April 2024 - Monthly Market Update

/Monthly Update || April 2024

“Memory – and the resulting prudence – always comes out the loser when pitted against greed.”

Opening Remarks

Greetings from Ikigai Asset Management¹ headquarters. We welcome the opportunity to bring to you our sixty-seventh Monthly Update and hope these are helpful in better understanding some of what we’re doing and what we’re seeing. We have the privilege of deploying capital on behalf of our investors into a new technology and asset class that has tremendous potential to make the world a better place and create trillions of dollars of value in the process.

We believe we are obligated to be shepherds of this technology – to do our part to push crypto towards fulfilling its potential. We strive to be an objective, reasonable, well-intentioned voice of truth amongst a chorus of biased, fallacious, pernicious opportunists. It’s an honor that we take seriously.

To that end, Bitcoin reached several new all-time highs in March for the first time since November of 2021 – the first time BTC has ever breached prior cycle highs before the halving, which is set for 4/20 (lolz). BTC closed at its highly monthly close ever, above $71k. It happened the same way in March that it happened last month - with strong net inflows into the ETFs totaling $3.6bn ($10bn inflows, net of $6.4bn outflows), plus some help from Saylor to the tune of $1.45bn. I think there’s good reason to think that ETF inflows will continue to be strong in the coming months and there’s good reason to think that’s going to be the major driver of price action.

You can check the Monthly Highlights below – there were a lot of moving pieces in crypto in March. Tons of back and forth on spot ETH ETFs. The crosscurrents for that situation are strong, with factors and domain experts diametrically opposed to one another. For now, it appears a May approval is unlikely (but not impossible). This has been my assumption all along and there continues to be nothing on the table to prevent an August approval, which has been my base case that I’ve discussed here previously. But there was a fair share of confusing occurrences relating to ETH and the pending ETFs that might make you question the SEC’s willingness to approve an ETH ETF this year at all. For now, it’s too up in the air to discuss in any further detail here and too confusing for me to make a strong call on at this point. We’ll have to wait for more information, which we’ll likely get in April.

There were other significant events in March that may or may not have knock-on effects down the line. There are SOME risks out there, both macro and idiosyncratic. But it’s almost unnerving that those risks feel relatively unlikely to come to fruition. BTC hasn’t had a pullback greater than 25% since Sam collapsed FTX. If you’ve been investing in crypto for a while, THAT makes you nervous. Where’s the next big pullback going to come from? If you’re managing other people’s money, it’s usually part of the job description to figure that out and act accordingly. True Black Swans are unknowable by definition, so that’s always possible. But like I said a couple months ago, it looks like a good year to be in the casino.

Invest

Ikigai is currently fielding interest from new investors globally. We are open to international investors and qualified accredited U.S. investors (including self-directed IRAs).

We accept new investors on the 1st and 15th of every month.

Contact us to see if you qualify.

March Highlights

Sam Bankman-Fried Sentenced to 25 Years in Prison

BTC ETFs See $3.6bn of Net inflows

MSTR Raises $800mm in Convertible Senior Notes, Buys $822mm of BTC

MSTR Raises $604mm on Convertible Senior Notes, Buys $623mm of BTC

BlackRock Partners with Securitize, Launches “BUIDL” – BlackRock USD Institutional Digital Liquidity Fund to Tokenize Treasuries, Raises $275mm in First Week

Lots of Chatter, Rumors and Back and Forth About ETH ETFs

Fidelity Joins Other Filers in Adding Staking to Spot ETH ETF Application

ETH Completes Dencun Upgrade, Lowering Fees on L2s

KuCoin and Founders Charged by DOJ with Crimes, Laundering >$9bn, ETH Named Commodity in Charges

SEC Meets with Grayscale and Coinbase on spot ETH ETFs, Discuss Correlation Analysis

FET, OCEAN and AGIX Cryptos Propose Token Merger into Newly Formed ASI

Trump Says "there has been a lot of use of Bitcoin, not sure would want to take away"

