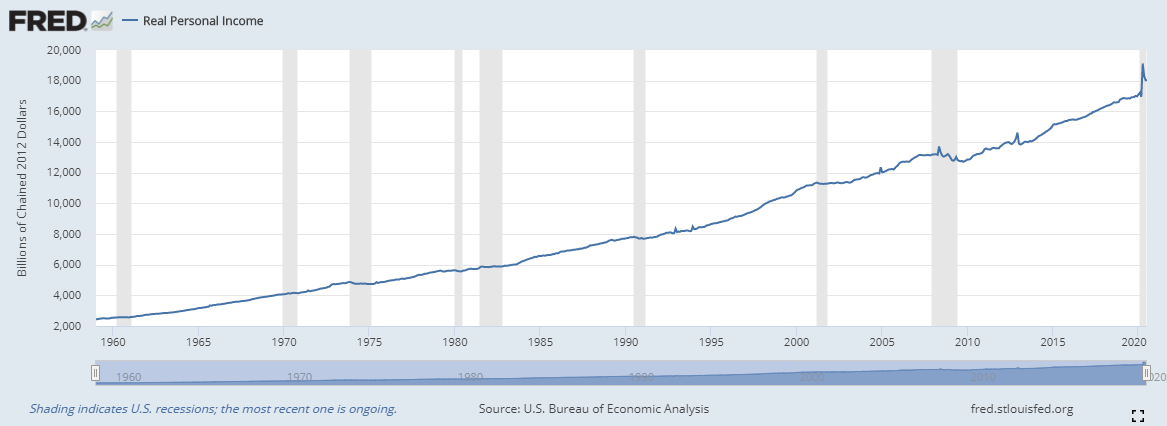

Fed Balance Sheet Expansion

Fed Balance Sheet growth has paused for now, albeit at astonishing levels.

Source: FRED. As of 8/26/20.

At his Jackson Hole speech on August 27th, Powell gave broad assurance monetary policy would remain exceedingly accommodative for years to come. To be fair, the market had mostly already priced that in. Powell wants inflation to run hot, to make up for the chart below.

Source: Ollari Consulting. As of 8/28/20.

Powell made his most pointed comments to date about avoiding “Japanfication” at all costs. The Phillips Curve (the inverse relationship between inflation and unemployment) is retired until further notice. The market knows the Fed will be there. And if they need to get weird, they’ll get weird. If something they’re doing isn’t quite exotic enough, they’ll tweak it. If the rest of the world (ex China and Russia) needs help, they’ll help them.

So what else does the market want from the Fed? The market knows the Fed can’t generate CPI inflation. Treasury and Congress can do that. All the Fed can do is generate asset price inflation. When I say “it’s all one trade”, that’s what I mean. It’s all one trade.

Source: Lohman Econometrics, bloomberg As of 8/12/20.

The Fed needs very low interest rates and a weak dollar. The interest rate side of things it has complete control over (for now). This line goes more or less where the Fed wants it to (for now).

Source: Tradingview. As of 8/31/20

Dollar weakness they have less control over, but rest assured they’re doing their part. Congress and Treasury need to do their part too. Is the DXY going a bit lower? Sure, maybe. Is it going a lot lower? Less likely, but maybe. But if it does, it will likely be because of a lot of fiscal stimulus.

Source: Tradingview. As of 8/31/20

All this monetary expansion and still not enough inflation. But it does explain the DXY, which is composed of 58% EUR. Lagarde better catch up!

Source: As of 8/17/20.

Fiscal Stimulus

Congress broke for summer break without a fiscal deal. The Dems wanted $3.4tn, Republicans “only” wanted $1tn. It wreaks of political theatre. Market expectations are probably at $1.5tn, to get done by end of September. To the extent the deal is more or less than that, asset prices may respond with disappointment or excitement. If it looks like Congress is going to play the politics card and block a deal into the November election, there’s a good chance markets will hate that. That would be equities down, oil down, gold and silver down, Bitcoin down, VIX up, DXY up. It’s a risk worth watching carefully.

Importantly, Powell can’t make his message any clearer – we need fiscal stimulus to generate inflation. That message may or may not make it through the political machine in DC and into actual legislature. But what is likely clear to all politicians is that social unrest sits on the brink of chaos. Fiscal stimulus can likely placate that. Politicians these days are known for doing the easy thing, so it’s a good bet that’s what they’ll do.

Gold

In August, gold rocketed past new ATHs to briefly over $2000 before pulling back from deeply overbought levels and consolidating above previous ATHs. At a glance, this chart wants higher.

Source: Tradingview. As of 8/31/20.

What this monthly line chart skips entirely is the intra-month volatility we saw in precious metals during August. See the chart below of silver. That 15% pullback is a big move in a short amount of time for an element of the periodic table. That said, we’re already back knocking on the door of higher highs.

Source: Tradingview. As of 8/31/20.

The precious metals trade is primarily predicated on negative real yields. That requires the Fed and Congress to act exceedingly dovish in concert with their monetary and fiscal policy. Right now, it appears the market is pricing in that plenty of fiscal will be coming. If that doesn’t materialize, gold will likely pull back. BTC may very well pull back with it.

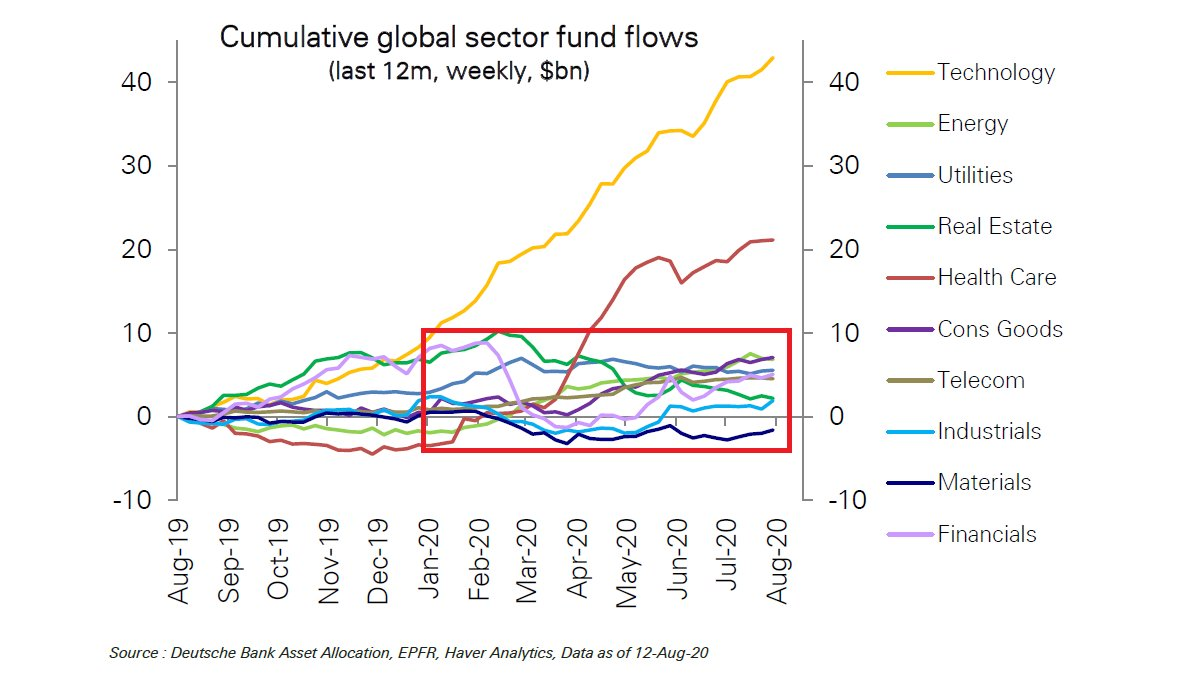

Is the gold trade crowded? Well, I believe it’s a fraction as crowded as Big Tech. But then again, it’s all one trade, right? And as of August, it’s now crowded with Warren Buffett, who bought $500mm of Barrick stock. For the times, they are a changin’.

Stock Market Weirdness

This is another major global factor continuing to go bananas. You see it in TSLA.

Source: @charliebilello

You see it in put/call ratios.

As of 8/25/20

You see it retail traders.

Source: @The_real_Fly

You see it in breadth, or rather lack thereof.

As of August 2020.

You see it in Big Tech, with APPL’s market cap exceeding the ENTIRE Russell 2000. Wait, what?

Source: Zerohedge. As of 9/1/20

And you may just be starting to see it in SPX/VIX divergence, a rare but important signal.

Source: TradingView. As of 8/31/20

Equities are vulnerable here. Their price levels are divorced from underlying economic health to a degree never before seen. Could it keep going from here? Absolutely. Will that require a lot of these other factors to thread the needle of bullishness in the coming weeks and months? Yes it will. Could that happen? Certainly. Would a 10% correction from here be healthy? Undoubtedly. What could cause that? No fiscal stimulus is a good bet. A meaningful uptick in social unrest is another good bet.

With all the exuberance in the face of so much uncertainty and potentially negative outcomes, it’s my bet we’ll see this chart higher in the next two months.

Source: TradingView. As of 8/31/20.

Pace of Economic Recovery

From some perspectives, it’s actually looking pretty good.

Source: Ollari Consulting. As of 9/1/20.

This is a real bounce and above the consensus expectations.

Source: As of 9/1/20

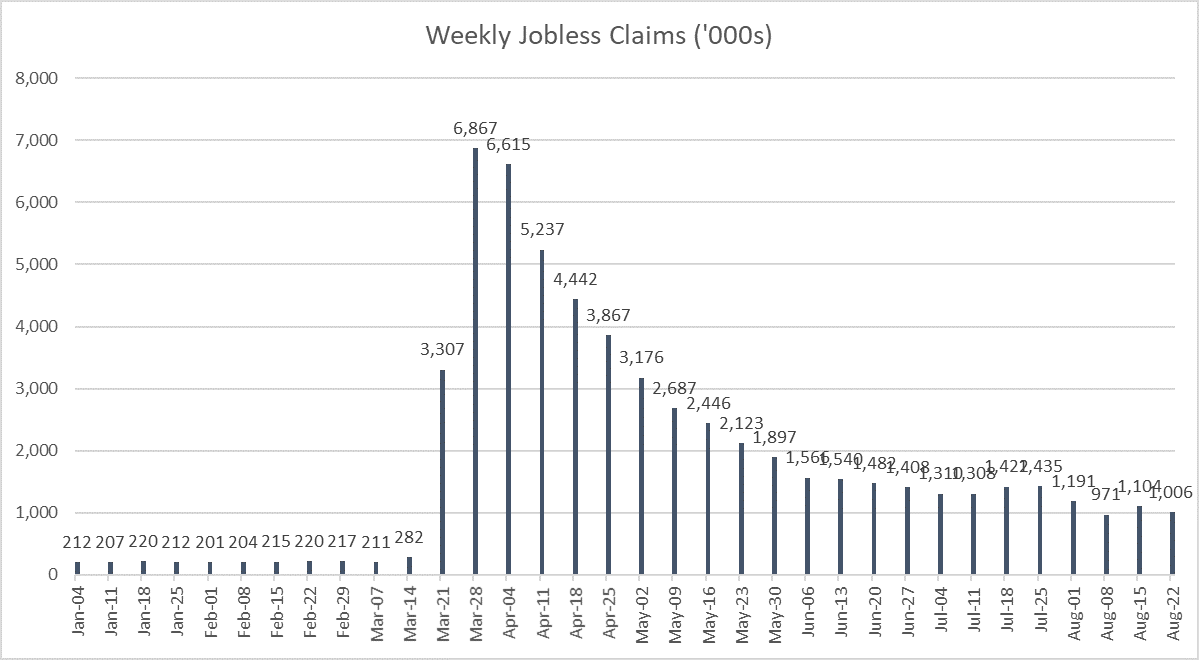

And yet from other perspectives, we’re a long way from out of the woods. New jobless claims appear to be flatlining.

Source: FRED. As of 8/27/20

But flatlined at a level about 5x pre-Covid.

Source: FRED. As of 8/27/20.

Economic sentiment doesn’t match the stock market.

Source: Ollari Consulting. As of 8/27/20.

Lots of people and lots of business aren’t paying rent. It’s not clear where many of them will get the money to ever repay the back rent owed.

As of August 2020.

At this point, the US government knows what they need to do. A lot more fiscal to take care of the 1mm new jobless claims per week. Tax breaks for all businesses. More loans to small businesses. Bailouts for real estate. Bailouts for municipalities. If they throw the kitchen sink at the problem and the US doesn’t go into another full-blown lockdown during a likely inevitable second wave, we may be able to climb out of this hole. There’s a lot of risk in that setup at the moment though.

Coronavirus

US has cases heading in the right direction.

Source: CDC. As of 9/1/20.

Deaths look less good but still >50% off the highs.

Source: CDC. As of 9/1/20.

Still other countries are struggling as much now as at any point in the last six months.

Source: CDC. As of 9/1/20.

Much attention has been paid to a potential vaccine and Trump has dangled this carrot to the market multiple times over the last several months. If a vaccine makes it out of FDA trials in the next two months, Trump will undoubtedly wave that flag to help swing the election, but it’s not my base case that a vaccine will have any significant impact on the US’s approach towards Covid in 2020 and I’m definitely not holding my breath that will get one before the election or even any time at all. Friendly reminder that if we do get a vaccine, it will be the first one ever for a coronavirus.

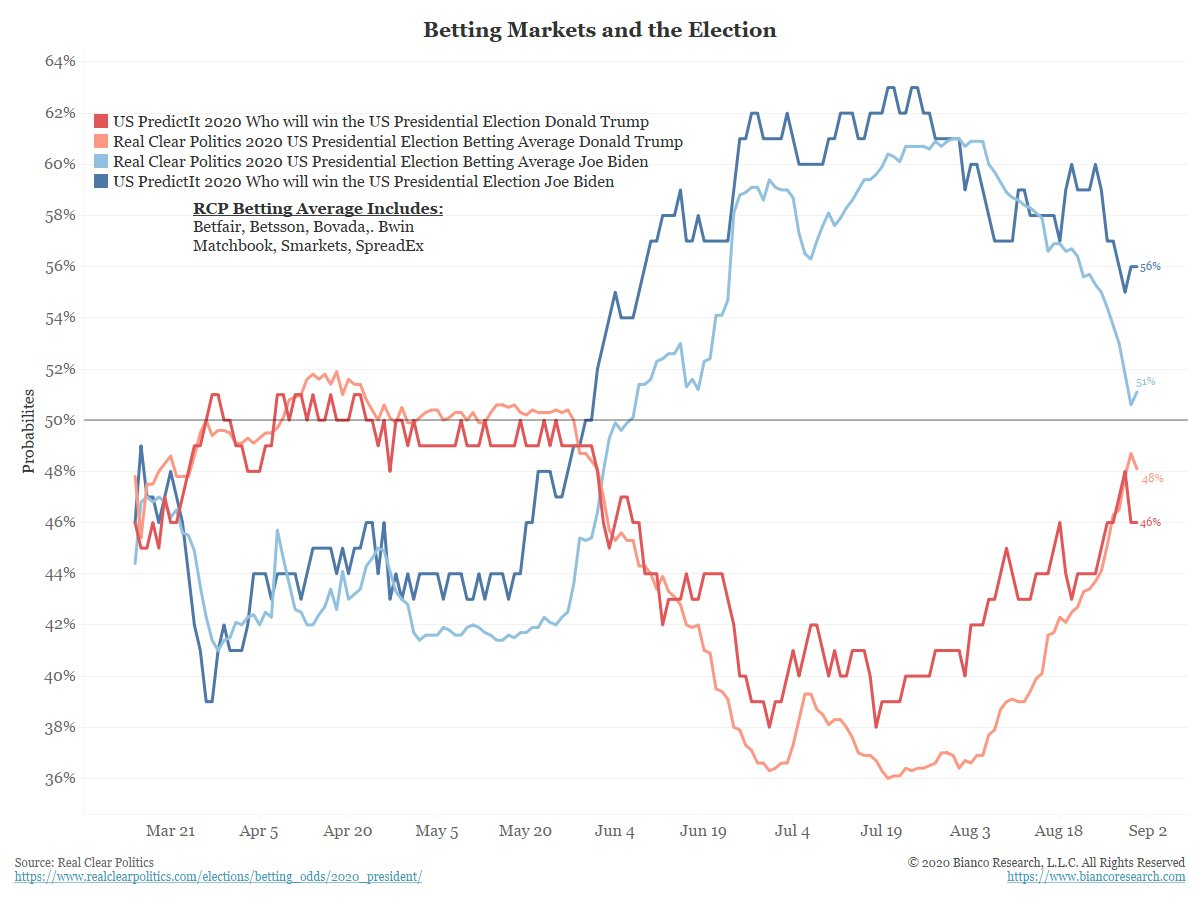

The 2020 Presidential Election

This factor has probably swung the most the last month. A picture tells a thousand words.

Source: real clear politics. as of August 2020.

After losing control of the narrative on the back of the Black Lives Matter protests across the nation, Trump appears to have rapidly moved back into the driver’s seat. The ravaging of Kenosha, WI may end up playing a pivotal part in his re-election.

Technology in Macro

The #StopHateForProfit campaign has waned in prominence, but Technology continues to hold a major spot on the global macro stage. In August, it was the US threatening to ban TikTok, forcing Chinese parent company ByteDance to scramble to try and get a sale of its US business to a US company. There are currently multiple parties bidding for TikTok US, including the unlikely bedfellows of Microsoft and Wal-Mart. In the meantime, in typical Zuck fashion, Instagram launched a virtually identical new feature called Reels in its platform to compete with TikTok. Additionally, two other tech giants clashed in August as Fortnite maker Epic Games had its Apple App Store account terminated over a legal battle involving in-app payments.

Both of these issues have, at their core, questions around data privacy and centralization – two factors that reside squarely in the realm of Distributed Ledger Technology and crypto assets. As long as these issues remain at the center of large-scale public debate, it keeps eyes peeled for viable alternatives.

Social Unrest

In August, Kenosha took the center stage and it was as ugly as anything we’ve seen to-date.

It is highly likely social unrest will increase into the elections and if Trump wins, will likely escalate further post-election. What started as primarily peaceful Black Lives Matter protests were quickly hijacked by Antifa and pushed into ugly looting and rioting. The BLM message, which many Americans support, has been overshadowed by anarchy and thuggish behavior, which very few Americans support. This has allowed Trump to regain control of this situation in the court of public opinion and use it to his advantage in the election, rather than have it work against him. In that way, the actions of the people most hellbent on getting Trump out of office are actually driving an increase in the likelihood he will remain there.

Should Trump win in November, what happens next with social unrest will be pivotal. Will checks in the mail placate the masses? Will enthusiasm for the cause collapse under the weight of “four more years”? What is the stamina of the people who are most upset with a system un the United States that is broadly working for fewer and fewer people? The answers aren’t clear, but they are important. After all, that’s what we’re actually here for. If money worked fine the way it is now, we wouldn’t need a non-sovereign money. If institutions weren’t failing so pervasively at so many levels, the Trust Revolution wouldn’t be so utterly necessary. But that’s not the world we’re living in. We’re trying to build something better. Someplace better.

“It’s All One Trade”

Last month we said, “it’s all one trade and the trade is crowded”. That’s still true. The market, through DXY, equities, yields, VIX, precious metals and BTC are pricing in a certain combination of events happening across multiple major macro factors. Could all those needles be threaded in the coming weeks and months? Sure, it’s possible. But the market is pricing in a lot already, so the risk of a partial reversal to all of this remains elevated. But it won’t happen without a significant development in one or more of the factors we’ve just discussed. Overall, my gut says the rumors of the dollar’s demise have been greatly exaggerated.

Source: Tradingview. As of 9/1/20.

MARKET UPDATE – LIQUID CRYPTO ASSET INVESTING

| Symbol | August | July | Q2-20 | Q1-20 | YTD | Q4-19 | Q3-19 | Q2-19 | Q1-19 | 2019 | % ATH |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 3% | 24% | 42% | -11% | 62% | -13% | -23% | 164% | 10% | 92% | -41% |

| ETH | 26% | 53% | 69% | 3% | 236% | -28% | -38% | 105% | 6% | -3% | -69% |

| XRP | 9% | 47% | 1% | -10% | 46% | -25% | -35% | 28% | -12% | -45% | -92% |

| BCH* | -12% | 40% | -1% | 26% | 53% | -3% | -47% | 154% | -1% | 30% | -89% |

| EOS | 5% | 31% | 6% | -14% | 25% | -13% | -49% | 38% | 63% | 0% | -86% |

| BNB | 12% | 34% | 22% | -8% | 69% | -13% | -51% | 86% | 182% | 123% | -6% |

| XTZ | 15% | 20% | 46% | 20% | 141% | 49% | -3% | -12% | 129% | 192% | -16% |

| XLM | 0% | 45% | 64% | -10% | 115% | -26% | -41% | -3% | -5% | -60% | -90% |

| LTC | 5% | 40% | 6% | -5% | 48% | -26% | -54% | 101% | 99% | 36% | -84% |

| TRX | 49% | 20% | 41% | -13% | 120% | -8% | -55% | 36% | 25% | -29% | -89% |

| Aggregate Mkt Cap | 12% | 29% | 44% | -5% | 98% | -14% | -29% | 117% | 14% | 51% | -55% |

| Aggr Alts Mkt Cap | 27% | 38% | 45% | 4% | 167% | -16% | -40% | 68% | 18% | -1% | -71% |

Source: CoinMarketCap. As of 8/31/20. BCH includes SV.

BTC’s +62% YTD performance, while outpacing all major asset classes, has been significantly outstripped by ETH, up a stunning 236% YTD. Where does that put ETHBTC currently? Elevated, to be sure, but we said that last month and ETH outperformed BTC by 23% in August.

Source: Tradingview. As of 9/1/20.

The driver of that outperformance is clear as day.

Source: Defipulse. As of 9/1/20.

The near-term fate of ETH falls entirely on the shoulders of DeFi and yield farming, which have reached full-blown mania. Can yield farming get way wackier from here? 2017 taught us that yes, without a doubt, it can. But the risks are high. The manner in which yield farming has exploded over the last two months is like combining the ingredients of a ponzi, a perpetual motion machine and trans-fee mining all rolled into one scammy cannoli, but with some ingenious mechanism design dusted over the top. At the current pace of Total Value Locked into unaudited and hastily (or maliciously) constructed smart contracts, the risk for a high value hack is high. Should this balloon pop in that manner, the air will likely leave with astonishing speed. Extreme levels of caution are warranted.

Should that balloon pop occur, a great question is, “will there be pieces worth picking up”? The answer is likely yes. Because my job is not to write newsletters but to put up attractive risk-adjusted returns for investors, key second and third questions are “what” and “at what price”. That remains to be seen and to be frank we don’t want to give it all away here. In the meantime, if sushi, yams, shrimp and kimchi mean more to you than food items, please be careful.

For the third month in a row, we’re showing you the BTC weekly chart. BTC is in rarified up here. Oscillators are elevated but not egregiously so. Long positioning is a bit offsides but not terribly so. There’s a good likelihood this has room to run to the upside in the near-term. If precious metals head higher from here, I think you can count on BTC following suit.

Source: TradingView. As of 9/1/20.

One of the most bullish trends in market structure is the shift of BTC derivatives open interest from unregulated exchanges to regulated - specifically from BitMEX to CME. This is what it looks like when The Herd is actually coming.

Source: Skew.com

The attraction of new traditional capital into BTC via CME futures represents a step-change in market structure and should not be ignored. This capital acts fundamentally different than your local neighborhood degen on Mex. The cash and carry trade for BTC appears to be attracting large amounts of capital from traditional market participants when the annualized returns of that trade get attractive enough. That type of capital doesn’t run out of money, thus a steep enough contango curve can and likely will begin acting like gravity. It’s already starting to happen. Bitcoin is growing up. That is welcomed.

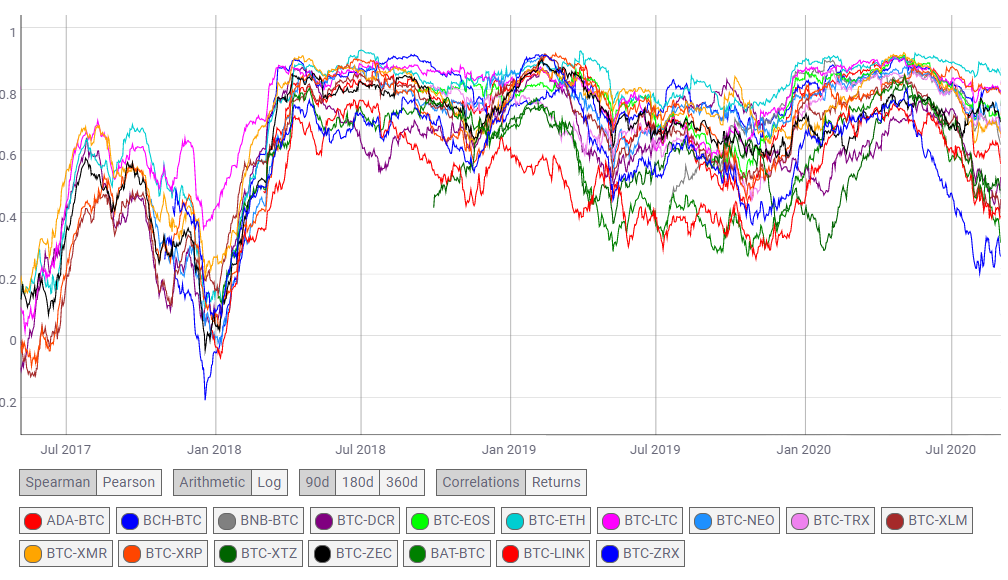

Cross-coin correlation is now nearly four months into a secular downtrend. This has allowed many Alts to decouple and meaningfully outperform BTC. We continue watching this closely.

Source: Coinmetrics. As of 8/31/20.

Closing Remarks

Exciting times, to be sure. Plenty of reason for optimism for both Bitcoin and pockets of Alts. And yet there are reasons to be cautious on both here. Caution on Alts is warranted because of DeFi smart contract risk, regulatory risk and the general lack of any actual sustainable use case in most of DeFi. Caution on Bitcoin is warranted because it’s wrapped up in the “all one trade”, which will need to thread the needle to continue on its path from here.

As a manager of a liquid crypto hedge fund, it’s my job to assess these risks in the context of potential returns and deploy capital accordingly. Doing so effectively and consistently in any asset class requires an investment process – structure around how capital is deployed and why. For Ikigai, that investment process has shifted primarily to systematic, models-driven exposure to BTC through our Programmatic Discretionary strategy.

With the stunning levels of risk present at seemingly every turn in crypto, a HUGE part of my job is to avoid the big landmines, which crypto tends to present a few times a year. That last landmine to blow up, on March 12th, put a number of my peers out of business and generated significant permanent capital losses. Above all, my job is to avoid that outcome. In order to do that effectively, a manager must assess the landscape of risks present on any given day. That assessment is best done through both quantitative and qualitative measurements – that is an investment process. The less clear the risks, both in their likelihood of occurring and the potential downside price action should they occur, the more difficult it is to responsibly deploy capital that is exposed to those risks.

Our Programmatic Discretionary strategy, at its core, is about limiting exposure to those risks that are most difficult to quantify, with the goal of outperforming BTC on a risk-adjusted basis for the long haul. After all, if we can avoid the landmines, there’s a real good chance Jay Powell is going to do most of the leg work for us to make a non-sovereign form of money worth more in the future than it is today.

“The reputation of a thousand years may be determined by the conduct of one hour”

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We believe we have built a team and a process that will produce these truths more quickly and more clearly than our competitors. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2020 Ikigai Asset Management, LLC. All Rights Reserved.

Investments in alternative investment vehicles entail substantial risk and are not intended as a complete investment program. Alternative investments are designed only for sophisticated investors who are able to bear the economic risk of losing all of their investment. Alternative investments: (1) often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; (2) can be highly illiquid; (3) are not required to provide periodic pricing or valuation information to investors; (4) may involve complex tax structures and delays in distributing important tax information; (5) are not subject to the same regulatory requirements as mutual funds; and (6) often charge high fees. Opportunities for redemption and transferability of interests in alternative investments are restricted so investors may not have access to capital when it is needed.

2. Past performance is not indicative of future results or a guarantee of future returns. The performance of any portfolio investments discussed in this document is not necessarily indicative of the performance of any other of Ikigai’s portfolio investments or any future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this document in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Gross returns do not reflect management fees or carried interest charged by Ikigai or any other Fund-level expenses that are borne by investors in a Fund, which will reduce returns and, in the aggregate, are expected to be substantial. Please see the additional disclosures at the end of this document for further important information regarding Ikigai’s track record.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS