The Scale of the Metaverse

/A few years ago, Elon Musk made the argument that we are probably living in a simulation. His reasoning was as follows.

Source: YouTube.com

If we are capable and willing to make simulations, which we are.

And if technology is advancing at such a pace that we have gone from pong to millions of players in photorealistic 3D in 50 years, then at some point in the future our capabilities to produce such simulations will have advanced to the point where they become indistinguishable from base reality.

Additionally, as the number and quality of our simulations increase exponentially there is a smaller and smaller chance that we are actually living in “base reality,” or in other words outside of the simulation.

Because if we were in fact in a simulation, how would we know?

I’ll set aside the philosophical and religious implications of this train of thought for now and just say that while we may not be able to definitively answer the simulation paradox, we do know that simulated realities, worlds and such are on the rise. Factories use simulations of the production process before a robotic arm or CNC machine produces anything. Video games create entire virtual worlds with any kind of lore you can imagine (old western, futuristic, medieval, etc). Therefore, as we think about the scale of the metaverse, we should not limit ourselves to what we can extrapolate from meatspace.

What I mean to say is that it’s entirely possible that the metaverse could become larger and more economically important than the physical world at some point. You might be thinking to yourself, “yeah, right what happens when the lights go off?” And there’s something to that. But if you compare how long it takes to spin up a web server to the time it takes to construct a shopping mall you’ll be on the right path. Is it fair to compare shopping malls and web servers? In many ways the answer is no, but if you are an investor then you might be wondering how best to deploy capital. And it turns out that technology companies beat the pants off of running your own McDonald’s franchise in terms of ROIC.

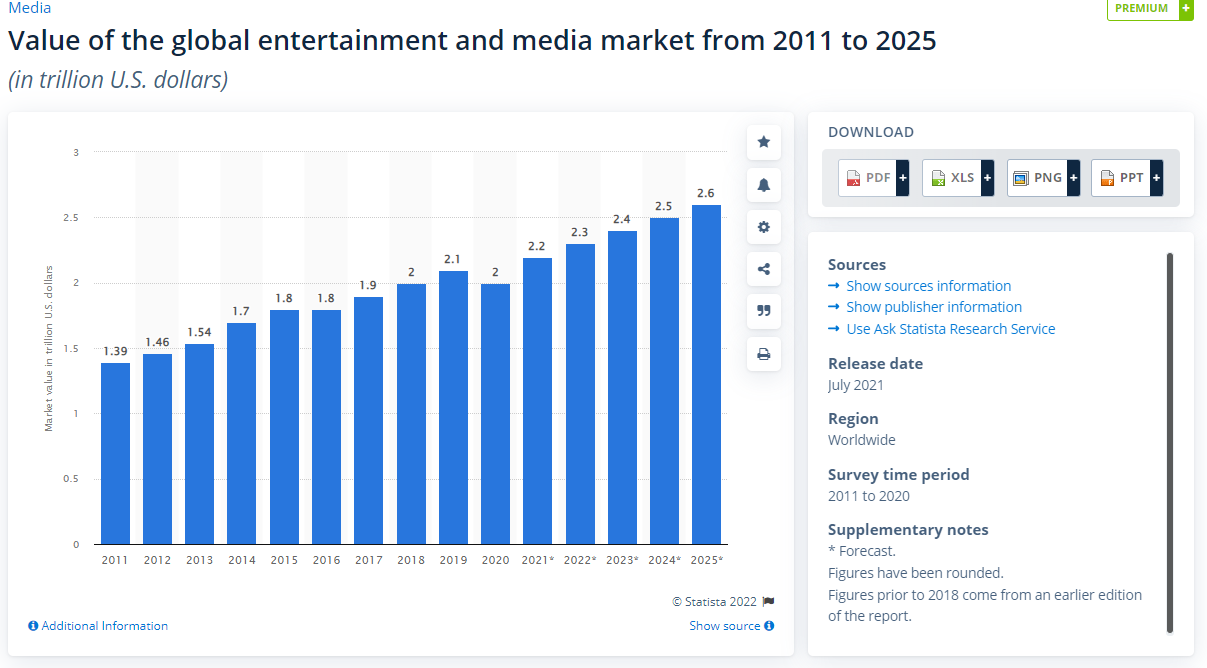

Consider the following. According to Statista, we are expected to spend $2.6 trillion U.S. Dollars on entertainment per year by 2025. I think this is on the low side given the changes that Covid-19 has brought to the world.

Source: Statista

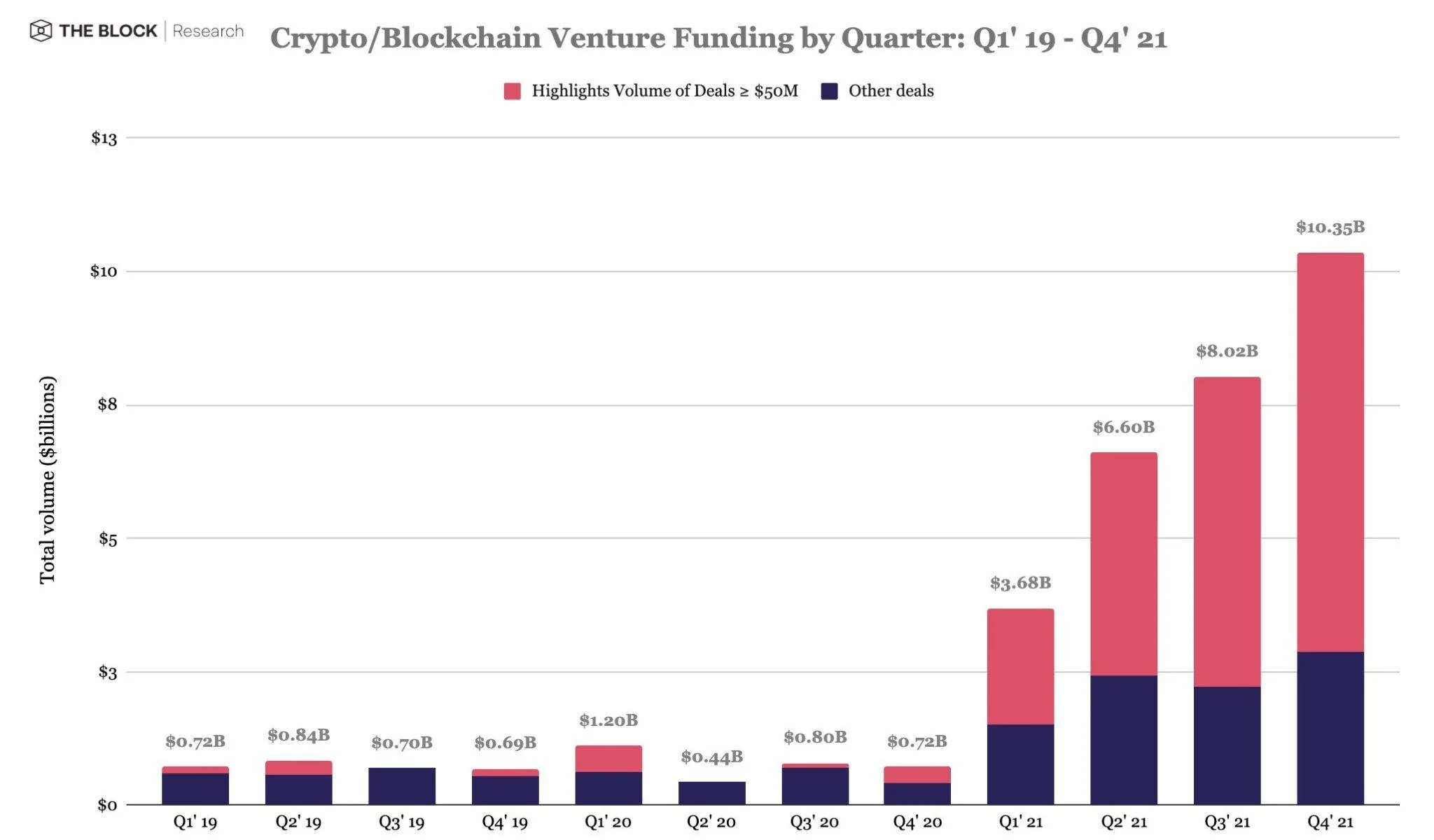

The Block Research reports that VC funding by quarter is going parabolic. And it shouldn’t be a surprise with unfunded pension liabilities and negative real rates around the globe. Where else can investors turn for yield?

Source: The Block Research

Now, we find ourselves at the dawn of a great turning point in the history of the world. For the first time we’re starting to think about ways in which we can be hyper connected to each other across national boundaries and cultural barriers. The reason this is possible now is of course because of our modern telecommunications networks and increasingly because of digital currencies. Never before have we been able to express value in terms of digital scarcity and be able to transact with each other at such speeds across the globe. Importantly, the rise of Web3 promises to make monetary transactions just another form of communication. This was the point of Andreas Antonopolous when he wrote “The Internet of Money.” There is no free speech without the ability to transact freely. And there is no democracy without strong property rights. As we move further into the digital age, more and more of our assets are becoming digital, and as far as we know there is no other way to enforce strong digital property rights than to use digital assets like cryptocurrency!

When you add it all up, it’s very hard to escape the idea that cryptocurrencies are going to be a necessary component of our collective future. When you think about the value that’s going to be created in the metaverse, it’s no wonder that capital is flowing into the crypto/DeFi/metaverse space like we’ve never seen before. The scale of the metaverse is bounded by only our own imaginations and by our ability to deliver. But as recent events have proven, necessity is the mother of invention. And I certainly wouldn’t want to bet against innovation in a world awash with capital and starving for change.

Thank you,