BlackRock Files to Purchase IBIT in Its $24bn AUM Strategic Income Opportunities Fund

Arizona State Senate Considering Adding BTC ETFs to State Retirement Portfolios

SEC Postpones Decision on BTC ETF Options Proposals

Tether Creates Bridge to Burn Tether on One Chain and Mint On Another “in case of disruption”

FTX Estate Sells 41mm Locked SOL to Various Investors at $50-$80/SOL

Court Rules Against Wahi Brothers in Coinbase Insider Trading Suit, Says Secondary Market Sales Are Securities Transactions

Coinbase Issues $1.1bn Convertible Senior Notes to Repay Existing Notes, General Corporate Purposes

Court Sanctions SEC in Debt Box Court Decision for Bad Faith Conduct

Crypto Super PAC Fairshake Runs Successful $10mm Campaign Against Katie Porter’s Primary Run for California Senate

Nigeria Demands $10bn from Binance, Detains Two Binance Executives Sent to Negotiate Over Charges and Fines, One of the Execs Escapes Nigerian Jail

Philippines Moves to Block Access to Binance

Commex, Which Purchased Binance’s Russia Business Last Year, Halts Deposits, to Close

Binance Spins Out $10bn Venture Fund

WisdomTree Receives NY BitLicense

OKX Delists USDT in EU

OKX to Shut Down in India

Figure Raises $61mm Series A Led by Jump, Faction, Pantera and Others

Drake Posts Video to Instagram of Saylor CNBC Interview Saying Bitcoin Will Eat Gold

SEC vs Terraform Labs Trial Commences, Former Jump Trader Testifies as Whistleblower

Two Democratic Senators Write Letter to Gensler Urging SEC to Block Future Crypto ETFs

EIA Drops Emergency Survey of BTC Miners in Response to Lawsuit Filed

BlackRock Launches Spot BTC ETF in Brazil

| Asset Class | Mar | Feb | Jan | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 | Instrument |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | 17% | 44% | 1% | 69% | 57% | -12% | 7% | 72% | 155% | -64% | 60% | BTC |

| NASDAQ | 1% | 5% | 2% | 8% | 14% | -3% | 15% | 21% | 54% | -33% | 27% | QQQ |

| S&P 500 | 3% | 5% | 2% | 10% | 11% | -4% | 8% | 7% | 24% | -19% | 27% | SPX |

| Total World Equities | 3% | 4% | 0% | 7% | 10% | -4% | 5% | 7% | 19% | -20% | 16% | VT |

| Emerging Market Equity | 3% | 4% | -5% | 2% | 6% | -4% | 0% | 4% | 6% | -22% | -5% | EEM |

| Gold | 9% | 0% | -1% | 8% | 12% | -4% | -3% | 8% | 13% | -1% | -4% | GLD |

| High Yield | 1% | 0% | 0% | 0% | 5% | -2% | -1% | 3% | 5% | -15% | 0% | HYG |

| Emerging Market Debt | 2% | 0% | -1% | 1% | 8% | -5% | 0% | 2% | 5% | -22% | -6% | EMB |

| Bank Debt | 325% | 1% | -1% | 323% | 1% | 0% | 1% | 1% | 3% | -7% | -1% | BKLN |

| Industrial Materials | 4% | -2% | -3% | -2% | -5% | 7% | -11% | 4% | -6% | -13% | 29% | DBB |

| USD | 0% | 1% | 2% | 3% | -5% | 3% | 0% | 0% | -2% | 8% | 6% | DXY |

| Volatility Index | -3% | -7% | 15% | 4% | -29% | 29% | -27% | -14% | -43% | 26% | -24% | VIX |

| Oil | 759% | 3% | 6% | 845% | -18% | 27% | -4% | -5% | -5% | 29% | 65% | USO |

Source: TradingView. As of 3/31/24.

In Memory of Daniel Kahneman, A Personal Inspiration

If you missed it, Dr Daniel Kahneman – winner of the Nobel Prize in Economics and one of the fathers of behavioral economics, passed away this week at the age of 90. Kahneman had a titanic impact on the fields of behavioral economics, judgement, decision-making and the psychology of experience.

Behavioral economics in general, and Kahneman’s work in particular, had a profound influence on my life. In 2007, I was taking upper-level finance classes at A&M, on my way to receiving a BBA in Accounting and a MS in Finance in 2008. I took +/- 30 hours of Finance classes between undergrad and grad school. I remember learning about efficient market hypothesis (EMH) and learning about many of the theories and formulas which are underpinned by EMH. Out of all my finance classes, we spent nearly zero time on behavior economics – a couple lectures total.

This struck me as weird at the time. EMH basically states that market participants are rational actors, all information is known to all participants as soon as it becomes available, and market prices immediately shift to reflect new information, thus prices are always “right”. Behavioral economics, in a way, is the opposite of that. Market participants are humans, and humans are not rational, especially not when faced with economic decisions. EMH never made nearly as much sense to me as behavioral economics did. And I was confused as to why we spent so much time in class on EMH stuff and so little time on behavioral economics stuff.

So for Christmas in 2007, my brother gave me this book-

The book was more or less a greatest hits of impactful behavioral finance research papers. By my last semester of grad school in the spring of 2008, I had already accepted an offer to go into investment banking after graduation., I had a light class schedule – 9 hours with only one hard class. So, I would go to a coffee shop a few times a week and read this book and take notes. I was enthralled. I read it cover to cover, and buried in a box somewhere in my mom’s garage is a yellow notepad full of notes I took. And I read other stuff I could find on behavioral economics, which is where I came across Kahneman’s work in prospect theory, loss aversion, et al (and later was blown away by Thinking Fast and Slow when it came out). I found the intersection of psychology and finance to be riveting. I felt like I had stumbled upon a field that I deeply connected with.

If you’ve been reading these letters for a while, you can probably tell that I have a tendency to look for a deeper “why” in many things. I generally find the deeper “why” to be more interesting than the surface level “why”. Behavioral economics scratched that itch in a major way for me back then. After graduation before starting work, as I was finishing the book, I promised myself that, although I wasn’t really about to use all this behavioral finance stuff in investment banking, someday I would have a job where I would look at the world through this lens. It was a lofty and inexact goal, but I honestly felt like it was a destiny of mine at the time.

Game theory is a sort of applied mathematics version of behavioral finance. I didn’t go super deep down the game theory rabbit hole while in school, but I hit the highlights – prisoner’s dilemma, Nash equilibriums, evolutionary game theory and mechanism design. So fast forward nine years later to May 2017, and I’m living in New York working at P72. Crypto keeps popping up on my radar because the prices are ripping, and I finally get around to reading the (9-page) Bitcoin white paper. Wish I had bothered to do that earlier! Immediately, the beauty of the mechanism design of Bitcoin was astonishing to me. You read about it, and then read some more. And you finally read enough that you think you understand how it works at a cursory level, and you think “no way that actually works”. And yet there it was in the summer of 2017! Working! I bought some Bitcoin and sent it to my Ledger and it worked! That’s wild! After several months of extensive self-study, I convinced myself that crypto was going to be a big deal and made a massive left-turn in my career to go pursue crypto investing full-time. It ended up being one of the most impactful decisions of my life.

When I saw Kahneman passed this week, I took a moment to appreciate his influence over my life and was reading through his many powerful quotes. I’ll leave you with some of my favorites:

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.”

“Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our ignorance.”

“Intelligence is not only the ability to reason; it is also the ability to find relevant material in memory and to deploy attention when needed.”

“This is the essence of intuitive heuristics: when faced with a difficult question, we often answer an easier one instead, usually without noticing the substitution.”

“We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.”

“We can be blind to the obvious, and we are also blind to our blindness.”

“The confidence that individuals have in their beliefs depends mostly on the quality of the story they can tell about what they see, even if they see little.”

“The world makes much less sense than you think. The coherence comes mostly from the way your mind works.”

“The illusion that we understand the past fosters overconfidence in our ability to predict the future.”

“Acquisition of skills requires a regular environment, an adequate opportunity to practice, and rapid and unequivocal feedback about the correctness of thoughts and actions.”

“A person who has not made peace with his losses is likely to accept gambles that would be unacceptable to him otherwise.”

“Experts who acknowledge the full extent of their ignorance may expect to be replaced by more confident competitors, who are better able to gain the trust of clients. An unbiased appreciation of uncertainty is a cornerstone of rationality—but it is not what people and organizations want.”

“When people believe a conclusion is true, they are also very likely to believe arguments that appear to support it, even when these arguments are unsound.”

“Higher income is associated with a reduced ability to enjoy the small pleasures of life.”

“Remember this rule: intuition cannot be trusted in the absence of stable regularities in the environment.”

“However, optimism is highly valued, socially and in the market; people and firms reward the providers of dangerously misleading information more than they reward truth tellers. One of the lessons of the financial crisis that led to the Great Recession is that there are periods in which competition, among experts and among organizations, creates powerful forces that favor a collective blindness to risk and uncertainty.”

“To be useful, your beliefs should be constrained by the logic of probability.”

“If you were allowed one wish for your child, seriously consider wishing him or her optimism.”

“The evidence of priming studies suggests that reminding people of their mortality increases the appeal of authoritarian ideas, which may become reassuring in the context of the terror of death.”

“We know that people can maintain an unshakable faith in any proposition, however absurd, when they are sustained by a community of like-minded believers.”

Market Update – Liquid Crypto Asset Investing

| Symbol | Mar | Feb | Jan | YTD | Q4-23 | Q3-23 | Q2-23 | Q1-23 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC | 17% | 44% | 1% | 69% | 57% | -12% | 7% | 72% | 155% | -64% | 60% |

| ETH | 9% | 46% | 0% | 60% | 37% | -14% | 6% | 52% | 91% | -67% | 399% |

| XRP | 7% | 17% | -18% | 2% | 19% | 9% | -12% | 58% | 81% | -59% | 278% |

| BCH* | 106% | 25% | -15% | 121% | 33% | -24% | 117% | 16% | 157% | -75% | 6% |

| EOS | 28% | 25% | -18% | 30% | 45% | -22% | -37% | 38% | -2% | -72% | 17% |

| BNB | 52% | 33% | -4% | 94% | 45% | -10% | -24% | 29% | 27% | -52% | 1269% |

| XTZ | 14% | 27% | -3% | 40% | 47% | -15% | -28% | 56% | 39% | -84% | 116% |

| XLM | 16% | 11% | -15% | 9% | 15% | 1% | 1% | 55% | 81% | -73% | 108% |

| LTC | 31% | 20% | -8% | 44% | 10% | -39% | 21% | 28% | 4% | -52% | 17% |

| TRX | -12% | 25% | 4% | 14% | 21% | 16% | 27% | 10% | 98% | -28% | 181% |

| Aggregate Mkt Cap | 20% | 41% | -3% | 63% | 51% | -6% | 1% | 49% | 119% | -64% | 186% |

| Aggregate DeFi* | 17% | 34% | -6% | 47% | 72% | -5% | -5% | 50% | 132% | -77% | 581% |

| Aggr Alts Mkt Cap | 23% | 35% | -5% | 58% | 53% | -2% | -5% | 33% | 90% | -64% | 479% |

Source: CoinMarketCap and CoinGecko. As of 3/31/24. BCH includes SV.

Bitcoin was up another 17% percent in March, +69% YTD. That’s a hell of a start and the first time BTC has ever reached new cycle ATHs prior to the halving (due 4/20/24). A number of Alts outperformed BTC in March but far fewer are outperforming YTD. ETH is lagging BTC 9% YTD. SOL is up a double YTD. DOGE is outperforming. Numerous Memecoins did completely ridiculous shit in March. Dogwifhat was +270% and now has a ~$4.5bn market cap. Ticker DEGEN was up 3,000% percent in March and now has a ~$700mm market cap. Sigh.

BTC continues to live by the ETF inflows and…well “die” by the inflows would be too strong of a word choice. BTC did experience a LOT of outflows in March. GBTC saw $6.4bn of outflows in March. That’s a real number. Rest of the ETFs did $10bn of inflows for a net $3.6bn of inflows. Major dollars sloshing around here. If you told me what the net inflows were going to be for April, I think I could be pretty confident in guessing what price is going to do.

There’s good reason to think the GBTC forced outflows from bankruptcy estates and special sits/arb desks is largely done. And there’s good reason to think that additional large pools of capital will receive access to the ETFs for the first time at the 90-day mark for the ETFs trading, which would be the week before the halving. That feels like higher to me to April. $80k+ wouldn’t surprise me for April.

As it relates to the halving coming up this month, only the 2016 halving saw price correct prior to going on a heater.

Source: @Pladizow. As of 3/31/24.

If you’ve been reading these letters for a LONG time, you know I used to talk about on-chain metrics often, and then I mentioned them less, and then I rarely mentioned them at all. The primary driver of my shift away from discussing these metrics was that the market structure changed. And I learned more and more about that ever-changing market structure. And I convinced myself these metrics weren’t ALL that helpful. So I talk about them less here. But on-chain metrics aren’t worthless. If for no other reason, they have memetic significance because many people look at them. Imagine if all these charts I’m about to show you were super overbought. Wouldn’t you think about taking some profits, even if some guy named Travis said they’re not all that accurate anymore?

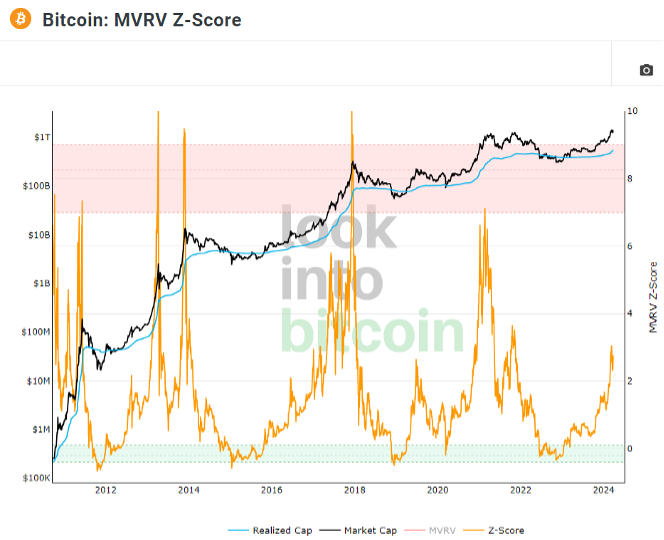

So that’s the preface. These are the charts-

Amazingly, MVRV Z-score is almost exactly where it was when BTC price broke prior ATH last cycle in November 2020 and the cycle before that in Jan 2017. It’s notable that timewise, that’s about 8 months earlier than last cycle and 10 months earlier than the cycle before, which speaks to the “left-translated cycle” concept I talked about last month. If it plays out like the prior two cycles, price is about to go on an absolute heater and top out 11-12 months from now.

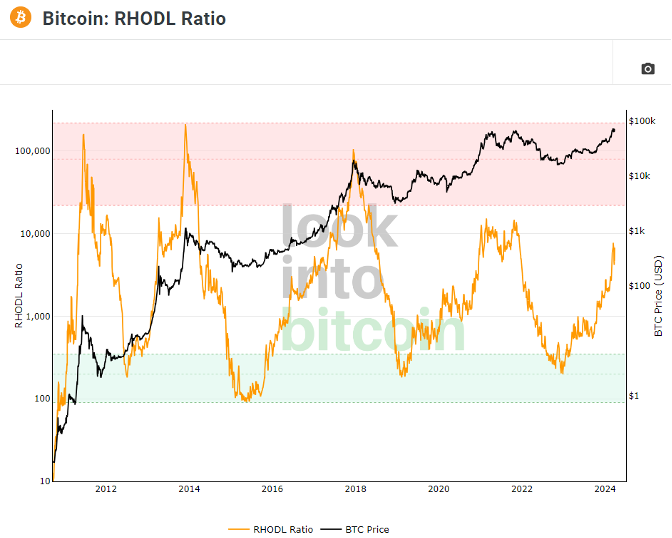

RHODL ratio is running a bit hot right now relative to prior cycles, and also early timewise the same way as MVRV Z-score.

You’d like to see a pullback in price here that would reset this a bit. You can also notice the consecutive lower cyclical highs over the last decade, so there’s a question of whether that trend will continue. RHODL looks at the relationship between coins that moved in the last week versus coins that moved 1-2 years ago. And the changes in market structure have shifted that behavior a lot. So I wouldn’t go bet the farm on this one (or any of these), but it’s still noteworthy.

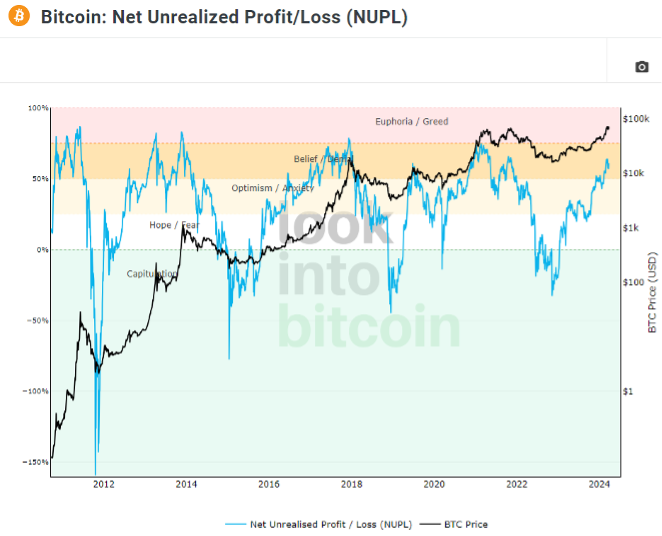

NUPL is also in-line with the prior two cycle breaks of previous ATH, and again early as it relates to time. This would also indicate an aggressive move up in price in the coming months.

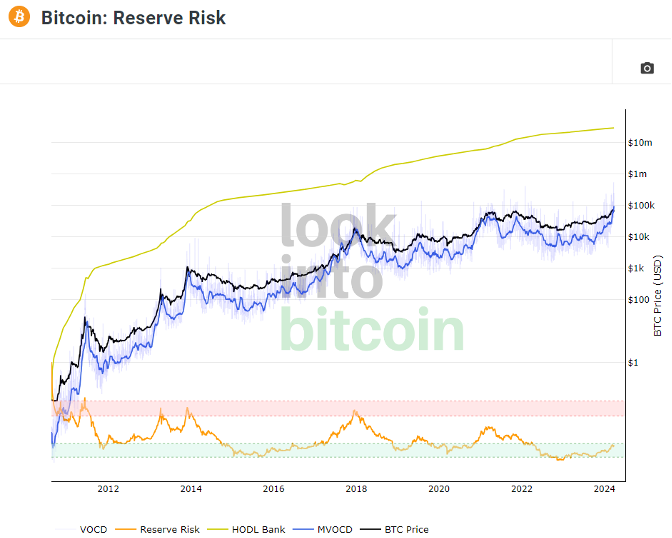

Reserve Risk was actually created by Ikigai’s own Hans HODL. It’s a derivative of Bitcoin Days Destroyed.

For the fourth time, current levels are about in-line with prior cyclical breaks of prior ATHs. Again, here it is noteworthy that we’ve seen lower cyclical highs for two consecutive cycles, and could see a lower high again this cycle. Even if that were the case, it would likely mean aggressively higher prices in the coming months.

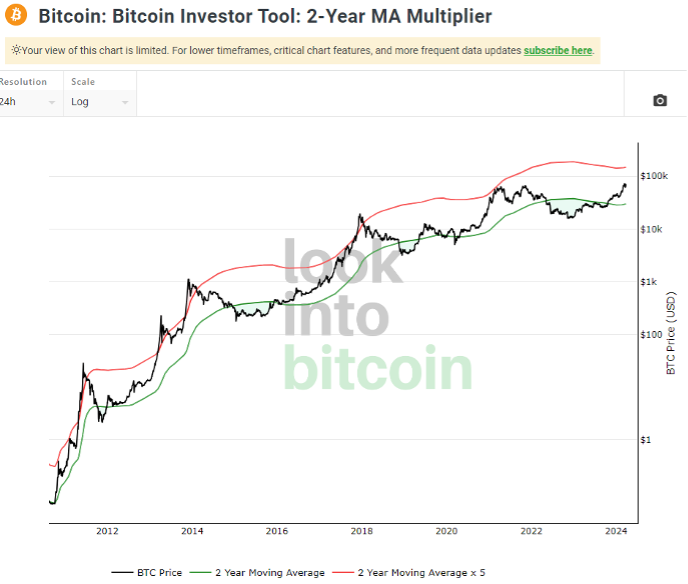

The 2-Year MA Multiplier isn’t an on-chain metric but a simple TA visualization. It’s in-line with prior cycle ATH breaks and has room to run from here.

The Pi Cycle Top Indicator is a similar MA-based metric, called the Pi Indicator because 350/111 = 3.14.

You can see there is still a decent-sized gap between the orange and green MAs, and that we are currently right on the green MA. Again, this is in-line with prior cyclical breaks of prior ATHs and would be indicative of strongly higher prices in coming months.

So…pretty much every indicator is saying the same thing – we’ve run hard, broke ATHs faster than usual, are hot but not too hot, price is heading strongly higher in the coming months and dips are for buying…niiiiice!

ETHBTC is currently at the bottom of its three-year range (white) -

Source: TradingView. As of 3/31/24.

And importantly, has been bouncing off the bottom of that range for the last six months (yellow). Purely from a TA perspective, this is a chart that looks at risk to me. The likelihood of a Wyckoff accumulation, with a spring and then “jump the creek”, looks somewhat diminished to me relative to a couple months ago. When you overlay the qualitative fundamentals on the chart, where we go from here is likely to be dependent on the spot ETH ETFs. As I mentioned earlier, there’s LOTS of moving pieces on that and I don’t have a strong opinion on it, other than I still feel pretty confident there will be a good ETHBTC long opportunity at some point this year (although there’s a path where that’s not true). You might get a chance to buy lower first though.

Last month I introduced “Adjusted Alt Dominance”, which is shown here again this month. I know, it’s a busy chart. Get used to it. We’ll likely be using it consistently for at least the next year.

Source: TradingView. As of 3/31/24.

I remind you of the potential fractal in the two yellow channels – now vs ~4 years ago. If this is a fractal, it’s a “left translated cycle” – pulling price action forward. I introduce a new red vertical line, comparing that period to the current period, except this time it’s happening ~3 months early in the cycle and happening with absolute BTC price (second panel in orange) much higher relative to prior cycles.

I currently continue to struggle to imagine the orange box from late 2020 materializing later this year. It would have to constitute an earth-shattering increase in BTC and ETH mkt caps, a massive sucking out of market cap from Alts into BTC and ETH, or some combination of the two. That sort of outcome is possible but I struggle to have it as my base case right now. The desire to shitcoin is simply too strong. So I think the fractal probably won’t play out. At some point in the coming quarters, I think we will experience something akin to the purple box – a proper Shitcoin Bonanza. Were that to be the case, it would make the current shitcoining look like a Treasury bond portfolio. We shall see.

Closing Remarks

The Feb 1st and March 1st monthly updates ended up being the two most widely read pieces I’ve ever written. The one-two punch of “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything” and “Financial Nihilism: The Zeitgeist of Young America” struck a chord unlike anything I’ve ever experienced. The tremendous response was mostly from crypto people, which makes sense given my audience, but it was far from solely crypto people. Financial nihilism in particular is a concept that all sorts of people have deeply resonated with – I see it because of how often I’m getting tagged and retweeted. Macro investors, boomers, tradfi VCs, residential real estate brokers, normies – broad and strong agreement in the assessment of financial nihilism.

So, if you’re the type of person that cares about crypto making a positive impact on the world, how do you feel about pretty much everyone agreeing that crypto is ground zero for the expression of financial nihilism? Are you sad? Mad? Exasperated? Overwhelmed? Defeated? Defiant? Motivated?

It wasn’t hard for me to come up with that list of emotions because I feel at least tinges of all of those. I’m sad because I know many of those acting out financial nihilism are doing so from a place of pain and hopelessness. I’m mad and exasperated because crypto, this thing I care so deeply about, believe so much in, and have sacrificed so much for, is being co-opted. Crypto is the tree and financial nihilism is the vine and the vine is going to choke the tree and kill it. I feel overwhelmed and defeated because this situation is objectively getting worse, not better. Crypto does not feel like it’s progressing to me, it feels like it’s regressing, despite number go up. I feel defiant and motivated because it is in my nature to fight tirelessly for the things I care about. I have a big motor for that sort of thing and as I always say, it’s a fight worth fighting. But if I were betting man, I wouldn’t be loving the odds we have right now on crypto fulfilling its potential to make the world a better place. I don’t know, maybe I need to take some of Kahneman’s advice about optimism. But I just call it like I see it and I get the sense that’s why folks pay attention to what I say.

They say the greatest trick the devil ever pulled was convincing the world that he doesn’t exist. If I were the powers that be and I was worried about crypto’s potential to disrupt the status quo, how would I go about preventing that potential from coming to fruition? There are front door ways of approaching that sort of thing and then there are side door ways. The front door is Operation Chokepoint 2.0 type of stuff. The side door would be to allow (facilitate?) a grassroots movement of hyper-gambling mania on absolute dogshit ponzi vaporware to proliferate to a degree that it chokes out that actual innovation that will lead to a disrupting of the status quo. The greatest trick the devil ever pulled was convincing the world that a disruptive technology with a ton of potential was just a shitcoin casino.

“Getting money is like digging with a needle; spending it is like water soaking into sand.”

– Japanese Proverb

Travis Kling

Founder & Chief Investment Officer

Ikigai Asset Management

P.S.

Included below is an incomplete list of memorable tweets from the last month. Twitter is not investment advice and my views could easily be wrong. That being said, like it or not, Twitter matters for crypto. I have no interest in being a talking head for a living and babbling about on Twitter is a long way away from being a good steward of investor capital. However, this is a community with open-source software in its DNA, and participants want to crowd-source the truth. We are shepherds of this technology. Answers to fundamental questions about this asset class are not currently clear, so having a public platform to share your views with the community is important. After all, you’re helping shape the future :)

1. Ikigai Asset Management is the trade name for a collection of advisory and consulting businesses operated by Travis Kling, Anthony Emtman, and their team.

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Ikigai as well as any Ikigai fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2023 Ikigai Asset Management, LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS